Radio Shack 2010 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2010 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

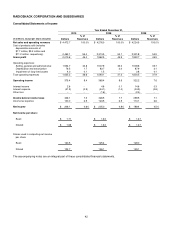

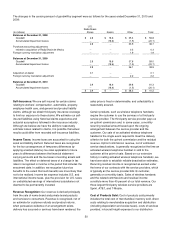

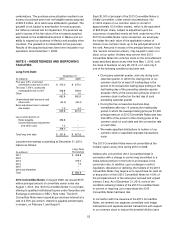

The changes in the carrying amount of goodwill by segment were as follows for the years ended December 31, 2010 and

2009:

(In millions)

U.S.

RadioShack

Stores

Kiosks

Other

Total

Balances at December 31, 2008

Goodwill $ 2.8 $ 18.6 $ 35.4 $ 56.8

Accumulated impairment losses -- (18.6) (1.5) (20.1)

2.8 -- 33.9 36.7

Purchase accounting adjustments

related to acquisition of RadioShack de Mexico

--

--

0.3

0.3

Foreign currency translation adjustment -- -- 1.9 1.9

Balances at December 31, 2009

Goodwill 2.8 18.6 37.6 59.0

Accumulated impairment losses -- (18.6) (1.5) (20.1)

2.8 -- 36.1 38.9

Acquisition of dealer

0.1

--

--

0.1

Foreign currency translation adjustment -- -- 2.2 2.2

Balances at December 31, 2010

Goodwill 2.9 18.6 39.8 61.3

Accumulated impairment losses -- (18.6) (1.5) (20.1)

$ 2.9 $ -- $ 38.3 $ 41.2

Self-Insurance: We are self-insured for certain claims

relating to workers’ compensation, automobile, property,

employee health care, and general and product liability

claims, although we obtain third-party insurance coverage

to limit our exposure to these claims. We estimate our self-

insured liabilities using historical claims experience and

actuarial assumptions followed in the insurance industry.

Although we believe we have the ability to reasonably

estimate losses related to claims, it is possible that actual

results could differ from recorded self-insurance liabilities.

Income Taxes: Income taxes are accounted for using the

asset and liability method. Deferred taxes are recognized

for the tax consequences of temporary differences by

applying enacted statutory tax rates applicable to future

years to differences between the financial statement

carrying amounts and the tax bases of existing assets and

liabilities. The effect on deferred taxes of a change in tax

rates is recognized in income in the period that includes the

enactment date. In addition, we recognize future tax

benefits to the extent that such benefits are more likely than

not to be realized. Income tax expense includes U.S. and

international income taxes, plus the provision for U.S. taxes

on undistributed earnings of international subsidiaries not

deemed to be permanently invested.

Revenue Recognition: Our revenue is derived principally

from the sale of name brand and private brand products

and services to consumers. Revenue is recognized, net of

an estimate for customer refunds and product returns,

when persuasive evidence of an arrangement exists,

delivery has occurred or services have been rendered, the

sales price is fixed or determinable, and collectability is

reasonably assured.

Certain products, such as wireless telephone handsets,

require the customer to use the services of a third-party

service provider. The third-party service provider pays us

an upfront commission and, in some cases, a monthly

recurring residual amount based upon the ongoing

arrangement between the service provider and the

customer. Our sale of an activated wireless telephone

handset is the single event required to meet the delivery

criterion for both the upfront commission and the residual

revenue. Upfront commission revenue, net of estimated

service deactivations, is generally recognized at the time an

activated wireless telephone handset is sold to the

customer at the point-of-sale. Based on our extensive

history in selling activated wireless telephone handsets, we

have been able to establish reliable deactivation estimates.

Recurring residual income is recognized as earned under

the terms of our contracts with the service providers, which

is typically as the service provider bills its customer,

generally on a monthly basis. Sales of wireless handsets

and the related commissions and residual income

constitute more than 40 percent of our total revenue. Our

three largest third-party wireless service providers are

Sprint, AT&T, and T-Mobile.

Cost of Products Sold: Cost of products sold primarily

includes the total cost of merchandise inventory sold, direct

costs relating to merchandise acquisition and distribution

(including depreciation and excise taxes), costs of services

provided, in-bound freight expenses to our distribution