Quest Diagnostics 2012 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2012 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.F- 14

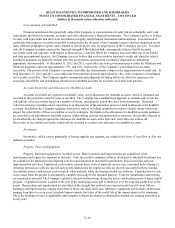

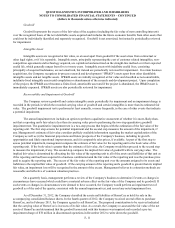

New Accounting Standards

In July 2012, the Financial Accounting Standards Board ("FASB") issued an amendment to the accounting standards

related to the testing of indefinite-lived intangible assets, other than goodwill, for impairment. Similar to the guidance related

to the testing of goodwill for impairment, an entity testing an indefinite-lived intangible asset for impairment has the option to

perform a qualitative assessment before calculating the fair value of the asset. If, after assessing the totality of events and

circumstances an entity determines that it is not more-likely-than-not that the indefinite-lived intangible asset is impaired, the

entity would not be required to perform the quantitative impairment test. However, if the qualitative assessment indicates that it

is more-likely-than-not that the fair value of the asset is less than its carrying amount, then the quantitative assessment must be

performed. An entity is permitted to perform the qualitative assessment on none, some or all of its indefinite-lived intangible

assets and may also bypass the qualitative assessment and begin with the quantitative assessment of indefinite-lived intangible

assets for impairment. This amendment is effective for the Company for annual and interim impairment tests performed on or

after January 1, 2013 and is not expected to have a material impact on the Company's consolidated financial statements.

In February 2013, the FASB issued a new accounting standard that adds new disclosure requirements for amounts

reclassified out of accumulated other comprehensive income ("AOCI"). The total changes in AOCI must be disaggregated

between reclassification adjustments and current period other comprehensive income. This new standard also requires an entity

to present reclassification adjustments out of AOCI either on the face of the income statement or in the notes to the financial

statements based on their source and the income statement line items affected by the reclassification. This standard is effective

prospectively for the Company for interim and annual periods beginning on January 1, 2013. The adoption of this standard is

not expected to have a material effect on the Company's consolidated financial statements.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(dollars in thousands unless otherwise indicated)