Radio Shack 2010 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2010 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.20

According to the Consumer Electronics Association

(“CEA”), sales of consumer electronics are expected to

remain strong, growing by more than 3% in 2011 to $186.4

billion due to the continued adoption of more portable digital

products. In 2011, the CEA estimates that smartphone

revenues will increase nearly 20% to more than $21 billion.

The innovation in certain mature consumer electronic

product categories, such as DVD players, camcorders and

audio products, has not been sufficient to maintain average

selling prices. These mature products have become

commoditized and have experienced price declines and

reduced margins.

Business Strategy and Performance

Our business strategy is focused around three specific

goals:

• Strengthen our financial position and flexibility

• Improve the quality of our operations, especially

customer service

• Strengthen our product offering and revitalize and

contemporize our brand

By taking a disciplined approach to cost control and

focusing on profitable sales and the strength of our balance

sheet, we have been able to make substantial progress

toward all three goals.

Over the past four years, we improved our margins,

returned excess cash to shareholders through share

repurchases, and controlled our costs. At the same time,

we continued to make operational improvements that

reinforced our strategic themes of mobility, innovation, and

service. In the third quarter of 2009, we added T-Mobile as

a third national wireless carrier to our RadioShack-branded

stores, positioning us to meet our customers’ desire for

multi-carrier options and to develop more aggressively our

position in the wireless market. In addition, we launched our

new brand platform – The Shack® – that began to capture

the attention of consumers and the marketplace.

We have continued to invest in strategic initiatives to drive

our long-term success, including:

• Growing our wireless business by taking advantage

of our multiple wireless carrier retail position, the

strong product growth cycle, and the growth in

penetration of smartphones

• Strengthening the offering in our non-wireless

product platforms by improving our merchandising

talent, transitioning to a more productive product

assortment, adding more national brands, and

increasing exposure of these categories in targeted

advertising and marketing

• Maximizing our dealer and franchise operations by

increasing our wireless offerings through these

channels and developing a consistent brand

experience

• Partnering with other retailers – such as Target – to

provide wireless service offerings in their stores

• Improving our use of real estate and taking

advantage of the current commercial real estate

market by reevaluating our leases for improved

terms or reduced costs

• Developing our international growth opportunities

through our company-owned stores in Mexico

As previously disclosed, in February 2009 we signed a

contract extension with Sam’s Club through March 31,

2011, with a transition period ending June 30, 2011, to

continue operating wireless kiosks in certain Sam’s Club

stores. As of December 31, 2010, we operated 417 of these

kiosks. Accordingly, this transition will begin on April 1,

2011, and conclude on June 30, 2011, with the assignment

to Sam’s Club of all kiosks operated by the Company in

Sam’s Club stores.

In the third quarter of 2010 the Company signed a multi-

year agreement with Target Corporation to operate wireless

kiosks in certain Target stores. In August 2010, we began

to roll out Target Mobile kiosks, with the objective of

operating kiosks in the majority of Target stores nationwide

by mid-2011. As of December 31, 2010, the Company

operated 850 Target Mobile kiosks, and it expects to

operate kiosks in approximately 1,450 Target stores by

June 30, 2011.

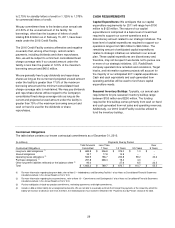

Thus, the Sam’s Club transition coincides with the

expansion of our kiosk program with Target. We expect a

decline in kiosks segment operating income -- reflecting the

impact of ramping up the new Target Mobile kiosks and

eliminating the Sam’s Club kiosks -- of approximately $10

million to $15 million in full-year 2011 compared to full-year

2010, with growth in kiosks segment operating income

expected to resume in 2012 following completion of the

Target Mobile kiosk rollout.