Radio Shack 2010 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2010 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

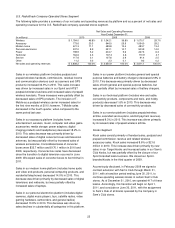

25

Compensation expense increased in dollars and as a

percentage of net sales and operating revenues. This

increase was driven by incentive compensation paid on

increased wireless sales and the hiring of additional

employees to support our Target kiosk locations.

Advertising expense was higher in 2010 primarily due to

incremental advertising related to brand building in the

second quarter of 2010.

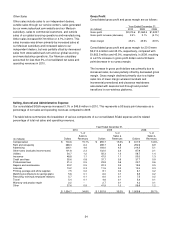

Depreciation and Amortization

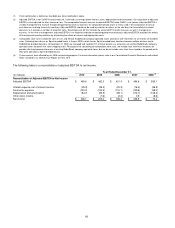

The table below provides a summary of our total

depreciation and amortization by segment.

Year Ended December 31,

(In millions) 2010 2009

2008

U.S. RadioShack

company-operated stores

$ 45.4

$ 45.8

$ 52.9

Kiosks 2.3

3.2 5.8

Other 3.7

5.8 1.8

Unallocated 32.8

38.1 38.6

Total depreciation and

amortization

$ 84.2

$ 92.9

$ 99.1

The table below provides an analysis of total depreciation

and amortization.

Year Ended December 31,

(In millions) 2010 2009

2008

Depreciation and

amortization expense

$ 76.5

$ 83.7

$ 87.9

Depreciation and

amortization included

in cost of products sold

7.7

9.2

11.2

Total depreciation and

amortization

$ 84.2

$ 92.9

$ 99.1

Total depreciation and amortization for 2010 declined $8.7

million or 9.4%. Our depreciation expense has been

trending lower over the past five years due to our lower

level of capital expenditures during this time compared with

a higher level of capital expenditures in 2005 and prior

years.

Impairment of Long-Lived Assets

Impairment of long-lived assets was $4.0 million and $1.5

million in 2010 and 2009, respectively. In 2010, this amount

was related primarily to underperforming U.S. RadioShack

company-operated stores and certain test store formats. In

2009, these amounts were related primarily to

underperforming U.S. RadioShack company-operated

stores and kiosk locations.

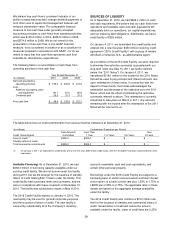

Net Interest Expense

Consolidated net interest expense, which is interest

expense net of interest income, was $ 39.3 million in both

2010 and 2009.

In 2010, interest expense primarily consisted of interest

paid at the stated coupon rate on our outstanding notes, the

non-cash amortization of the discount on our convertible

notes, cash received on our interest rate swaps, and the

non-cash change in fair value of our interest rate swaps.

Interest expense decreased $2.2 million in 2010. This

decrease was primarily driven by the reduced principal

balance of our long-term notes due in May 2011 resulting

from the September 2009 repurchase of $43.2 million of the

principal amount of our notes and increased payments

received on our interest rate swap contracts during 2010.

Non-cash interest expense was $15.2 million in 2010

compared with $13.7 million in 2009.

Interest income decreased $2.2 million in 2010. This

decrease was primarily due to lower average cash

balances in the second half of 2010.

Income Tax Expense

Our effective tax rate for 2010 was 38.7%, compared with

37.6% for 2009. The 2010 effective tax rate was affected by

the net reversal of approximately $1.2 million in previously

unrecognized tax benefits, deferred tax assets and accrued

interest due to the effective settlement of state income tax

matters during the period. These discrete items lowered the

effective tax rate by 0.4 percentage points.

The 2009 effective tax rate was affected by the net reversal

of approximately $6.1 million in previously unrecognized tax

benefits, deferred tax assets and accrued interest due to

the effective settlement of state income tax matters during

the period. These discrete items lowered the effective tax

rate by 1.9 percentage points.

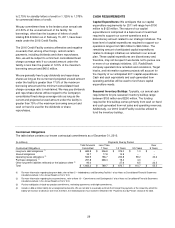

2009 COMPARED WITH 2008

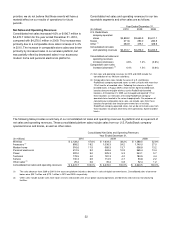

Net Sales and Operating Revenues

Consolidated net sales increased 1.2% or $51.5 million to

$4,276.0 million for the year ended December 31, 2009,

compared with $4,224.5 million in 2008. This increase was

primarily due to a comparable store sales increase of 1.3%

in 2009. The increase in comparable store sales was driven

primarily by increased sales in our wireless and modern

home platforms, but was partially offset by decreased sales

in our accessory and personal electronics platforms.

U.S. RadioShack Company-Operated Stores Segment

Sales in our wireless platform increased 25.3% in 2009.

This sales increase was driven by increased sales in our

Sprint postpaid wireless business, the addition of T-Mobile

as a postpaid wireless carrier, and increased sales of

prepaid wireless handsets. These increases were partially

offset by decreased sales of GPS products.

Sales in our accessory platform decreased 10.2% in 2009.

This sales decrease was primarily driven by decreased