Quest Diagnostics 2012 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2012 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

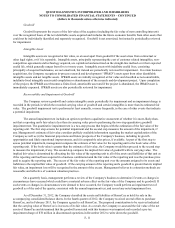

F- 21

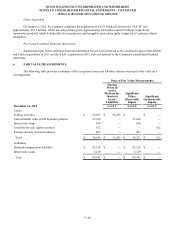

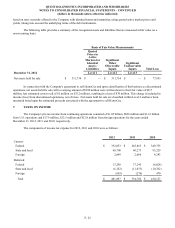

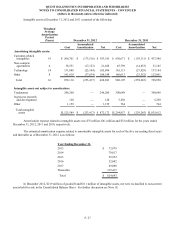

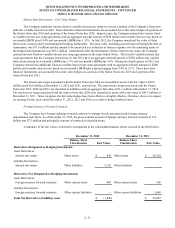

Basis of Fair Value Measurements

Quoted

Prices in

Active

Markets for

Identical

Assets /

Liabilities

Significant

Other

Observable

Inputs

Significant

Unobservable

Inputs

December 31, 2011 Level 1 Level 2 Level 3

Assets:

Interest rate swaps $ 56,520 $ — $ 56,520 $ —

Trading securities 46,926 46,926 — —

Cash surrender value of life insurance policies 20,936 — 20,936 —

Available-for-sale equity securities 646 — — 646

Foreign currency forward contracts 180 — 180 —

Total $ 125,208 $ 46,926 $ 77,636 $ 646

Liabilities:

Deferred compensation liabilities $ 71,688 $ — $ 71,688 $ —

Foreign currency forward contracts 1,648 — 1,648 —

Total $ 73,336 $ — $ 73,336 $ —

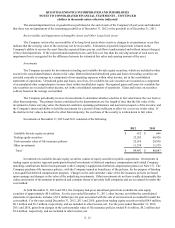

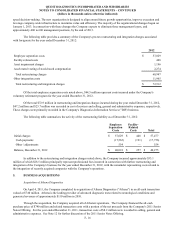

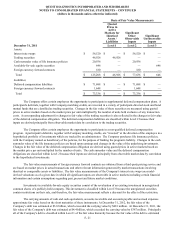

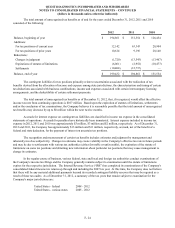

The Company offers certain employees the opportunity to participate in supplemental deferred compensation plans. A

participant's deferrals, together with Company matching credits, are invested in a variety of participant-directed stock and bond

mutual funds that are classified as trading securities. Changes in the fair value of these securities are measured using quoted

prices in active markets based on the market price per unit multiplied by the number of units held exclusive of any transaction

costs. A corresponding adjustment for changes in fair value of the trading securities is also reflected in the changes in fair value

of the deferred compensation obligation. The deferred compensation liabilities are classified within Level 2 because their

inputs are derived principally from observable market data by correlation to the trading securities.

The Company offers certain employees the opportunity to participate in a non-qualified deferred compensation

program. A participant's deferrals, together with Company matching credits, are “invested” at the direction of the employee in a

hypothetical portfolio of investments which are tracked by an administrator. The Company purchases life insurance policies,

with the Company named as beneficiary of the policies, for the purpose of funding the program's liability. Changes in the cash

surrender value of the life insurance policies are based upon earnings and changes in the value of the underlying investments.

Changes in the fair value of the deferred compensation obligation are derived using quoted prices in active markets based on

the market price per unit multiplied by the number of units. The cash surrender value and the deferred compensation

obligations are classified within Level 2 because their inputs are derived principally from observable market data by correlation

to the hypothetical investments.

The fair value measurements of foreign currency forward contracts are obtained from a third-party pricing service and

are based on market prices in actual transactions and other relevant information generated by market transactions involving

identical or comparable assets or liabilities. The fair value measurements of the Company's interest rate swaps are model-

derived valuations as of a given date in which all significant inputs are observable in active markets including certain financial

information and certain assumptions regarding past, present and future market conditions.

Investments in available-for-sale equity securities consist of the revaluation of an existing investment in unregistered

common shares of a publicly-held company. This investment is classified within Level 3 because the unregistered securities

contain restrictions on their sale, and therefore, the fair value measurement reflects a discount for the effect of the restriction.

The carrying amounts of cash and cash equivalents, accounts receivable and accounts payable and accrued expenses

approximate fair value based on the short maturities of these instruments. At December 31, 2012, the fair value of the

Company’s debt was estimated at $3.8 billion, which exceeded the carrying value by $481 million. At December 31, 2011, the

fair value of the Company's debt was estimated at $4.4 billion, which exceeded the carrying value by $387 million. Principally

all of the Company's debt is classified within Level 1 of the fair value hierarchy because the fair value of the debt is estimated

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(dollars in thousands unless otherwise indicated)