Quest Diagnostics 2012 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2012 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F- 20

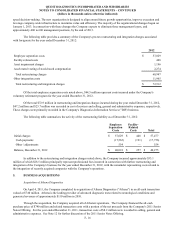

Other Acquisition

On January 6, 2012, the Company completed the acquisition of S.E.D. Medical Laboratories ("S.E.D.") for

approximately $50.5 million. Of the all-cash purchase price, approximately $28 million and $19 million, respectively,

represented goodwill, which is deductible for tax purposes, and intangible assets, principally comprised of customer-related

intangibles.

Pro Forma Combined Financial Information

Supplemental pro forma combined financial information has not been presented as the combined impact of the Athena

and Celera acquisitions in 2011 and the S.E.D. acquisition in 2012 were not material to the Company's consolidated financial

statements.

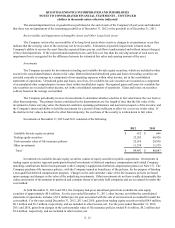

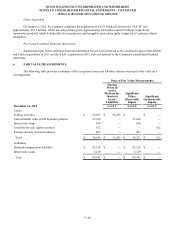

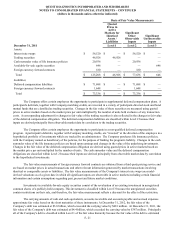

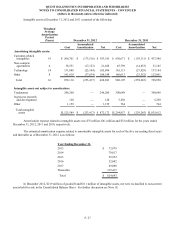

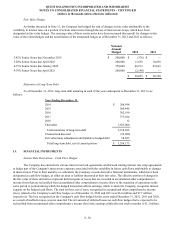

6. FAIR VALUE MEASUREMENTS

The following table provides a summary of the recognized assets and liabilities that are measured at fair value on a

recurring basis:

Basis of Fair Value Measurements

Quoted

Prices in

Active

Markets for

Identical

Assets /

Liabilities

Significant

Other

Observable

Inputs

Significant

Unobservable

Inputs

December 31, 2012 Level 1 Level 2 Level 3

Assets:

Trading securities $ 52,283 $ 52,283 $ — $ —

Cash surrender value of life insurance policies 25,018 — 25,018 —

Interest rate swaps 830 — 830 —

Available-for-sale equity securities 612 — — 612

Foreign currency forward contracts 403 — 403 —

Total $ 79,146 $ 52,283 $ 26,251 $ 612

Liabilities:

Deferred compensation liabilities $ 82,218 $ — $ 82,218 $ —

Interest rate swaps 3,129 — 3,129 —

Total $ 85,347 $ — $ 85,347 $ —

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(dollars in thousands unless otherwise indicated)