Quest Diagnostics 2012 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2012 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.F- 33

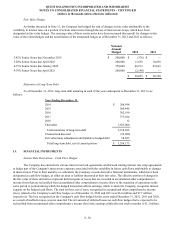

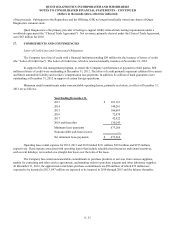

Dividends

During each of the first three quarters in 2012, the Company's Board of Directors declared a quarterly cash dividend of

$0.17 per common share, and in November 2012, declared an increase in the quarterly cash dividend from $0.17 per common

share to $0.30 per common share. This 76% increase raises the annual dividend rate to $1.20 per common share from $0.68 per

common share and represents a three-fold increase from the annual rate in effect in 2011.

During each of the first three quarters of 2011, the Company's Board of Directors declared a quarterly cash dividend of

$0.10 per common share and in October 2011, declared an increase in the quarterly cash dividend from $0.10 per common

share to $0.17 per common share.

Share Repurchase Plan

In January 2012, the Company’s Board of Directors authorized the Company to repurchase an additional $1 billion of

the Company’s common stock, increasing the total available authorization at that time to $1.1 billion. The share repurchase

authorization has no set expiration or termination date.

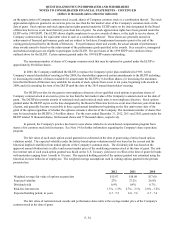

For the year ended December 31, 2012, the Company repurchased 3.4 million shares of its common stock at an

average price of $58.31 per share for a total of $200 million. At December 31, 2012, $865 million remained available under the

Company’s share repurchase authorizations.

For the year ended December 31, 2011, the Company repurchased 17.3 million shares of its common stock at an

average price of $54.05 per share for a total of $935 million, including 15.4 million shares purchased in the first quarter from

SB Holdings Capitial Inc., a wholly-owned subsidiary of GlaxoSmithKline plc., at an average price of $54.30 per share for a

total of $835 million.

For the year ended December 31, 2010, the Company repurchased 14.7 million shares of its common stock at an

average price of $51.04 per share for $750 million, including 4.5 million shares purchased in the first quarter at an average

price per share of $56.21 for $251 million under an accelerated share repurchase transaction (“ASR”) with a bank.

Under the ASR, in January 2010, the Company repurchased 4.5 million shares of the Company's outstanding common

stock for an initial purchase price of $56.05 per share. The purchase price of these shares was subject to an adjustment based on

the volume weighted average price of the Company's common stock during a period following execution of the agreement. The

total cost of the initial purchase was $250 million. The purchase price adjustment was settled in the first quarter of 2010 and

resulted in an additional cash payment of $0.7 million, for a final purchase price of $251 million, or $56.21 per share.

For the years ended December 31, 2012, 2011 and 2010 the Company reissued 3.9 million shares, 3.6 million shares

and 2.1 million shares, respectively, for employee benefit plans.

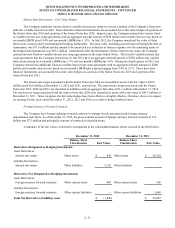

15. STOCK OWNERSHIP AND COMPENSATION PLANS

Employee and Non-employee Directors Stock Ownership Programs

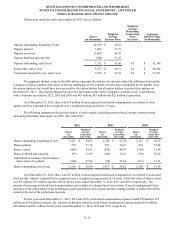

In 2005, the Company established the ELTIP to replace the Company's prior Employee Equity Participation Programs

established in 1999 (the “1999 EEPP”). At the Company's annual shareholders' meeting in May 2012, the shareholders

approved certain amendments to the ELTIP including: (i) increasing the number of shares available for award under the ELTIP

by approximately 7 million shares; (ii) limiting the number of shares subject to stock options or SARs that may be awarded to

an individual during any fiscal year to 2,000,000; (iii) limiting the number of shares subject to stock awards that may be

awarded to an individual during any fiscal year to 1,000,000; (iv) prohibiting the exchange of stock options or SARs for cash;

and (v) extending the term of the ELTIP until the date of the 2022 annual shareholders' meeting.

The ELTIP provides for three types of awards: (a) stock options, (b) stock appreciation rights and (c) stock awards.

The ELTIP provides for the grant to eligible employees of either non-qualified or incentive stock options, or both, to purchase

shares of Company common stock at an exercise price no less than the fair market value of the Company's common stock on

the date of grant. The stock options are subject to forfeiture if employment terminates prior to the end of the vesting period

prescribed by the Board of Directors. Grants of stock appreciation rights allow eligible employees to receive a payment based

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(dollars in thousands unless otherwise indicated)