Radio Shack 2010 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2010 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

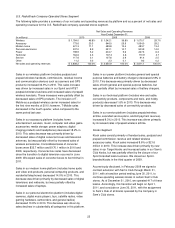

Other Sales

Other sales include sales to our independent dealers,

outside sales through our service centers, sales generated

by our www.radioshack.com website and our Mexican

subsidiary, sales to commercial customers, and outside

sales of our global sourcing operations and manufacturing.

Other sales increased $17.8 million or 4.7% in 2010. This

sales increase was driven primarily by increased sales at

our Mexican subsidiary and increased sales to our

independent dealers, but was partially offset by decreased

sales from www.radioshack.com and our global sourcing

and manufacturing operations. Our Mexican subsidiary

accounted for less than 5% of consolidated net sales and

operating revenues in 2010.

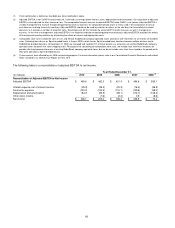

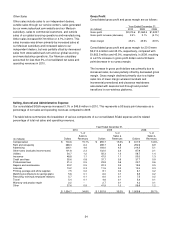

Gross Profit

Consolidated gross profit and gross margin are as follows:

Year Ended December 31,

(In millions) 2010

2009

2008

Gross profit $2,010.6

$1,962.5

$1,922.7

Gross profit increase (decrease) 2.5%

2.1%

(5.1%)

Gross margin 45.0%

45.9%

45.5%

Consolidated gross profit and gross margin for 2010 were

$2,010.6 million and 45.0%, respectively, compared with

$1,962.5 million and 45.9%, respectively, in 2009, resulting

in a 2.5% increase in gross profit dollars and a 90 basis

point decrease in our gross margin.

The increase in gross profit dollars was primarily due to

increased sales, but was partially offset by decreased gross

margin. Gross margin declined primarily due to a higher

sales mix of lower margin wireless handsets and

incremental promotional and clearance markdowns

associated with seasonal sell-through and product

transitions in non-wireless platforms.

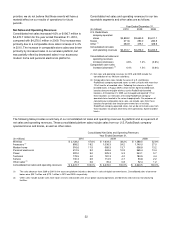

Selling, General and Administrative Expense

Our consolidated SG&A expense increased 3.1% or $46.8 million in 2010. This represents a 50 basis point decrease as a

percentage of net sales and operating revenues compared to 2009.

The table below summarizes the breakdown of various components of our consolidated SG&A expense and its related

percentage of total net sales and operating revenues.

Year Ended December 31,

2010 2009 2008

Dollars

% of

Sales &

Revenues

Dollars

% of

Sales &

Revenues

Dollars

% of

Sales &

Revenues

(In millions)

Compensation $ 700.6

15.7%

$ 655.7

15.3%

$ 617.5

14.6%

Rent and occupancy 288.3

6.4

289.7

6.8

292.6

6.9

Advertising

206.1

4.6

193.0

4.5

214.5

5.1

Other taxes (excludes income taxes) 101.8

2.3

102.0

2.4

87.9

2.1

Utilities 54.7

1.2

55.3

1.3

58.7

1.4

Insurance 48.8

1.1

47.5

1.1

55.0

1.3

Credit card fees 35.6

0.8

37.7

0.9

37.7

0.9

Professional fees 21.4

0.5

23.9

0.6

23.7

0.6

Repairs and maintenance 20.2

0.5

22.3

0.5

19.5

0.5

Licenses 13.2

0.3

11.5

0.3

12.4

0.3

Printing, postage and office supplies 7.5

0.2

8.1

0.2

8.1

0.2

Matching contributions to savings plans 5.6

0.1

6.0

0.1

6.5

0.2

Recruiting, training & employee relations 5.7

0.1

6.0

0.1

7.5

0.2

Travel 5.4

0.1

4.6

0.1

5.4

0.1

Warranty and product repair 2.2

--

2.7

0.1

4.2

0.1

Other 37.6

0.9

41.9

1.0

58.6

1.2

$ 1,554.7

34.8%

$ 1,507.9

35.3%

$ 1,509.8

35.7%