Quest Diagnostics 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

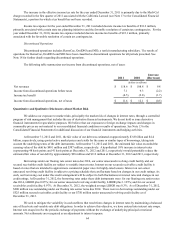

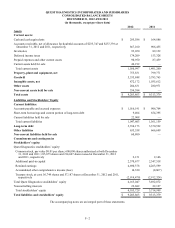

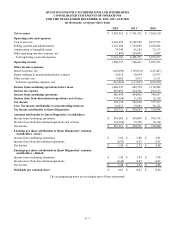

Contractual Obligations and Commitments

The following table summarizes certain of our contractual obligations as of December 31, 2012:

Payments due by period

(in thousands)

Contractual Obligations Total

Less than

1 year 1-3 years 3-5 years After 5 years

Outstanding debt $ 3,300,000 $ — $ 700,000 $ 675,000 $ 1,925,000

Capital lease obligations 27,610 9,404 15,440 2,754 12

Interest payments on outstanding debt 2,070,428 165,861 326,730 258,555 1,319,282

Operating leases 673,266 181,167 246,864 114,992 130,243

Purchase obligations 95,944 39,234 46,837 8,202 1,671

Merger consideration obligation 960 960———

Total contractual obligations $ 6,168,208 $ 396,626 $ 1,335,871 $ 1,059,503 $ 3,376,208

Interest payments on our long-term debt have been calculated after giving effect to our interest rate swap agreements,

using the interest rates as of December 31, 2012 applied to the December 31, 2012 balances, which are assumed to remain

outstanding through their maturity dates.

A full description of the terms of our indebtedness and related debt service requirements and our future payments

under certain of our contractual obligations is contained in Note 12 to the Consolidated Financial Statements. A full discussion

and analysis regarding our minimum rental commitments under noncancelable operating leases and noncancelable

commitments to purchase product or services at December 31, 2012 is contained in Note 17 to the Consolidated Financial

Statements. A full discussion and analysis regarding our acquisition of Celera and the merger consideration related to shares of

Celera which had not been surrendered as of December 31, 2012 is contained in Note 5 to the Consolidated Financial

Statements.

As of December 31, 2012, our total liabilities associated with unrecognized tax benefits were approximately $199

million, which were excluded from the table above. We believe it is reasonably possible that these liabilities may decrease by

up to approximately $8 million within the next twelve months, primarily as a result of the expiration of statutes of limitations,

settlements and/or the conclusion of tax examinations on certain tax positions. For the remainder, we cannot make reasonably

reliable estimates of the timing of the future payments of these liabilities. See Note 7 to the Consolidated Financial Statements

for information regarding our contingent tax liability reserves.

Our credit agreements contain various covenants and conditions, including the maintenance of certain financial ratios,

that could impact our ability to, among other things, incur additional indebtedness. As of December 31, 2012, we were in

compliance with the various financial covenants included in our credit agreements and we do not expect these covenants to

adversely impact our ability to execute our growth strategy or conduct normal business operations.

Unconsolidated Joint Ventures

We have investments in unconsolidated joint ventures in Phoenix, Arizona; Indianapolis, Indiana; and Dayton, Ohio,

which are accounted for under the equity method of accounting. We believe that our transactions with our joint ventures are

conducted at arm’s length, reflecting current market conditions and pricing. Total net revenues of our unconsolidated joint

ventures equal less than 6% of our consolidated net revenues. Total assets associated with our unconsolidated joint ventures are

less than 2% of our consolidated total assets. We have no material unconditional obligations or guarantees to, or in support of,

our unconsolidated joint ventures and their operations.

Requirements and Capital Resources

We estimate that we will invest approximately $250 million during 2013 for capital expenditures to support and

expand our existing operations, principally related to investments in information technology, laboratory equipment and

facilities, including specific initiatives associated with our Invigorate program.