Radio Shack 2010 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2010 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.26

sales in digital-to-analog converter boxes, wireless

accessories, imaging accessories, and media storage, but

was partially offset by increased sales of television

antennas. Consolidated sales of converter boxes were

$170.1 million and $204.8 million in 2009 and 2008,

respectively. The decrease in converter box sales occurred

in the second half of the year after the transition to digital

television occurred in June 2009.

Sales in our modern home platform increased 1.3% in

2009. In this platform we recorded sales gains in netbooks,

digital televisions, and VoIP products, which were

substantially offset by sales declines in laptops, residential

telephones, and DVD players.

Sales in our personal electronics platform decreased 22.4%

in 2009. This decrease was driven primarily by sales

declines in digital cameras, digital music players, video

game consoles, satellite radios, and toys.

Sales in our power platform decreased 9.9% in 2009. This

decrease was primarily driven by decreased sales of both

general and special purpose batteries. Our sales

performance in this platform was negatively affected by the

disruption during the transition process of the assortment to

our Enercell brand.

Sales in our technical platform decreased 2.1% in 2009.

We recorded an increase in sales of wire and cable

products, which was more than offset by decreased sales

across most of the other product categories in this platform.

Sales in our service platform increased 17.7% in 2009. This

increase was driven primarily by increased sales of prepaid

wireless airtime and extended service plans.

Kiosks Segment

Kiosk sales decreased 11.8% or $33.5 million in 2009. We

realized a sales increase in our Sam’s Club business,

which was offset by a reduced number of kiosk locations.

This decrease in locations was partially due to the closure

of underperforming Sprint-branded kiosk locations in the

first half of 2009 and the closure of the remainder of our

Sprint-branded kiosks in the third quarter. For more

information regarding the reduction in kiosk outlets, see the

Retail Locations table in Item 2 – “Properties” in this Annual

Report on Form 10-K.

Other Sales

Other sales increased $45.2 million or 13.7% in 2009. This

sales increase was primarily attributable to the

consolidation of our Mexican subsidiary for all of 2009, but

was partially offset by decreased sales to our independent

dealers. Our Mexican subsidiary accounted for less than

5% of consolidated net sales and operating revenues in

2009.

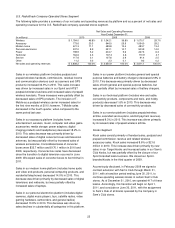

Gross Profit

Consolidated gross profit and gross margin for 2009 were

$1,962.5 million and 45.9%, respectively, compared with

$1,922.7 million and 45.5% in 2008, resulting in a 2.1%

increase in gross profit dollars and a 40 basis point

increase in our gross margin.

The improvement in gross margin was partially driven by

improved product mix, combined with fewer markdowns as

a result of more effective promotional productivity, inventory

management and higher sell-through of seasonal products.

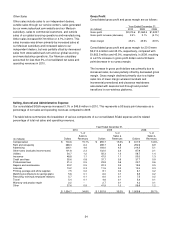

Selling, General and Administrative Expense

Our consolidated SG&A expense decreased 0.1% or $1.9

million in 2009. This represents a 40 basis point decrease

as a percentage of net sales and operating revenues

compared to 2008.

Compensation expense increased in dollars and as a

percentage of net sales and operating revenues. This

increase was driven by more incentive compensation and

the consolidation of our Mexican subsidiary for all of 2009.

Total rent and occupancy expense decreased from 2008.

This decrease was primarily driven by reduced rent related

to our amended headquarters lease and the closing of our

Sprint-branded kiosks. These decreases were partially

offset by the consolidation of our Mexican subsidiary for all

of 2009.

Advertising expense decreased in 2009 primarily due to

reduced spending in the second quarter of the year. While

our advertising expense in the second half of the year was

consistent with the same period last year, we shifted a

significant portion of our advertising expenditures from

product specific promotional activities to building

awareness of our new brand creative platform, The Shack®.

The increase in other taxes was partially driven by

increased payroll taxes associated with increased

compensation expense. Additionally, we recorded an $8.2

million sales and use tax benefit from the settlement of a

sales tax issue in 2008.

Our insurance expense has decreased in recent years due

to lower workers’ compensation costs. This has been the

result of better claims experience during this time.

The decrease in other SG&A expense was primarily due to

a $12.1 million non-cash charge recorded in connection

with our amended headquarters lease in 2008.

Depreciation and Amortization

Total depreciation and amortization for 2009 declined $6.2

million or 6.3%. This decrease was primarily due to reduced

capital expenditures in recent years when compared with

prior years.