Quest Diagnostics 2012 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2012 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.45

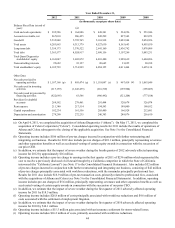

(j) Includes $3.1 million of pre-tax financing related transaction costs associated with the acquisition of Celera, a $3.2 million

pre-tax gain associated with the sale of an investment, and $18.2 million of discrete income tax benefits, primarily

associated with certain state tax planning initiatives and the favorable resolution of certain tax contingencies.

(k) Includes discrete income tax benefits of $22.1 million, primarily associated with favorable resolutions of certain tax

contingencies.

(l) Includes $20.4 million of pre-tax charges related to the early extinguishment of debt, primarily related to the June 2009 and

November 2009 Debt Tender Offers and a $7.0 million pre-tax charge related to the write-off of an investment. Also

includes $7.0 million of income tax benefits, primarily associated with certain discrete tax benefits.

(m) Includes an $8.9 million pre-tax charge associated with the write-down of an equity investment. Also includes discrete

income tax benefits of $16.5 million, primarily associated with the favorable resolution of certain tax contingencies.

(n) Includes related charges in discontinued operations for the asset impairment associated with HemoCue and the loss on sale

associated with OralDNA totaling $86 million. Discontinued operations also includes a $7.5 million income tax expense

related to the re-valuation of deferred tax assets associated with HemoCue and a $4.4 million income tax benefit related to

the remeasurement of deferred taxes associated with HemoCue as a result of an enacted income tax rate change in Sweden.

In February 2013, we entered into an agreement to sell HemoCue (see Note 18 to the Consolidated Financial Statements

for further details).

(o) Includes pre-tax charges of $75 million related to the government investigation of NID. See Note 18 to the Consolidated

Financial Statements.

(p) Includes receipts of $71.8 million from the termination of certain interest rate swap agreements.

(q) Includes payments associated with the settlement of the California Lawsuit, restructuring and integration costs, and

transaction costs associated with the acquisitions of Athena and Celera totaling $320 million, or $202 million net of an

associated reduction in estimated tax payments.

(r) Includes payments associated with restructuring and integration costs totaling $14.2 million, or $8.6 million net of an

associated reduction in estimated tax payments.

(s) Includes payments primarily made in the second quarter of 2009 totaling $314 million in connection with the NID

settlement (see Note 18 to the Consolidated Financial Statements), or $208 million net of an associated reduction in

estimated tax payments.