Quest Diagnostics 2012 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2012 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.49

The legislation also includes provisions aimed at reducing the overall cost of healthcare. Impacting laboratories

specifically, the legislation provides for annual reductions in the Medicare clinical laboratory fee schedule of 1.75% for five

years which began in 2011 and includes a productivity adjustment which reduces the CPI market basket update. The legislation

also imposes an excise tax on the seller for the sale of certain medical devices in the United States, including those purchased

and used by laboratories, beginning in 2013.

In addition, the legislation is focused on reducing the growth of healthcare costs. The legislation establishes the

Independent Payment Advisory Board, which will be responsible, beginning in 2014, annually to submit proposals aimed at

reducing Medicare cost growth while preserving quality. These proposals automatically will be implemented unless Congress

enacts alternative proposals that achieve the same savings targets. Further, the legislation calls for a Center for Medicare and

Medicaid Innovation that will examine alternative payment methodologies and conduct demonstration programs.

The legislation may result in a higher demand for our services as a result of increased access to health insurance

coverage for previously uninsured and underinsured individuals. Because of the many variables involved, we are unable to

predict with certainty the effect of the legislation on our business. However, we believe that we are well positioned to respond

to the evolving healthcare environment and related market forces.

Reimbursement for Services

Payments for diagnostic testing services are made by physicians, hospitals, employers, healthcare insurers, patients

and governmental authorities. Physicians, hospitals and employers are typically billed on a fee-for-service basis based on

negotiated fee schedules. Fees billed to healthcare insurers and patients are based on the laboratory's patient fee schedule,

subject to any limitations on fees negotiated with the healthcare insurers or with physicians on behalf of their patients.

Medicare and Medicaid reimbursements are based on fee schedules set by governmental authorities. Government payers, such

as Medicare and Medicaid, as well as healthcare insurers and larger employers, have taken steps and may continue to take steps

to control the cost, utilization and delivery of healthcare services, including diagnostic testing services.

Part B of the Medicare program contains fee schedule payment methodologies for diagnostic testing services, and for

pathology and other physician services, performed for covered patients, including a national ceiling on the amount that carriers

could pay under their local Medicare clinical testing fee schedules. The Medicare Clinical Laboratory Fee Schedule for 2013 is

decreased by 2.95% (excluding sequestration) from 2012 levels. In December 2012, Congress delayed by one year a potential

decrease of approximately 26% in the physician fee schedule that otherwise would have become effective January 1, 2013, but

implemented relative value unit changes significantly impacting physician fee schedule reimbursement for tissue biopsies that

are expected to reduce reimbursement for tissue biopsy services. Also, an additional 2% reduction in the Medicare Clinical

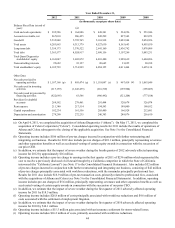

Laboratory Fee Schedule for 2013, associated with sequestration, was delayed until April 1, 2013. In 2012, approximately 13%

of our consolidated revenues were reimbursed by Medicare under the Clinical Laboratory Fee Schedule.

Healthcare insurers, which typically negotiate directly or indirectly on behalf of their members, represent

approximately one-half of our DIS volumes and one-half of our net revenues from our DIS business. Larger healthcare insurers

typically contract with large commercial clinical laboratories because they can provide services to their members on a national

or regional basis. In addition, larger commercial clinical laboratories are better able to achieve the low-cost structures necessary

to profitably service the members of large healthcare insurers and can provide test utilization data across various products in a

consistent format. In certain markets, such as California, healthcare insurers may delegate their covered members to

independent physician associations, which in turn negotiate with laboratories for diagnostic testing services on behalf of their

members.

The trend of consolidation among physicians, hospitals, employers, healthcare insurers and other intermediaries has

continued, resulting in fewer but larger customers and payers with significant bargaining power to negotiate fee arrangements

with healthcare providers, including clinical laboratories. Healthcare insurers sometimes require that diagnostic testing service

providers accept discounted fee structures or assume all or a portion of the utilization risk associated with providing testing

services to their members enrolled in highly-restricted plans through capitated payment arrangements. Under these capitated

payment arrangements, we and the healthcare insurers agree to a predetermined monthly reimbursement rate for each member

enrolled in a restricted plan, generally regardless of the number or cost of services provided by us. In 2012, we derived

approximately 12% of our testing volume and 4% of our DIS net revenues from capitated payment arrangements.

Most healthcare insurers also offer programs such as preferred provider organizations (“PPOs”) and consumer driven

health plans that offer a greater choice of healthcare providers. Most of our agreements with major healthcare insurers are non-

exclusive arrangements. As a result, under these non-exclusive arrangements, physicians and patients have more freedom of