Radio Shack 2010 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2010 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.27

Impairment of Long-Lived Assets

Impairment of long-lived assets was $1.5 million and $2.8

million for 2009 and 2008, respectively. These amounts

were related primarily to underperforming U.S. RadioShack

company-operated stores and kiosk locations.

Net Interest Expense

Consolidated net interest expense, which is interest

expense net of interest income, was $39.3 million for 2009

compared with $20.3 million for 2008.

Interest expense primarily consists of interest paid on the

stated coupon rate for our outstanding bonds, the non-cash

amortization of discounts and premiums on our outstanding

bonds, cash paid or received on our interest rate swaps,

and the non-cash change in fair value of our interest rate

swaps in 2009. Interest expense increased $9.2 million in

2009. This increase was primarily driven by increased

interest expense related to our 2013 convertible notes.

These notes were outstanding for twelve months in 2009

and four months in 2008. This increase was partially offset

by increased payments received on our interest rate swap

contracts in 2009 and the repurchase of $43.2 million of our

notes due in May 2011. Non-cash interest expense was

$13.7 million in 2009 compared with $5.0 million in 2008.

Interest income decreased $9.8 million in 2009. This

decrease was due to a lower interest rate environment in

2009, but was partially offset by larger average cash

balances in 2009.

Other Loss

During 2009 we recorded other loss of $1.6 million

compared with other loss of $2.4 million in 2008. The 2009

loss was recognized in conjunction with the repurchase of a

portion of our 2011 Notes. The 2008 loss represented

losses related to our derivative exposure to Sirius XM

Radio, Inc. warrants as a result of our fair value

measurements of these warrants. At December 31, 2008,

the fair value of these warrants was zero, and these

warrants expired in the first quarter of 2009.

Income Tax Expense

Our effective tax rate for 2009 was 37.6% compared with

36.8% for 2008. The 2009 effective tax rate was affected by

the net reversal of approximately $6.1 million in previously

unrecognized tax benefits, deferred tax assets and accrued

interest due to the effective settlement of state income tax

matters during the period. These discrete items lowered the

effective tax rate by 1.9 percentage points.

The 2008 effective tax rate was affected by the execution of

a closing agreement with respect to a Puerto Rico income

tax matter during the year, which resulted in a credit to

income tax expense; this discrete item lowered the effective

tax rate for 2008 by 1.0 percentage point. In addition, the

2008 effective tax rate was affected by the net reversal of

approximately $4.1 million in unrecognized tax benefits,

deferred tax assets and accrued interest related to the

settlement of various state income tax matters and the

expiration of the statute of limitations with respect to our

2002 taxable year; this net reversal lowered the effective

tax rate for 2008 by 1.4 percentage points.

RECENTLY ISSUED ACCOUNTING

PRONOUNCEMENTS

Refer to Note 2 – “Summary of Significant Accounting

Policies” under the section titled “New Accounting

Standards” in the Notes to Consolidated Financial

Statements.

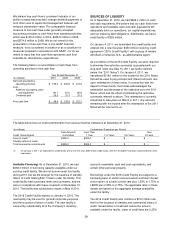

LIQUIDITY AND CAPITAL RESOURCES

Cash Flow Overview

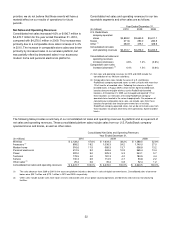

Operating Activities: Cash provided by operating activities

in 2010 was $155.0 million, compared with $245.8 million in

2009. Cash flows from operating activities are comprised of

net income plus non-cash adjustments to net income and

working capital components. Cash provided by net income

plus non-cash adjustments to net income was $343.9

million and $333.7 million in 2010 and 2009, respectively.

Cash used in working capital components was $188.9

million and $87.9 million in 2010 and 2009, respectively.

Our cash used in working capital components in 2010 was

driven by higher accounts receivable and inventory

balances to support our increased wireless business and

our Target kiosk expansion. Cash used in working capital

components in 2010 was also driven by lower accrued

expenses and current liabilities related to insurance, legal

reserves and compensation.

Investing Activities: Cash used in investing activities was

$80.0 million and $80.8 million in 2010 and 2009,

respectively. Capital expenditures of $80.1 million in 2010

were consistent with last year. Capital expenditures

primarily related to information system projects, Target

Mobile kiosks, and our U.S. RadioShack company-operated

stores.

Financing Activities: Net cash used in financing activities

was $413.8 million in 2010 compared with $71.6 million in

2009. This increase was primarily driven by the repurchase

of $398.8 million of our common stock in 2010 under our

share repurchase program, compared with no repurchases

in 2009.

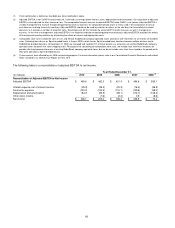

Free Cash Flow: Our free cash flow, defined as cash flows

from operating activities less dividends paid and additions to

property, plant and equipment, was $48.4 million in 2010,

$133.5 million in 2009, and $157.7 million in 2008. The

decrease in free cash flow for 2010 was attributable to

decreased cash flow from operating activities as described

above.