Radio Shack 2010 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2010 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

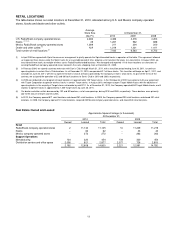

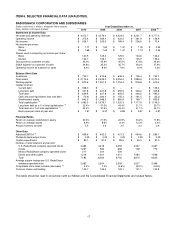

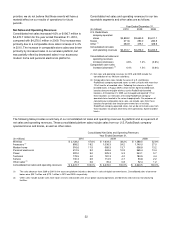

ITEM 6. SELECTED FINANCIAL DATA (UNAUDITED).

RADIOSHACK CORPORATION AND SUBSIDIARIES

(Dollars and shares in millions, except per share amounts,

ratios, locations and square footage)

Year Ended December 31,

2010 2009 2008 2007 2006

(

4

)

Statements of Income Data

Net sales and operating revenues $ 4,472.7 $ 4,276.0 $ 4,224.5 $ 4,251.7 $ 4,777.5

Operating income $ 375.4 $ 369.4 $ 322.2 $ 381.9 $ 156.9

Net income $ 206.1 $ 205.0 $ 189.4 $ 236.8 $ 73.4

Net income per share:

Basic $ 1.71 $ 1.63 $ 1.47 $ 1.76 $ 0.54

Diluted $ 1.68 $ 1.63 $ 1.47 $ 1.74 $ 0.54

Shares used in computing net income per share:

Basic 120.5 125.4 129.0 134.6 136.2

Diluted 122.7 126.1 129.1 135.9 136.2

Gross profit as a percent of sales 45.0% 45.9% 45.5% 47.6% 44.6%

SG&A expense as a percent of sales 34.8% 35.3% 35.7% 36.2% 37.9%

Operating income as a percent of sales 8.4% 8.6% 7.6% 9.0% 3.3%

Balance Sheet Data

Inventories $ 723.7 $ 670.6 $ 636.3 $ 705.4 $ 752.1

Total assets $ 2,175.4 $ 2,429.3 $ 2,254.0 $ 1,989.6 $ 2,070.0

Working capital $ 870.6 $ 1,361.2 $ 1,154.4 $ 818.8 $ 615.4

Capital structure:

Current debt $ 308.0 $ -- $ -- $ -- $ 149.4

Long-term debt $ 331.8 $ 627.8 $ 659.5 $ 348.2 $ 345.8

Total debt $ 639.8 $ 627.8 $ 659.5 $ 348.2 $ 495.2

Cash and cash equivalents less total debt $ (70.4) $ 280.4 $ 155.3 $ 161.5 $ (23.2)

Stockholders' equity $ 842.5 $ 1,048.3 $ 860.8 $ 769.7 $ 653.8

Total capitalization

(1)

$ 1,482.3 $ 1,676.1 $ 1,520.3 $ 1,117.9 $ 1,149.0

Long-term debt as a % of total capitalization

(1)

22.4% 37.5% 43.4% 31.1% 30.1%

Total debt as a % of total capitalization

(1)

43.2% 37.5% 43.4% 31.1% 43.1%

Book value per share at year end $ 7.97 $ 8.37 $ 6.88 $ 5.87 $ 4.81

Financial Ratios

Return on average stockholders' equity 20.3% 21.5% 22.9% 33.2% 11.8%

Return on average assets 8.9% 8.9% 9.3% 12.3% 3.4%

Annual inventory turnover

3.5 3.6 3.5 3.3 2.9

Other Data

Adjusted EBITDA

(2)

$ 459.6 $ 462.3 $ 421.3 $ 494.6 $ 285.1

Dividends declared per share $ 0.25 $ 0.25 $ 0.25 $ 0.25 $ 0.25

Capital expenditures $ 80.1 $ 81.0 $ 85.6 $ 45.3 $ 91.0

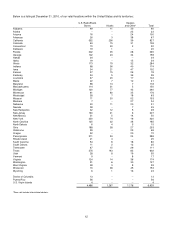

Number of retail locations at year end:

U.S. RadioShack company-operated stores 4,486 4,476 4,453 4,447 4,467

Kiosks 1,267 562 688 739 772

Mexico RadioShack company-operated stores 211 204 200 -- --

Dealer and other outlets 1,219 1,321 1,411 1,484 1,596

Total 7,183 6,563 6,752 6,670 6,835

Average square footage per U.S. RadioShack

company-operated store

2,482

2,504

2,505

2,527

2,496

Comparable store sales increase (decrease)

(3)

4.4% 1.3% (0.6%) (8.2%) (5.6%)

Common shares outstanding 105.7 125.2 125.1 131.1 135.8

This table should be read in conjunction with our MD&A and the Consolidated Financial Statements and related Notes.