Red Lobster 2004 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2004 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review 2004

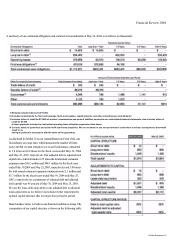

could differ from the assumptions used. A quarter percentage point

change in the defined benefit plans' discount rate and the expected

long-term rate of return on plan assets would increase or decrease

earnings before income taxes by $0.8 million and $0.4 million,

respectively. A quarter percentage point change in our postretire-

ment benefit plan discount rate would increase or decrease earnings

before income taxes by $0.1 million. A one percentage point

increase in the health care cost trend rates would have increased the

accumulated postretirement benefit obligation (APBO) by $4 mil-

lion at May 30, 2004, and the aggregate of the service cost and

interest cost components of net periodic postretirement benefit

cost by $0.3 million for fiscal 2004. A one percentage point decrease

in the health care cost trend rates would have decreased the APBO

by $3 million at May 30, 2004, and the aggregate of the service cost

and interest cost components of net periodic postretirement benefit

cost by $0.3 million for fiscal 2004. These changes in assumptions

would not significantly impact our funding requirements.

We are not aware of any trends or events that would materially

affect our capital requirements or liquidity. We believe that our

internal cash-generating capabilities, borrowings available under

our shelf registration for unsecured debt securities, and short-term

commercial paper program should be sufficient to finance our capi-

tal expenditures, stock repurchase program, and other operating

activities through fiscal 2005.

OFF-BALANCE SHEET ARRANGEMENTS

We are not a party to any off-balance sheet arrangements that have,

or are reasonably likely to have, a current or future material effect

on our financial condition, changes in financial condition, revenues

or expenses, results of operations, liquidity, capital expenditures,

or capital resources.

FINANCIAL CONDITION

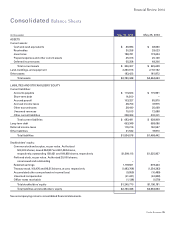

Our current assets totaled $346 million at May 30,2004, compared

to $326 million at May 25, 2003. The increase resulted primarily

from increases in inventories of $25 million that resulted from oppor-

tunistic product purchases made during fiscal 2004.

Our current liabilities were $683 million at May 30,2004, compared

to $640 million at May 25, 2003. At May 30, 2004, $15 million of

short-term debt was outstanding under our commercial paper

program, which was used to fund current operations and capital

expenditures. Accrued payroll of $103 million at May 30, 2004,

increased from $86 million at May 25, 2003, principally due to

higher incentive compensation earned in fiscal 2004. Other cur-

rent liabilities of $228 million at May 30, 2004, increased from

$202 million at May 25, 2003, principally due to a $19 million

increase in liabilities associated with our non-qualified deferred

compensation plan and a $7 million increase in sales tax payable as

a result of higher fourth quarter sales in fiscal 2004. Accrued income

taxes of $49 million at May 30, 2004, decreased from $68 million

at May 25, 2003, principally due to timing of income tax payments

made and changes in temporary differences included in the deferred

tax balances associated with current income tax deductions for

certain land, buildings, and equipment. The $ 19 million decrease

in accrued income taxes is offset by the related increase in net non-

current deferred income tax liabilities at May 30, 2004.

QUANTITATIVE AND QUALITATIVE DISCLOSURES

ABOUT MARKET RISK

We are exposed to a variety of market risks, including fluctuations

in interest rates, foreign currency exchange rates, and commodity

prices. To manage this exposure, we periodically enter into inter-

est rate, foreign currency exchange, and commodity instruments

for other than trading purposes (see Notes 1 and 8 of the Notes to

Consolidated Financial Statements).

We use the variance/covariance method to measure value at risk,

over time horizons ranging from one week to one year, at the

95 percent confidence level. At May 30, 2004, our potential losses

in future net earnings resulting from changes in foreign currency

exchange rate instruments, commodity instruments, and floating

rate debt interest rate exposures were approximately $2 million

over a period of one year (including the impact of the interest rate

swap agreements discussed in Note 8 to the Notes to Consolidated

Financial Statements). The value at risk from an increase in the fair

value of all of our long-term fixed rate debt, over a period of one

year, was approximately $22 million. The fair value of our long-

term fixed rate debt during fiscal 2004 averaged $690 million, with

a high of $714 million and a low of $669 million. Our interest rate

risk management objective is to limit the impact of interest rate

changes on earnings and cash flows by targeting an appropriate

mix of variable and fixed rate debt.

Darden Restaurants 31