Radio Shack 2010 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2010 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

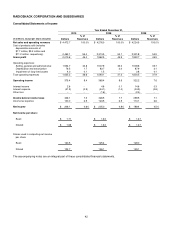

52

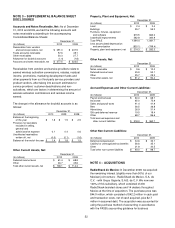

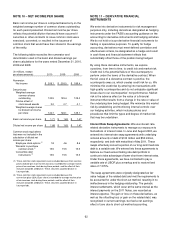

NOTE 3 – SUPPLEMENTAL BALANCE SHEET

DISCLOSURES

Accounts and Notes Receivable, Net: As of December

31, 2010 and 2009, we had the following accounts and

notes receivable outstanding in the accompanying

Consolidated Balance Sheets:

December 31,

(In millions) 2010 2009

Receivables from vendors

and service providers, net

$ 291.0

$ 247.5

Trade accounts receivable 57.6 49.1

Other receivables 30.3 27.7

Allowance for doubtful accounts

(1.4) (1.8)

Accounts and notes receivable, net

$ 377.5 $ 322.5

Receivables from vendors and service providers relate to

earned wireless activation commissions, rebates, residual

income, promotions, marketing development funds and

other payments from our third-party service providers and

product vendors, after taking into account estimates for

service providers’ customer deactivations and non-

activations, which are factors in determining the amount of

wireless activation commissions and residual income

earned.

The change in the allowance for doubtful accounts is as

follows:

December 31,

(In millions) 2010 2009

2008

Balance at the beginning

of the year

$ 1.8

$ 1.5

$ 2.5

Provision for bad debts

included in selling,

general and

administrative expense

0.1

0.4

0.6

Uncollected receivables

written off, net

(0.5)

(0.1)

(1.6)

Balance at the end of the year $ 1.4 $ 1.8 $ 1.5

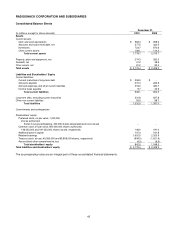

Other Current Assets, Net:

December 31,

(In millions) 2010 2009

Deferred income taxes $ 61.4 $ 68.8

Other 46.7 45.6

Total other current assets, net $ 108.1 $ 114.4

Property, Plant and Equipment, Net:

December 31,

(In millions) 2010 2009

Land $ 2.4 $ 2.4

Buildings 55.7 55.2

Furniture, fixtures, equipment

and software

673.5

663.2

Leasehold improvements 362.8 360.9

Total PP&E 1,094.4 1,081.7

Less accumulated depreciation

and amortization

(820.1)

(799.4)

