Quest Diagnostics 2012 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2012 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F- 32

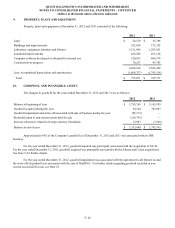

14. PREFERRED STOCK AND COMMON STOCKHOLDERS’ EQUITY

Series Preferred Stock

Quest Diagnostics is authorized to issue up to 10 million shares of Series Preferred Stock, par value $1.00 per share.

The Company's Board of Directors has the authority to issue such shares without stockholder approval and to determine the

designations, preferences, rights and restrictions of such shares. Of the authorized shares, 1.3 million shares have been

designated Series A Preferred Stock. No shares are currently outstanding.

Common Stock

On May 4, 2006, the Company's Restated Certificate of Incorporation was amended to increase the number of

authorized shares of common stock, par value $0.01 per share, from 300 million shares to 600 million shares.

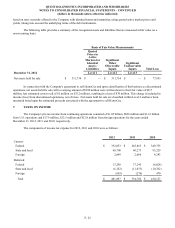

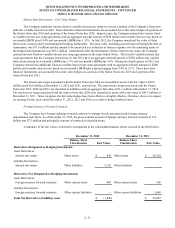

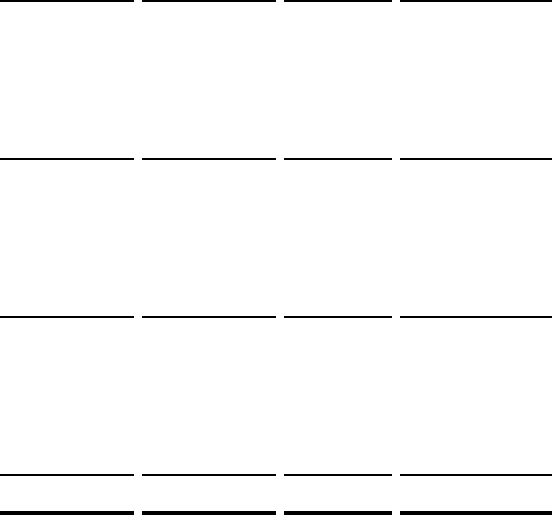

Accumulated Other Comprehensive Income (Loss)

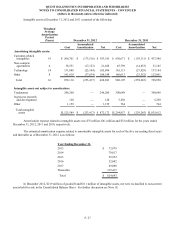

The components of accumulated other comprehensive income (loss) for 2012, 2011 and 2010 were as follows:

Foreign

Currency

Translation

Adjustment

Market Value

Adjustment

Deferred

Loss

Accumulated

Other

Comprehensive

Income (Loss)

Balance, December 31, 2009 $ (13,408)$ (216)$ (7,337)$ (20,961)

Currency translation 27,271 — — 27,271

Market valuation, net of tax — 3,090 — 3,090

Net deferred loss on cash flow hedges, net of tax — — 724 724

Other — 502 — 502

Balance, December 31, 2010 13,863 3,376 (6,613) 10,626

Currency translation (12,920)——

(12,920)

Market valuation, net of tax — (2,696)— (2,696)

Net deferred loss on cash flow hedges, net of tax — — (1,042)(1,042)

Other — (2,035)— (2,035)

Balance, December 31, 2011 943 (1,355)(7,655)(8,067)

Currency translation 24,520 — — 24,520

Market valuation, net of tax — (20)— (20)

Net deferred loss on cash flow hedges, net of tax — — 838 838

Other — (2,951)— (2,951)

Balance, December 31, 2012 $ 25,463 $ (4,326)$ (6,817) $ 14,320

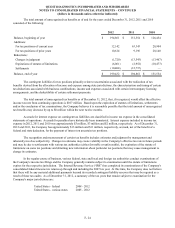

The market valuation adjustments represent unrealized holding gains (losses) on available-for-sale securities, net of

taxes. The net deferred loss on cash flow hedges represents deferred losses on the Company’s interest rate related derivative

financial instruments designated as cash flow hedges, net of amounts reclassified to interest expense (see Note 13). For the

years ended December 31, 2012, 2011 and 2010, the tax effects related to the market valuation adjustments and deferred losses

were not material. Foreign currency translation adjustments are not adjusted for income taxes since they relate to indefinite

investments in non-U.S. subsidiaries.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(dollars in thousands unless otherwise indicated)