Radio Shack 2010 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2010 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.6

well as our proxy statements, as soon as reasonably

practicable after we electronically file this material with, or

furnish it to, the SEC. You may review these documents,

under the heading “Investor Relations,” by accessing our

corporate website:

http://www.radioshackcorporation.com

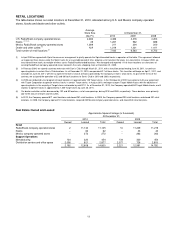

For information regarding the net sales and operating

revenues and operating income for each of our business

segments for fiscal years ended December 31, 2010, 2009

and 2008, please see Note 16 – “Segment Reporting” in the

Notes to Consolidated Financial Statements.

ITEM 1A. RISK FACTORS.

One should carefully consider the risks and uncertainties

described below, as well as other information set forth in

this Annual Report on Form 10-K. There may be additional

risks that are not presently material or known, and the

following list should not be construed as an exhaustive list

of all factors that could cause actual results to differ

materially from those expressed in forward-looking

statements made by us. If any of the events described

below occur, our business, results of operations, financial

condition, liquidity or access to the capital markets could be

materially adversely affected.

We may be unable to successfully execute our strategy

to provide cost-effective solutions to meet the routine

consumer electronics needs and distinct consumer

electronics wants of our customers.

To achieve our strategy, we have undertaken a variety of

strategic initiatives. Our failure to successfully execute our

strategy or the occurrence of certain events, including the

following, could materially adversely affect our ability to

maintain or grow our comparable store sales and our

business generally:

• Our inability to keep our extensive store distribution

system updated and conveniently located near our

target customers

• Our employees’ inability to provide solutions,

answers, and information related to increasingly

complex consumer electronics products

• Our inability to recognize evolving consumer

electronics trends and offer products that customers

need or want

Adverse changes in national and world-wide economic

conditions could negatively affect our business.

The continued uncertainty in the economy could have a

significant negative effect on U.S. consumer spending,

particularly discretionary spending for consumer electronics

products, which, in turn, could directly affect our sales.

Consumer confidence, recessionary and inflationary trends,

equity market levels, consumer credit availability, interest

rates, consumers’ disposable income and spending levels,

energy prices, job growth, income tax rates and

unemployment rates may affect the volume of customer

traffic and level of sales in our locations. Continued

negative trends of any of these economic conditions,

whether national or regional in nature, could materially

adversely affect our results of operations and financial

condition.

In addition, potential disruptions in the capital and credit

markets could have a significant effect on our ability to

access the U.S. and global capital and credit markets, if

needed. These potential disruptions in the capital and credit

market conditions could materially adversely affect our

ability to borrow under our credit facility, or materially

adversely affect the banks that underwrote our credit

facility. The availability of financing will depend on a variety

of factors, such as economic and market conditions, the

availability of credit, and our credit ratings. If needed, we

may not be able to successfully obtain any necessary

additional financing on favorable terms, or at all.

Our inability to increase or maintain profitability of our

operations could materially adversely affect our results

of operations and financial condition.

A critical component of our business strategy is to improve

our overall profitability. Our ability to increase profitable

sales in existing stores may be affected by:

• Our success in attracting customers into our stores

• Our ability to choose the correct mix of products to

sell

• Our ability to keep stores stocked with merchandise

customers will purchase

• Our ability to maintain fully-staffed stores with

appropriately trained employees

• Our ability to remain relevant to the consumer

• Our ability to sustain existing retail channels such as

our kiosks

Any reductions or changes in the growth rate of the

wireless industry or other changes in the dynamics of

the industry could materially adversely affect our

results of operations and financial condition.

Sales of wireless handsets and the related commissions

and residual income constitute a significant portion of our

total revenue. Consequently, changes in the wireless

industry, such as those discussed below, could materially

adversely affect our results of operations and financial

condition.

Lack of growth in the wireless industry tends to have a

corresponding effect on our wireless sales. Because growth

in the wireless industry is often driven by the adoption rate