Property, plant and equipment, net $ 274.3 $ 282.3

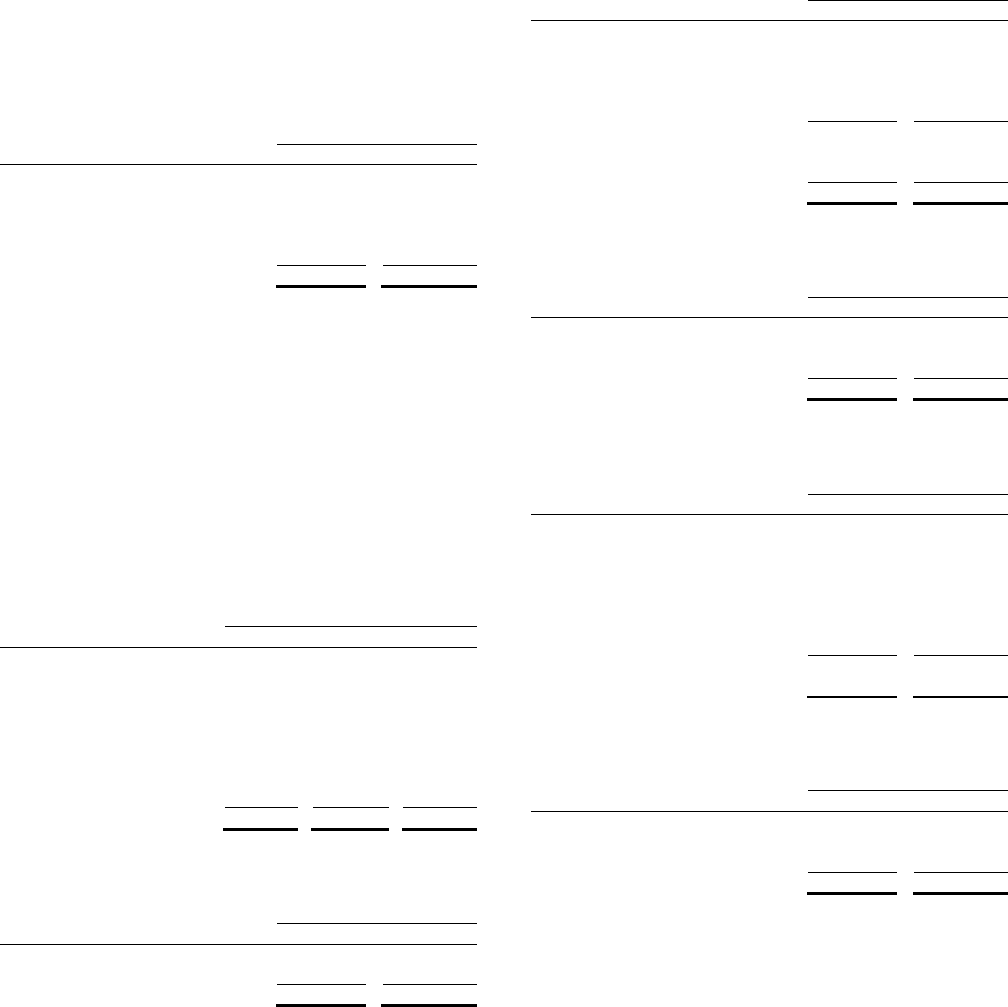

Other Assets, Net:

December 31,

(In millions) 2010 2009

Notes receivable $ 9.6 $ 10.0

Deferred income taxes 45.9 53.1

Other 25.7 29.3

Total other assets, net $ 81.2 $ 92.4

Accrued Expenses and Other Current Liabilities:

December 31,

(In millions) 2010 2009

Payroll and bonuses $ 60.0 $ 68.7

Insurance 65.0 75.9

Sales and payroll taxes 41.4 41.9

Rent 36.5 36.8

Advertising

26.9 31.4

Gift card deferred revenue 19.5 19.4

Other 68.7 86.6

Total accrued expenses and

other current liabilities

$ 318.0

$ 360.7

Other Non-Current Liabilities:

December 31,

(In millions) 2010 2009

Deferred compensation $ 34.6 $ 33.1

Liability for unrecognized tax benefits 36.6 35.1

Other 21.8 30.5

Total other non-current liabilities $ 93.0 $ 98.7

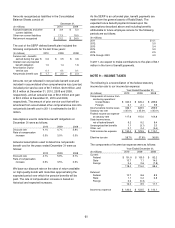

NOTE 4 – ACQUISITIONS

RadioShack de Mexico: In December 2008, we acquired

the remaining interest (slightly more than 50%) of our

Mexican joint venture - RadioShack de Mexico, S.A. de

C.V. - with Grupo Gigante, S.A.B. de C.V. We now own

100% of this subsidiary, which consisted of 200

RadioShack-branded stores and 14 dealers throughout

Mexico at the time of acquisition. The purchase price was

$44.9 million, which consisted of $42.2 million in cash paid

and transaction costs, net of cash acquired, plus $2.7

million in assumed debt. The acquisition was accounted for

using the purchase method of accounting in accordance

with the FASB’s accounting guidance for business