Radio Shack 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

During the third quarter of 2006, we granted 1.7 million

options under the 1997, 1999 and 2001 ISPs to our Chief

Executive Officer and Chief Financial Officer. These options

vested over four years from the date of grant and have a

term of seven years. We also granted 2.5 million non-plan

options to our Chief Executive Officer as part of an

inducement grant related to the terms of his employment.

These options vested over four years from the date of grant

and have a term of seven years. An additional market

condition was attached to 2.0 million of these non-plan

options that restricted exercise until certain stock price

hurdles had been achieved. The market condition was met

in 2007, and all stock price hurdles have been achieved.

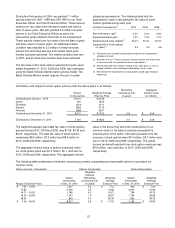

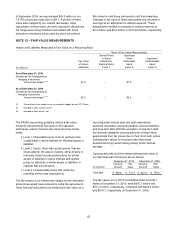

The fair value of the stock options granted during the years

ended December 31, 2010, 2009 and 2008, was estimated

using the Black-Scholes-Merton option-pricing model. The

Black-Scholes-Merton model requires the use of certain

subjective assumptions. The following table lists the

assumptions used in calculating the fair value of stock

options granted during each year:

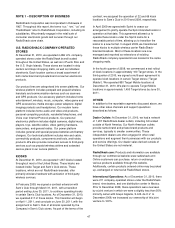

Valuation Assumptions

(1)

2010

2009

2008

Risk free interest rate

(2)

2.3%

2.0%

2.8%

Expected dividend yield 1.3%

1.8%

1.0%

Expected stock price volatility

(3)

42.4%

50.4%

40.5%

Expected life of stock options

(in years)(4)

5.4

5.4

4.6

(1) Forfeitures are estimated using historical experience and projected

employee turnover.

(2) Based on the U.S. Treasury constant maturity interest rate whose term

is consistent with the expected life of our stock options.

(3) We consider both the historical volatility of our stock price, as well as

implied volatilities from exchange-traded options on our stock.

(4) We estimate the expected life of stock options based upon historical

experience.

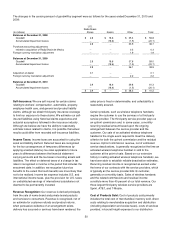

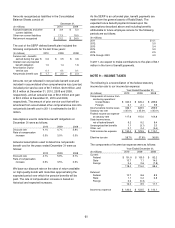

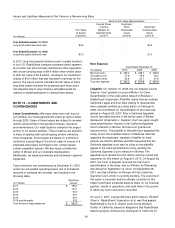

Information with respect to stock option activity under the above plans is as follows:

Shares

(In thousands)

Weighted Average

Exercise Price

Remaining

Contractual Life

(in years)

Aggregate

Intrinsic Value

(in millions)

Outstanding at January 1, 2010 10,014 $ 20.28

Grants 194 19.23

Exercised (213) 15.11

Expired (892) 37.30

Forfeited (586) 36.01

Outstanding at December 31, 2010 8,517 $ 17.52 2.8 $ 34.4

Exercisable at December 31, 2010

7,134

$ 18.83

2.4

$ 23.6

The weighted-average grant-date fair value of stock options

granted during 2010, 2009 and 2008, was $7.08, $4.32 and

$6.33, respectively. The total fair value of stock options

vested was $8.5 million, $7.2 million and $8.5 million in

2010, 2009 and 2008, respectively.

The aggregate intrinsic value of options exercised under

our stock option plans was $1.3 million, $0.1, and zero for

2010, 2009 and 2008, respectively. The aggregate intrinsic

value is the amount by which the market price of our

common stock on the date of exercise exceeded the

exercise price of the option. Net cash proceeds from the

exercise of stock options were $4.0 million, $0.7 million and

zero in 2010, 2009 and 2008, respectively. The actual

income tax benefit realized from stock option exercises was

$0.5 million, zero and zero, in 2010, 2009 and 2008,

respectively.

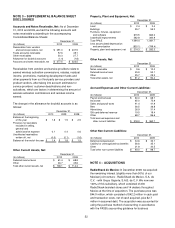

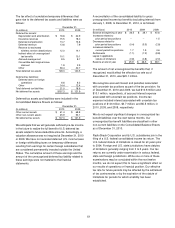

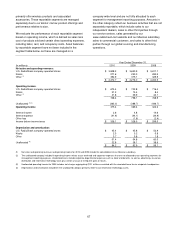

The following table summarizes information concerning currently outstanding and exercisable options to purchase our

common stock:

(Share amounts in thousands) Options Outstanding Options Exercisable

Range of Exercise Prices

Shares

Outstanding

at Dec. 31, 2010

Weighted

Average

Remaining

Contractual Life

(in years)

Weighted

Average

Exercise Price

Shares

Exercisable

at Dec. 31, 2010

Weighted

Average

Exercise Price

$ 7.05 – 13.58 1,347 5.2 $ 7.13 403 $ 7.05

13.82 4,000 2.5 13.82 4,000 13.82

14.71 – 19.20 1,180 4.2 18.27 754 18.10

19.20 – 35.08 1,147 1.5 26.57 1,134 26.65

38.35 843 0.2 38.35 843 38.35

$ 7.05 – 38.35 8,517 2.8 $ 17.52 7,134 $ 18.83