Radio Shack 2010 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2010 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

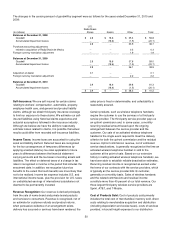

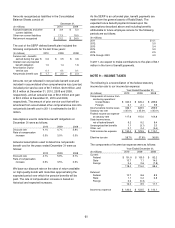

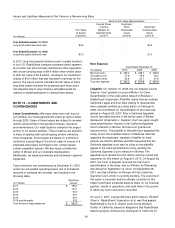

Amounts recognized as liabilities in the Consolidated

Balance Sheets consist of:

December 31,

(In millions) 2010 2009

Accrued expenses and other

current liabilities

$ 3.9 $ 5.0

Other non-current liabilities 17.3 19.0

Net amount recognized $ 21.2 $ 24.0

The cost of the SERP defined benefit plan included the

following components for the last three years:

(In millions) 2010 2009 2008

Service cost – benefits

earned during the year

$ 0.6

$ 0.5

$ 0.6

Interest cost on projected

benefit obligation

1.0

1.4

1.6

Amortization of prior

service cost

0.1

0.1

0.1

Net periodic benefit cost $ 1.7 $ 2.0 $ 2.3

Amounts not yet reflected in net periodic benefit cost and

included in accumulated other comprehensive loss (pre-tax)

included prior service cost of $0.7 million, $0.8 million, and

$0.9 million at December 31, 2010, 2009 and 2008,

respectively, and an actuarial loss of $0.2 million and gain

of $0.3 million at December 31, 2010 and 2009,

respectively. The amount of prior service cost that will be

amortized from accumulated other comprehensive loss into

net periodic benefit cost in 2011 is estimated to be $0.1

million.

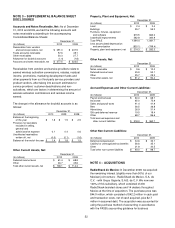

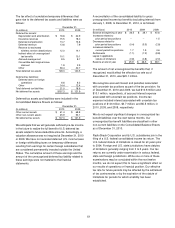

Assumptions used to determine benefit obligations at

December 31 were as follows:

2010 2009 2008

Discount rate 4.1% 4.7% 5.9%

Rate of compensation

increase

3.5%

3.5%

3.5%

Actuarial assumptions used to determine net periodic

benefit cost for the years ended December 31 were as

follows:

2010 2009 2008

Discount rate 4.7% 5.9% 5.7%

Rate of compensation

increase

3.5%

3.5%

3.5%

We base our discount rate on the rates of return available

on high-quality bonds with maturities approximating the

expected period over which the pension benefits will be

paid. The rate of compensation increase is based on

historical and expected increases.

As the SERP is an unfunded plan, benefit payments are

made from the general assets of RadioShack. The

expected future benefit payments based upon the

assumptions described above and including benefits

attributable to future employee service for the following

periods are as follows:

(In millions)

2011 $ 4.1

2012 3.5

2013 3.4

2014 3.0

2015 2.5

2016 through 2020 4.0

In 2011, we expect to make contributions to the plan of $4.1

million in the form of benefit payments.

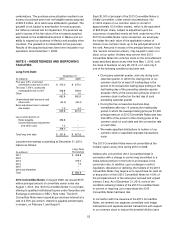

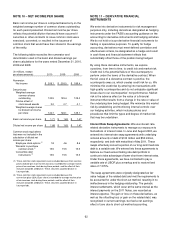

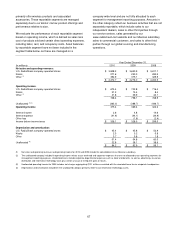

NOTE 9 – INCOME TAXES

The following is a reconciliation of the federal statutory

income tax rate to our income tax expense:

Year Ended December 31,

(In millions) 2010

2009

2008

Components of income from

continuing operations:

United States $ 334.0 $ 326.4 $ 289.6

Foreign 2.1 2.1 9.9

Income before income taxes 336.1 328.5 299.5

Statutory tax rate x 35.0%

x 35.0%

x 35.0%

Federal income tax expense

at statutory rate

117.6

115.0

104.8

State income taxes,

net of federal benefit

9.2

9.2

8.4

Unrecognized tax benefits 1.1 (3.1) 2.3

Other, net 2.1 2.4 (5.4)

Total income tax expense $ 130.0 $ 123.5 $ 110.1

Effective tax rate 38.7%

37.6%

36.8%

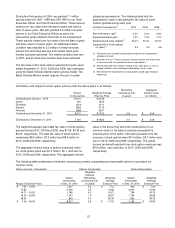

The components of income tax expense were as follows:

Year Ended December 31,

(In millions) 2010

2009 2008

Current:

Federal $ 101.9

$ 105.3

$ 92.2

State 13.7 7.1 14.0

Foreign 2.4 2.6 (7.8)

118.0 115.0 98.4

Deferred:

Federal 10.7 8.6 8.9

State 1.1 0.2 2.8

Foreign 0.2 (0.3)

--

12.0 8.5 11.7

Income tax expense $ 130.0 $ 123.5 $ 110.1