Radio Shack 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.66

• Beginning on July 1, 2010, the wireless service

provider was no longer obligated to pay future

residual revenue amounts to the Company for a

period of time for customers activated on or before

June 30, 2010. For the first six months of 2010,

these residual revenue amounts averaged

approximately $9 million per quarter. Based on this

average, we would receive no residual revenue

payments from this wireless service provider for

eight quarters beginning with the third quarter of

2010 under the terms of the settlement agreement.

The effects of the settlement agreement have been

reflected in net sales and operating revenues for 2010.

In the third quarter of 2010, we reached an agreement with

this wireless service provider to modify the commission and

chargeback provisions of our wireless reseller agreement.

Based on the terms of the settlement agreement, the terms

of the amended wireless reseller agreement, and the

performance of our business with this wireless service

provider, we do not believe that these events will have a

material effect on our results of operations for future

periods.

NOTE 15 – SUBSEQUENT EVENTS

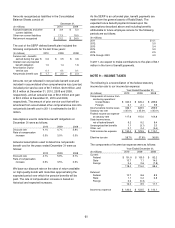

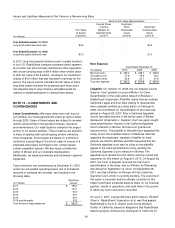

On January 4, 2011, we terminated our $325 million credit

facility and entered into a five-year, $450 million revolving

credit agreement (“2016 Credit Facility”) with a group of

lenders with Bank of America, N.A., as administrative

agent. The 2016 Credit Facility expires on January 4, 2016.

The 2016 Credit Facility may be used for general corporate

purposes and the issuance of letters of credit. This facility is

secured by substantially all of the Company’s inventory,

accounts receivable, cash and cash equivalents, and

certain other personal property.

Borrowings under the 2016 Credit Facility are subject to a

borrowing base of certain secured assets and bear interest,

at our option, at a bank’s prime rate plus 1.25% to 1.75% or

LIBOR plus 2.25% to 2.75%. The applicable rates in these

ranges are based on the aggregate average availability

under the facility.

The 2016 Credit Facility also contains a $150 million sub-

limit for the issuance of standby and commercial letters of

credit. Issued letters of credit will reduce the amount

available under the credit facility. Letter of credit fees are

2.25% to 2.75% for standby letters of credit or 1.125% to

1.375% for commercial letters of credit.

We pay commitment fees to the lenders at an annual rate

of 0.50% of the unused amount of the credit facility. No

borrowings, other than the issuance of letters of credit

totaling $32.8 million as of February 15, 2011, have been

made under the 2016 Credit Facility.

The 2016 Credit Facility contains affirmative and negative

covenants that, among other things, restrict certain

payments, including dividends and share repurchases.

Also, we will be subject to a minimum consolidated fixed

charge coverage ratio if our unused amount under the

facility is less than the greater of 12.5% of the maximum

borrowing amount and $45.0 million.

We are generally free to pay dividends and repurchase

shares as long as the current and projected unused amount

under the facility is greater than 17.5% of the maximum

borrowing amount and the minimum consolidated fixed

charge coverage ratio is maintained. We may pay dividends

and repurchase shares without regard to the Company's

consolidated fixed charge coverage ratio as long as the

current and projected unused amount under the facility is

greater than 75% of the maximum borrowing amount and

cash on hand is used for the dividends or share

repurchases.

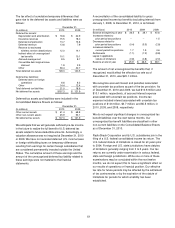

As a condition of the 2016 Credit Facility, we were required

to eliminate the restrictive covenants associated with our

2011 Notes. On January 4, 2011, we transferred $318.1

million to the trustee for the 2011 Notes that will be used to

pay principal and interest amounts due on redemption of

these notes. In connection with the deposit of these funds,

the trustee acknowledged the satisfaction and discharge of

the indenture as to the 2011 Notes, which had the effect of

eliminating the restrictive covenants referred to above. This

redemption is currently scheduled to take place on March 4,

2011. Any amounts remaining with the trustee after the

redemption of the 2011 Notes will be returned to us.

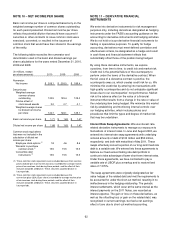

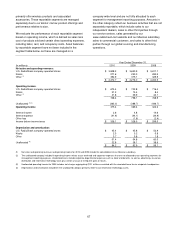

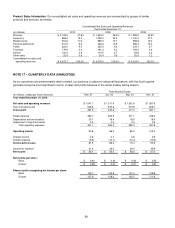

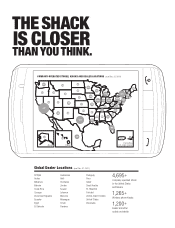

NOTE 16 – SEGMENT REPORTING

We have two reportable segments, U.S. RadioShack

company-operated stores and kiosks. The U.S.

RadioShack company-operated stores segment consists

solely of our 4,486 U.S. company-operated retail stores, all

operating under the RadioShack brand name. Our kiosks

segment consists of our network of 1,267 kiosks, primarily

located in Target and Sam’s Club locations. In April 2009

we agreed with Sprint to cease our arrangement to jointly

operate the Sprint-branded kiosks in operation at that date.

This agreement allowed us to operate these kiosks under

the Sprint name for a reasonable period of time, allowing us

to transition the kiosks to a new format. In August 2009, we

transitioned these kiosks to multiple wireless carrier

RadioShack-branded locations. They are now managed

and reported as extensions of existing RadioShack

company-operated stores located in the same shopping

malls. Both of our reportable segments engage in the sale

of consumer electronics products; however, our kiosks