Radio Shack 2010 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2010 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.21

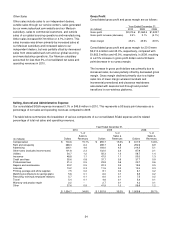

RESULTS OF OPERATIONS

2010 Summary

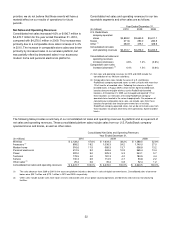

Net sales and operating revenues increased $196.7 million,

or 4.6%, to $4,472.7 million when compared with last year.

Comparable store sales increased 4.4%. This increase was

driven by increased sales in our Sprint and AT&T postpaid

wireless business, increased sales of prepaid wireless

handsets and airtime, and increased sales of wireless

accessories. These increases were partially offset by sales

declines in digital-to-analog converter boxes, GPS

products, netbooks, digital televisions and digital cameras.

The inclusion of T-Mobile as a postpaid wireless carrier

increased sales for the first nine months of 2010; however,

T-Mobile sales decreased in the fourth quarter, when

compared to the same period last year.

Gross margin decreased by 90 basis points from last year

to 45.0%. Gross margin declined primarily due to a higher

sales mix of lower margin wireless handsets and

incremental promotional and clearance markdowns

associated with seasonal sell-through and product

transitions in non-wireless platforms.

Selling, general and administrative (“SG&A”) expense

increased $46.8 million when compared with last year. This

increase was driven by incentive compensation paid on

increased wireless sales, additional employees to support

our Target kiosk locations, and incremental advertising

expense related to brand building in the second quarter of

2010. As a percentage of net sales and operating

revenues, SG&A decreased by 50 basis points to 34.8%.

As a result of the factors above, operating income

increased $6.0 million, or 1.6%, to $375.4 million when

compared with last year.

Net income increased $1.1 million to $206.1 million when

compared with last year. Net income per diluted share was

$1.68 compared with $1.63 last year.

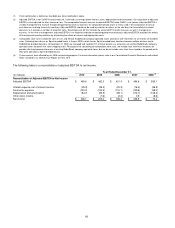

Adjusted EBITDA decreased $2.7 million, or 0.6%, to

$459.6 million when compared with last year.

2010 COMPARED WITH 2009

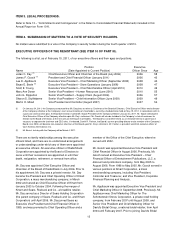

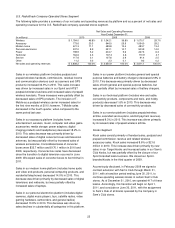

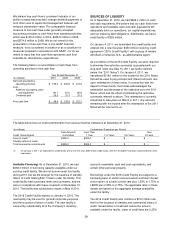

Wireless Service Provider Settlement Agreement

The business terms of our relationships with our wireless

service providers are governed by our wireless reseller

agreements. These contracts are complex and include

provisions determining our upfront commission revenue,

net of chargebacks for wireless service deactivations; our

acquisition and return of wireless handsets; and, in some

cases, future residual revenue, performance targets and

marketing development funds. Disputes occasionally arise

between the parties regarding the interpretation of these

contract provisions.

Certain disputes arose with one of the Company’s wireless

service providers pertaining to upfront commission revenue

for activations prior to July 1, 2010, and related

chargebacks for wireless service deactivations.

Negotiations regarding resolution of these disputes

culminated in the signing of a settlement agreement in July

2010. In connection with the decision to settle these

disputes, the Company considered the following: the timing

of cash outflows and inflows in connection with the disputed

upfront commission revenue and related chargebacks, and

the estimated future residual revenue; the benefits of

settling the disputes and agreeing to enter into good faith

negotiations with the wireless service provider in the third

quarter of 2010 to modify the commission and chargeback

provisions of our wireless reseller agreement; and the risks

associated with the ultimate realization of the estimated

future residual revenue.

Key elements of the settlement agreement include the

following:

• All disputes relating to upfront commission revenue

for activations prior to July 1, 2010, and related

chargebacks were settled.

• The wireless service provider agreed to pay $141

million to the Company on or before July 30, 2010.

• The Company and the wireless service provider

agreed to enter into good faith negotiations in the

third quarter of 2010 to modify the commission and

chargeback provisions of our wireless reseller

agreement.

• Beginning on July 1, 2010, the wireless service

provider was no longer obligated to pay future

residual revenue amounts to the Company for a

period of time for customers activated on or before

June 30, 2010. For the first six months of 2010,

these residual revenue amounts averaged

approximately $9 million per quarter. Based on this

average, we would receive no residual revenue

payments from this wireless service provider for

eight quarters beginning with the third quarter of

2010 under the terms of the settlement agreement.

The effects of the settlement agreement have been

reflected in net sales and operating revenues in the

consolidated financial statements for 2010.

In the third quarter, we reached an agreement with this

wireless service provider to modify the commission and

chargeback provisions of our wireless reseller agreement.

Based on the terms of the settlement agreement, the terms

of the amended wireless reseller agreement, and the

performance of our business with this wireless service