Red Lobster 2004 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2004 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

RETIREMENTPLANS

14Defined Benefit Plans and Postretirement Benefit Plan

Substantially all of our employees are eligible to participate in a retirement plan. We sponsor non-contributory defined

benefit pension plans for our salaried employees, in which benefits are based on various formulas that include years of

service and compensation factors, and for a group of hourly employees, in which a fixed level of benefits are provided.

Pension plan assets are primarily invested in U.S., international, and private equities, long duration fixed income securities, and real assets.

Our policy is to fund, at a minimum, the amount necessary on an actuarial basis to provide for benefits in accordance with the requirements

of the Employee Retirement Income Security Act of 1974, as amended. We also sponsor a contributory postretirement benefit plan that

provides health care benefits to our salaried retirees. During fiscal 2004, 2003, and 2002, we funded the defined benefit pension plans in

the amount of $85, $20,063, and $41, respectively. We expect to contribute approximately $100 to our defined benefit pension plans during

fiscal 2005. During fiscal 2004, 2003, and 2002, we funded the postretirement benefit plan in the amount of $172, $140, and $123, respec-

tively. We expect to contribute approximately $260 to our postretirement benefit plan during fiscal 2005.

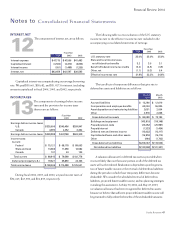

The following provides a reconciliation of the changes in the plan benefit obligation, fair value of plan assets, and the funded status of

the plans as of February 28, 2004 and 2003:

DefinedBenefitPlans PostretirementBenefitPlan

2004 2003 2004 2003

ChangeinBenefitObligation:

Benefitobligationatbeginningofperiod $129,636 $ 111,155 $ 14,809 $ 9,356

Servicecost 4,516 3,732 626 388

Interestcost 7,076 7,088 919 648

Participantcontributions – – 128 112

Benefitspaid (5,553) (4,558) (299) (252)

Actuarialloss 8,014 12,219 702 4,557

Benefitobligationatendofperiod $143,689 $129,636 $16,885 $14,809

ChangeinPlanAssets:

Fairvalueatbeginningofperiod $115,962 $109,574 $ – $ –

Actualreturnonplanassets 34,759 (9,117) – –

Employercontributions 85 20,063 172 140

Participantcontributions – – 128 112

Benefitspaid (5,554) (4,558) (300) (252)

Fairvalueatendofperiod $145,252 $115,962 $ – $ –

ReconciliationofthePlan’sFundedStatus:

Fundedstatusatendofperiod $ 1,563 $ (13,675) $(16,885) $(14,809)

Unrecognizedpriorservicecost (479) (936) – 29

Unrecognizedactuarialloss 62,062 79,805 6,458 6,089

ContributionsforMarchtoMay 22 19 77 35

Prepaid(accrued)benefitcosts $ 63,168 $ 65,213 $(10,350) $ (8,656)

ComponentsoftheConsolidatedBalanceSheets:

Prepaidbenefitcosts $ 67,077 $ 68,873 $ – $ –

Accruedbenefitcosts (4,859) (4,496) (10,350) (8,656)

Accumulatedothercomprehensiveloss 950 836 – –

Netasset(liability)recognized $ 63,168 $ 65,213 $(10,350) $ (8,656)

Notesto

Consolidated Financial Statements

Financial Review 2004