Radio Shack 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.32

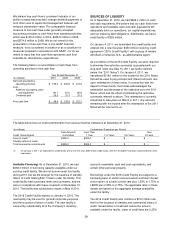

Accelerated Share Repurchase Program: As mentioned

above, in August 2010, we entered into an accelerated

share repurchase program with two investment banks to

repurchase shares of our common stock under our

approved share repurchase program. On August 24, 2010,

we paid $300 million to the investment banks in exchange

for an initial delivery of 11.7 million shares to us. At the

conclusion of the ASR program, we received an additional

3.2 million shares. The 14.9 million shares delivered to us

were based on the average daily volume weighted average

price of our common stock over a period beginning

immediately after the effective date of the ASR agreements

and ending on November 2, 2010.

Treasury Stock Retirement: In December 2010, our

Board of Directors approved the retirement of 45.0 million

shares of our common stock held as treasury stock. These

shares returned to the status of authorized and unissued.

OFF-BALANCE SHEET ARRANGEMENTS

Other than the operating leases described above, we do

not have any off-balance sheet financing arrangements,

transactions, or special purpose entities.

INFLATION

With the exception of increased energy costs in the first half

of 2008, inflation has not significantly affected us over the

past three years. We do not expect inflation to have a

significant effect on our operations in the foreseeable

future.

OTHER MATTERS

Separate from our wireless service provider settlement

agreement in July 2010, we notified T-Mobile that they had

breached their agreement with us. Under the agreement, T-

Mobile has until March 21, 2011, to cure the breaches. In

the event that T-Mobile is unable to cure the breaches, we

have the right to terminate the agreement. The outcome of

this action is uncertain and the ultimate resolution of this

matter could have a material adverse effect on our results

of operations, financial condition and business operations.

CRITICAL ACCOUNTING POLICIES AND

ESTIMATES

Our consolidated financial statements are prepared in

accordance with generally accepted accounting principles

(“GAAP”) in the United States. The application of GAAP

requires us to make estimates and assumptions that affect

the reported values of assets and liabilities at the date of

the financial statements, the reported amount of revenues

and expenses during the reporting period, and the related

disclosures of contingent assets and liabilities. The use of

estimates is pervasive throughout our financial statements

and is affected by management’s judgment and

uncertainties. Our estimates, assumptions and judgments

are based on historical experience, current market trends

and other factors that we believe to be relevant and

reasonable at the time the consolidated financial

statements are prepared. We continually evaluate the

information used to make these estimates as our business

and the economic environment change. Actual results may

differ materially from these estimates under different

assumptions or conditions.

In the Notes to Consolidated Financial Statements, we

describe the significant accounting policies used in the

preparation of our consolidated financial statements. The

accounting policies and estimates we consider most critical

are revenue recognition; inventory valuation; estimation of

reserves and valuation allowances specifically related to

insurance, tax and legal contingencies; valuation of long-

lived assets and intangibles, including goodwill; and stock-

based compensation.

We consider an accounting policy or estimate to be critical

if it requires difficult, subjective or complex judgments, and

is material to the portrayal of our financial condition,

changes in financial condition or results of operations. The

selection, application and disclosure of our critical

accounting policies and estimates have been reviewed by

the Audit and Compliance Committee of our Board of

Directors.

Revenue Recognition

Description

Our revenue is derived principally from the sale of name

brand and private brand products and services to

consumers. Revenue is recognized, net of an estimate for

customer refunds and product returns, when persuasive

evidence of an arrangement exists, delivery has occurred

or services have been rendered, the sales price is fixed or

determinable, and collectability is reasonably assured.

Certain products, such as wireless telephone handsets,

require the customer to use the services of a third-party

service provider. The third-party service provider pays us

an upfront commission for obtaining a new customer and, in

some cases, a monthly recurring residual amount based

upon the ongoing arrangement between the service

provider and the customer. Our sale of an activated

wireless telephone handset is the single event required to

meet the delivery criterion for both the upfront commission

and the recurring residual revenue. Upfront commission

revenue, net of estimated wireless service deactivations, is

generally recognized at the time an activated wireless

telephone handset is sold to the customer at the point-of-

sale. Recurring residual revenue is recognized as earned

under the terms of each contract with the service provider,

which is typically as the service provider bills its customer,

generally on a monthly basis.