Radio Shack 2010 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2010 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

In September 2009, we completed a tender offer to

purchase for cash any and all of these notes. Upon

expiration of the offer, $43.2 million of the aggregate

outstanding principal amount of the notes was validly

tendered and accepted. We paid a total of $46.6 million,

which consisted of the purchase price of $45.4 million for

the tendered notes plus $1.2 million in accrued and unpaid

interest, to the holders of the tendered notes.

On January 4, 2011, we announced our intention to redeem

any and all outstanding 2011 Notes on March 4, 2011. See

Note 15 - “Subsequent Events” in the Notes to

Consolidated Financial Statements for more information.

Operating Leases: We use operating leases, primarily for

our retail locations and our corporate campus, to lower our

capital requirements.

Continuing Lease Obligations: We have obligations

under retail leases for locations that we assigned to other

businesses. The majority of these lease obligations arose

from leases for which CompUSA Inc. (“CompUSA”)

assumed responsibility as part of its purchase of our

Computer City, Inc. subsidiary in August 1998. Because the

company that assumed responsibility for these leases has

ceased operations, we may be responsible for rent due

under the leases.

Following an announcement by CompUSA in February

2007 of its intention to close as many as 126 stores and an

announcement in December 2007 that it had been acquired

by Gordon Brothers Group, CompUSA’s stores ceased

operations in January 2008. We may be responsible for

rent due on a portion of the leases that relate to the closed

stores. As of February 3, 2011, we had been named as a

defendant in a total of 13 lawsuits from lessors seeking

payment from us, 12 of which have been resolved.

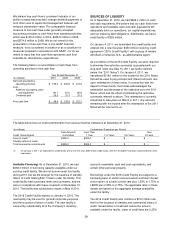

Based on all available information pertaining to the status of

these lawsuits, and after applying the Financial Accounting

Standards Board’s (“FASB”) guidance on accounting for

contingencies, the balance of our accrual for these

obligations was $2.4 million and $6.2 million at December

31, 2010 and 2009, respectively. We will continue to

monitor this situation for new information on outstanding

litigation and settlements, but we do not consider the

amounts of these obligations, both individually and in the

aggregate, to be material to our results of operations or

financial position.

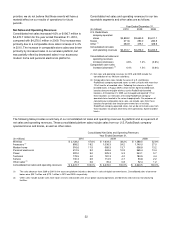

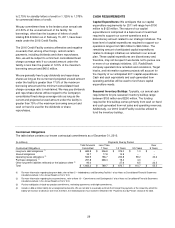

Capitalization

The following table sets forth information about our

capitalization on the dates indicated.

December 31,

2010 2009

(Dollars in millions)

Dollars

% of Total

Capitalization

Dollars

% of Total

Capitalization

Short-term debt $ 308.0

20.8% $ -- -- %

Long-term debt 331.8

22.4 627.8

37.5

Total debt 639.8

43.2 627.8

37.5

Stockholders’

equity

842.5

56.8

1,048.3

62.5

Total capitalization

$1,482.3

100.0% $1,676.1

100.0%

Our debt-to-total capitalization ratio increased in 2010 from

2009, primarily due to the repurchase of $398.8 million of

our common stock in 2010.

Dividends: We have paid common stock cash dividends

for 24 consecutive years. On November 4, 2010, our Board

of Directors declared an annual dividend of $0.25 per

share. The dividend was paid on December 16, 2010, to

stockholders of record on November 26, 2010. The

dividend payment of $26.5 million was funded from cash on

hand.

Share Repurchases: In July 2008, our Board of Directors

approved a share repurchase program with no expiration

date authorizing management to repurchase up to $200

million of our common stock. During the third quarter of

2008, we repurchased 6.0 million shares or $110.0 million

of our common stock under this program. As of December

31, 2008, $90.0 million was available for share repurchases

under this program.

In August 2009, our Board of Directors approved a $200

million increase in this share repurchase program. As of

December 31, 2009, $290 million of the total authorized

amount was available for share repurchases under this

program.

In August 2010, our Board of Directors approved an

increase in this share repurchase program from $400

million to $610 million, with $500 million available for share

repurchases under this program. In November 2010, we

completed a $300 million accelerated share repurchase

(“ASR”) program that we entered into in August 2010,

which is further discussed below. We repurchased 14.9

million shares under the ASR program. In addition, after the

conclusion of the ASR program, we repurchased $98.6

million worth of shares in the open market, representing 4.9

million shares. As of December 31, 2010, $101.4 million of

the total authorized amount was available for share

repurchases under this program.