Radio Shack 2010 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2010 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.65

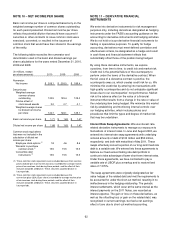

mileage expenses associated with their use of personal

vehicles to make transfers of merchandise between our

stores. On February 9, 2009, the court granted the plaintiffs’

Motion for Class Certification. Following mediation, the

parties reached agreement to settle the lawsuit for a total of

$4.5 million, subject to court approval. On April 19, 2010,

the court granted preliminary approval of the settlement,

and on August 9, 2010, granted final approval. The

settlement proceeds were delivered to the claim

administrator for distribution to the class members and

others on October 1, 2010.

Separate from our wireless service provider settlement

agreement discussed in Note 14, we notified T-Mobile that

they had breached their agreement with us. Under the

agreement, T-Mobile has until March 21, 2011, to cure the

breaches. In the event that T-Mobile is unable to cure the

breaches, we have the right to terminate the agreement.

The outcome of this action is uncertain and the ultimate

resolution of this matter could have a material adverse

effect on our results of operations, financial condition and

business operations.

We have various other pending claims, lawsuits, disputes

with third parties, investigations and actions incidental to

the operation of our business, including certain cases

discussed generally below under “Continuing Lease

Obligations.” Although occasional adverse settlements or

resolutions may occur and negatively affect earnings in the

period or year of settlement, it is our belief that their

ultimate resolution will not have a material adverse effect

on our financial position or liquidity.

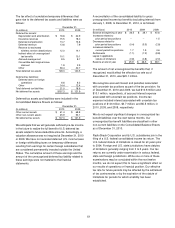

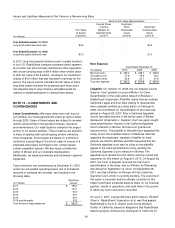

Continuing Lease Obligations: We have obligations

under retail leases for locations that we assigned to other

businesses. The majority of these lease obligations arose

from leases for which CompUSA Inc. (“CompUSA”)

assumed responsibility as part of its purchase of our

Computer City, Inc. subsidiary in August 1998. Because the

company that assumed responsibility for these leases has

ceased operations, we may be responsible for rent due

under the leases.

Following an announcement by CompUSA in February

2007 of its intention to close as many as 126 stores and an

announcement in December 2007 that it had been acquired

by Gordon Brothers Group, CompUSA’s stores ceased

operations in January 2008. We may be responsible for

rent due on a portion of the leases that relate to the closed

stores. As of February 3, 2011, we had been named as a

defendant in a total of 13 lawsuits from lessors seeking

payment from us, 12 of which have been resolved.

Based on all available information pertaining to the status of

these lawsuits, and after applying the FASB’s accounting

guidance on accounting for contingencies, the balance of

our accrual for these obligations was $2.4 million and $6.2

million at December 31, 2010 and 2009, respectively. We

will continue to monitor this situation for new information on

outstanding litigation and settlements, but we do not

consider the amounts of these obligations, both individually

and in the aggregate, to be material to our results of

operations or financial position.

Purchase Obligations: We had purchase obligations of

$291.8 million at December 31, 2010, which include product

commitments, marketing agreements and freight

commitments. Of this amount, $268.4 million related to 2011.

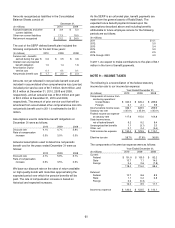

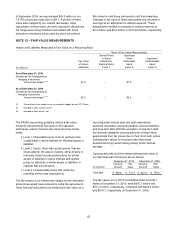

NOTE 14 – WIRELESS SERVICE PROVIDER

SETTLEMENT AGREEMENT

The business terms of our relationships with our wireless

service providers are governed by our wireless reseller

agreements. These contracts are complex and include

provisions determining our upfront commission revenue,

net of chargebacks for wireless service deactivations; our

acquisition and return of wireless handsets; and, in some

cases, future residual revenue, performance targets and

marketing development funds. Disputes occasionally arise

between the parties regarding the interpretation of these

contract provisions.

Certain disputes arose with one of the Company’s wireless

service providers pertaining to upfront commission revenue

for activations prior to July 1, 2010, and related

chargebacks for wireless service deactivations.

Negotiations regarding resolution of these disputes

culminated in the signing of a settlement agreement in July

2010. In connection with the decision to settle these

disputes, the Company considered the following: the timing

of cash outflows and inflows in connection with the disputed

upfront commission revenue and related chargebacks, and

the estimated future residual revenue; the benefits of

settling the disputes and agreeing to enter into good faith

negotiations with the wireless service provider in the third

quarter of 2010 to modify the commission and chargeback

provisions of our wireless reseller agreement; and the risks

associated with the ultimate realization of the estimated

future residual revenue. Key elements of the settlement

agreement include the following:

• All disputes relating to upfront commission revenue

for activations prior to July 1, 2010, and related

chargebacks were settled.

• The wireless service provider agreed to pay $141

million to the Company on or before July 30, 2010.

• The Company and the wireless service provider

agreed to enter into good faith negotiations in the

third quarter of 2010 to modify the commission and

chargeback provisions of our wireless reseller

agreement.