Radio Shack 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

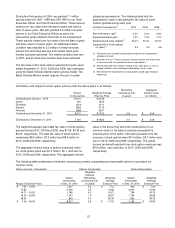

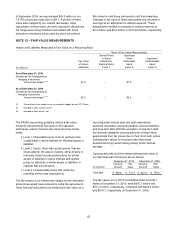

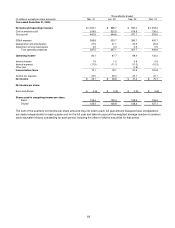

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis

Basis of Fair Value Measurements

Fair Value

of Assets

(Liabilities)

Quoted Prices

in Active

Markets for

Identical Items

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

(In millions)

Year Ended December 31, 2010

Long-lived assets held and used $0.9 -- -- $0.9

Year Ended December 31, 20

09

Long-lived assets held and used $1.0 -- -- $1.0

In 2010, long-lived assets held and used in certain locations

of our U.S. RadioShack company-operated stores segment

and certain test store formats classified as other operations

with a total carrying value of $4.9 million were written down

to their fair value of $0.9 million, resulting in an impairment

charge of $4.0 million that was included in earnings for the

period. The inputs used to calculate the fair value of these

long-lived assets included the projected cash flows and a

risk-adjusted rate of return that we estimated would be

used by a market participant in valuing these assets.

NOTE 13 – COMMITMENTS AND

CONTINGENCIES

Lease Commitments: We lease rather than own most of

our facilities. Our lease agreements expire at various dates

through 2025. Some of these leases are subject to renewal

options and provide for the payment of taxes, insurance

and maintenance. Our retail locations comprise the largest

portion of our leased facilities. These locations are primarily

in major shopping malls and shopping centers owned by

other companies. Some leases are based on a minimum

rental plus a percentage of the store's sales in excess of a

stipulated base figure (contingent rent). Certain leases

contain escalation clauses. We also lease a distribution

center in Mexico and our corporate headquarters.

Additionally, we lease automobiles and information systems

equipment.

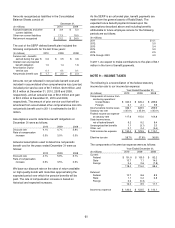

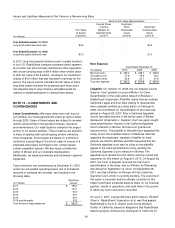

Future minimum rent commitments at December 31, 2010,

under non-cancelable operating leases (net of immaterial

amounts of sublease rent income), are included in the

following table.

(In millions)

Operating

Leases

2011 $ 196.7

2012 140.1

2013 93.7

2014 60.1

2015 39.1

2016 and thereafter 33.2

Total minimum lease payments $ 562.9

Rent Expense:

Year Ended December 31,

(In millions) 2010 2009 2008

Minimum rents $ 229.0

$ 228.7

$ 228.8

Occupancy cost 37.6

39.4

38.2

Contingent rents 23.6

23.7

27.8

Total rent expense $ 290.2

$ 291.8

$ 294.8

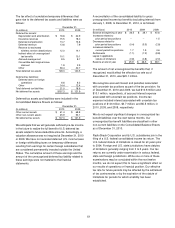

Litigation: On October 10, 2008, the Los Angeles County

Superior Court granted our second Motion for Class

Decertification in the class action lawsuit of Brookler v.

RadioShack Corporation. Plaintiffs’ claims that we violated

California's wage and hour laws relating to meal periods

were originally certified as a class action on February 8,

2006. Our first Motion for Decertification of the class was

denied on August 29, 2007. After a California Appellate

Court's favorable decision in the similar case of Brinker

Restaurant Corporation v. Superior Court, we again sought

class decertification. Based on the California Appellate

Court’s decision in Brinker, the trial court granted our

second motion. The plaintiffs in Brookler have appealed this

ruling. Due to the unsettled nature of California state law

regarding the employers’ standard of liability for meal

periods, we and the Brookler plaintiffs requested that the

California appellate court stay its ruling on the plaintiffs’

appeal of the class decertification ruling, pending the

California Supreme Court’s decision in Brinker. The

appellate court denied this joint motion and then heard oral

arguments for this matter on August 5, 2010. On August 26,

2010, the Court of Appeals reversed the trial court’s

decertification of the class, and our Petition for Rehearing

was denied on September 14, 2010. On September 28,

2010, we filed a Petition for Review with the California

Supreme Court, which is currently pending. The outcome of

this action is uncertain and the ultimate resolution of this

matter could have a material adverse effect on our financial

position, results of operations, and cash flows in the period

in which any such resolution is recorded.

On June 7, 2007, a purported class action lawsuit, Richard

Stuart v. RadioShack Corporation, et al, was filed against

RadioShack in the U.S. District Court for the Northern

District of California, based on allegations that RadioShack

failed to properly reimburse its employees in California for