Quest Diagnostics 2012 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2012 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.F- 36

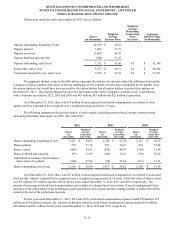

Employee Stock Purchase Plan

Under the Company's Employee Stock Purchase Plan (“ESPP”), substantially all employees can elect to have up to

10% of their annual wages withheld to purchase Quest Diagnostics common stock. The purchase price of the stock is 85% of

the market price of the Company's common stock on the last business day of each calendar month. Under the ESPP, the

maximum number of shares of Quest Diagnostics common stock which may be purchased by eligible employees is 5 million.

Approximately 406, 425 and 464 thousand shares of common stock were purchased by eligible employees in 2012, 2011 and

2010, respectively.

Defined Contribution Plans

The Company maintained qualified defined contribution plans covering substantially all of its employees. Prior to

2012, the Company matched employee contributions up to a maximum of 6%. As of January 1, 2012, the maximum Company

matching contribution was reduced from 6% to 5% of eligible employee compensation. The Company's expense for

contributions to its defined contribution plans aggregated $73 million, $82 million and $79 million for 2012, 2011 and 2010,

respectively.

Supplemental Deferred Compensation Plans

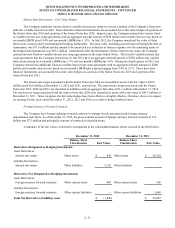

The Company has a supplemental deferred compensation plan that is an unfunded, non-qualified plan that provides for

certain management and highly compensated employees to defer up to 50% of their salary in excess of their defined

contribution plan limits and for certain eligible employees, up to 95% of their variable incentive compensation. Prior to 2012,

the Company matched employee contributions up to a maximum of 6%. As of January 1, 2012, the maximum Company

matching contribution was reduced from 6% to 5% of eligible employee compensation. The compensation deferred under this

plan, together with Company matching amounts, are credited with earnings or losses measured by the mirrored rate of return on

investments elected by plan participants. Each plan participant is fully vested in all deferred compensation, Company match

and earnings credited to their account. The Company maintained another unfunded, non-qualified supplemental deferred

compensation plan that was not material. The amounts accrued under the Company's deferred compensation plans were $52

million and $47 million at December 31, 2012 and 2011, respectively. Although the Company is currently contributing all

participant deferrals and matching amounts to trusts, the funds in these trusts, totaling $52 million and $47 million at

December 31, 2012 and 2011, respectively, are general assets of the Company and are subject to any claims of the Company's

creditors.

The Company also offers certain employees the opportunity to participate in a non-qualified deferred compensation

program. Eligible participants are allowed to defer up to 20 thousand dollars of eligible compensation per year. The Company

matches employee contributions equal to 25%, up to a maximum of 5 thousand dollars per plan year. A participant's deferrals,

together with Company matching credits, are “invested” at the direction of the employee in a hypothetical portfolio of

investments which are tracked by an administrator. Each participant is fully vested in their deferred compensation and vest in

Company matching contributions over a four-year period at 25% per year. The amounts accrued under this plan were $30

million and $25 million at December 31, 2012 and 2011, respectively. The Company purchases life insurance policies, with the

Company named as beneficiary of the policies, for the purpose of funding the program's liability. The cash surrender value of

such life insurance policies was $25 million and $21 million at December 31, 2012 and 2011, respectively.

For the years ended December 31, 2012, 2011 and 2010, the Company's expense for matching contributions to these

plans were not material.

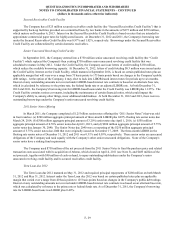

16. RELATED PARTY TRANSACTIONS

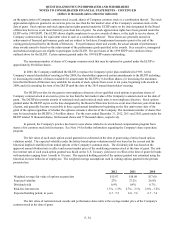

At December 31, 2010, GSK beneficially owned approximately 18% of the outstanding shares of Quest Diagnostics

common stock. On January 31, 2011, the Company agreed to repurchase from SB Holdings Capital Inc., a wholly-owned

subsidiary of GSK, approximately one-half of GSK's ownership interest in the Company, or 15.4 million shares of the

Company's common stock at a purchase price of $54.30 per share for $835 million (the “Repurchase”).

In a separate transaction on January 31, 2011, GSK agreed to sell in an underwritten offering to the public, its

remaining ownership interest in the Company, or 15.4 million shares of the Company's common stock (the “Offering”). The

Company did not sell any shares of common stock in the Offering, which closed on February 4, 2011, and did not receive any

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(dollars in thousands unless otherwise indicated)