Red Lobster 2004 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2004 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notesto

Consolidated Financial Statements

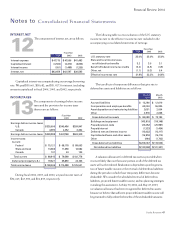

The weighted-average assumptions used in the Black Scholes

model were as follows:

StockOptions

GrantedinFiscalYear

2004 2003 2002

Risk-freeinterestrate 2.62% 4.37% 4.50%

Expectedvolatilityofstock 30.0% 30.0% 30.0%

Dividendyield 0.2% 0.2% 0.1%

Expectedoptionlife 6.0years 6.0years 6.0years

Restricted stock and restricted stock unit (RSU) awards are

recognized as unearned compensation, a component of stockhold-

ers’ equity, based on the fair market value of our common stock

on the award date. These amounts are amortized to compensa-

tion expense, using the straight-line method, over the vesting

period using assumed forfeiture rates for different types of awards.

Compensation expense is adjusted in future periods if actual

forfeiture rates differ from initial estimates.

Net Earnings Per Share

Basic net earnings per share are computed by dividing net earnings

by the weighted-average number of common shares outstanding

for the reporting period. Diluted net earnings per share reflect the

potential dilution that could occur if securities or other contracts

to issue common stock were exercised or converted into common

stock. Outstanding stock options issued by us represent the only

dilutive effect reflected in diluted weighted-average shares out-

standing. Options do not impact the numerator of the diluted net

earnings per share computation.

Options to purchase 4,643,389 shares, 3,952,618 shares, and

161,220 shares of common stock were excluded from the calcula-

tion of diluted net earnings per share for fiscal 2004, 2003, and

2002, respectively, because their exercise prices exceeded the

average market price of common shares for the period.

Comprehensive Income (Loss)

Comprehensive income (loss) includes net earnings and other

comprehensive income (loss) items that are excluded from net

earnings under U.S. generally accepted accounting principles.

Other comprehensive income (loss) items include foreign currency

translation adjustments, the effective unrealized portion of changes

in the fair value of cash flow hedges, and amounts associated with

minimum pension liability adjustments.

Foreign Currency

The Canadian dollar is the functional currency for our Canadian

restaurant operations. Assets and liabilities denominated in

Canadian dollars are translated into U.S. dollars using the exchange

rates in effect at the balance sheet date. Results of operations are

translated using the average exchange rates prevailing throughout

the period. Translation gains and losses are reported as a separate

component of accumulated other comprehensive income (loss)

in stockholders’ equity. Aggregate cumulative translation losses

were $9,960 and $10,354 at May 30, 2004, and May 25, 2003,

respectively. Gains (losses) from foreign currency transactions,

which amounted to $(53), $(105), and $33, are included in the

consolidated statements of earnings for fiscal 2004, 2003, and

2002, respectively.

Use of Estimates

The preparation of financial statements in conformity with U.S.

generally accepted accounting principles requires us to make esti-

mates and assumptions that affect the reported amounts of assets

and liabilities and disclosure of contingent assets and liabilities

at the date of the financial statements, and the reported amounts

of sales and expenses during the reporting period. Actual results

could differ from those estimates.

Segment Reporting

As of May 30, 2004, we operated 1,325 Red Lobster, Olive Garden,

Bahama Breeze, Smokey BonesBarbeque & Grill and Seasons 52

restaurants in North America as part of a single operating segment.

The restaurants operate principally in the U.S. within the casual

dining industry, providing similar products to similar customers.

The restaurants also possess similar pricing structures, resulting in

similar long-term expected financial performance characteristics.

Revenues from external customers are derived principally from

food and beverage sales. We do not rely on any major customers as

a source of revenue. We believe we meet the criteria for aggregat-

ing our operations into a single reporting segment.

Reclassifications

Certain reclassifications, including the reclassification of asset

impairment charges and credits from selling, general, and admin-

istrative expenses, have been made to prior year amounts to con-

form to current year presentation.

41

Financial Review 2004