Radio Shack 2010 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2010 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.36

ITEM 7A. QUANTITATIVE AND QUALITATIVE

DISCLOSURES ABOUT MARKET RISK.

At December 31, 2010, the only derivative instruments that

materially increased our exposure to market risks for

interest rates, foreign currency rates, commodity prices or

other market price risks were interest rate swaps, which

serve as an economic hedge on our long-term debt. We do

not use derivatives for speculative purposes. Refer to Note

11 – “Derivative Financial Instruments” in Notes to

Consolidated Financial Statements of this Annual Report on

Form 10-K for additional information.

Our exposure to interest rate risk results from changes in

short-term interest rates. Interest rate risk exists with

respect to our net investment position at December 31,

2010, of $312.1 million, consisting of fluctuating short-term

investments of $462.1 million and offset by $150 million of

indebtedness which, because of our interest rate swaps,

effectively bears interest at short-term floating rates. A

hypothetical change of 100 basis points in the interest rate

applicable to this floating-rate net exposure would result in

a change in annual net interest expense of $3.1 million and

an approximate $0.4 million change to the fair value of our

interest rate swaps, which would also affect net interest

expense. This hypothesis assumes no change in the

principal or investment balance.

We have market risk arising from changes in foreign

currency exchange rates related to our purchase of

inventory from manufacturers located in China and other

areas outside of the U.S. Our purchases are denominated

in U.S. dollars; however, the strengthening of the Chinese

currency, or other currencies, against the U.S. dollar could

cause our vendors to increase the prices of items we

purchase from them. It is not possible to estimate the effect

of foreign currency exchange rate changes on our

purchases of this inventory. We are also exposed to foreign

currency fluctuations related to our Mexican subsidiary,

which accounted for less than 5% of consolidated net sales

and operating revenues in 2010.

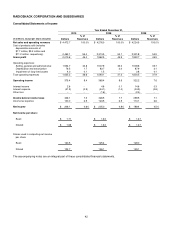

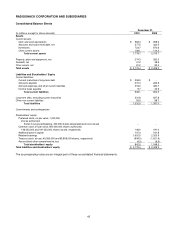

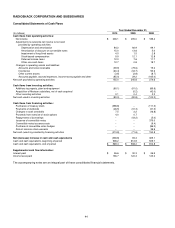

ITEM 8. FINANCIAL STATEMENTS AND

SUPPLEMENTARY DATA.

The Index to our Consolidated Financial Statements is

found on page 40. Our Consolidated Financial Statements

and Notes to Consolidated Financial Statements follow the

index.

ITEM 9. CHANGES IN AND DISAGREEMENTS

WITH ACCOUNTANTS ON ACCOUNTING AND

FINANCIAL DISCLOSURE.

None.

ITEM 9A. CONTROLS AND PROCEDURES.

Evaluation of Disclosure Controls and Procedures

We have established a system of disclosure controls and

other procedures that are designed to ensure that

information required to be disclosed by us in the reports

that we file or submit under the Exchange Act, is recorded,

processed, summarized and reported within the time

periods specified by the SEC’s rules and forms, and that

such information is accumulated and communicated to

management, including our Chief Executive Officer and

Chief Financial Officer, as appropriate to allow timely

decisions regarding required disclosure. An evaluation of

the effectiveness of the design and operation of our

disclosure controls and procedures (as defined in Rule 13a-

15(e) under the Exchange Act) was performed as of the

end of the period covered by this annual report. This

evaluation was performed under the supervision and with

the participation of management, including our CEO and

CFO.

Based upon that evaluation, our CEO and CFO have

concluded that these disclosure controls and procedures

were effective.

Management’s Report on Internal Control Over

Financial Reporting

Our management is responsible for establishing and

maintaining adequate internal control over financial

reporting, as such term is defined in Exchange Act Rule

13a-15(f). Under the supervision and with the participation

of our management, including our CEO and CFO, we

conducted an evaluation of the effectiveness of our internal

control over financial reporting based on the framework in

“Internal Control – Integrated Framework” issued by the

Committee of Sponsoring Organizations of the Treadway

Commission. Based on our evaluation under the framework

in “Internal Control – Integrated Framework,” our

management concluded that our internal control over

financial reporting was effective as of December 31, 2010.

The effectiveness of our internal control over financial

reporting as of December 31, 2010, has been audited by

PricewaterhouseCoopers LLP, an independent registered

public accounting firm, as stated in their report which is

included herein.

Changes in Internal Controls

There were no changes in our internal control over financial

reporting that occurred during our last fiscal quarter that

have materially affected, or are reasonably likely to

materially affect, our internal control over financial

reporting.

ITEM 9B. OTHER INFORMATION.

None.