Pottery Barn 2011 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2011 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

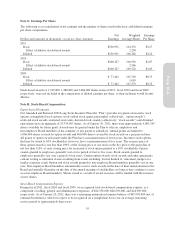

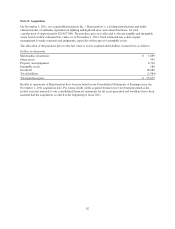

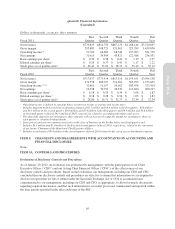

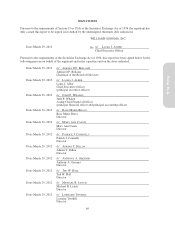

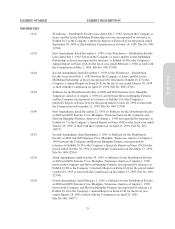

Quarterly Financial Information

(Unaudited)

Dollars in thousands, except per share amounts

Fiscal 2011

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

Full

Year

Net revenues $770,825 $814,750 $867,176 $1,268,144 $3,720,895

Gross margin 295,883 308,721 331,963 523,289 1,459,856

Operating income1,2 51,700 64,085 68,744 197,203 381,732

Net earnings 31,615 39,309 43,421 122,586 236,931

Basic earnings per share3$ 0.30 $ 0.38 $ 0.42 $ 1.19 $ 2.27

Diluted earnings per share3$ 0.29 $ 0.37 $ 0.41 $ 1.17 $ 2.22

Stock price (as of quarter-end) 4$ 43.41 $ 37.02 $ 38.35 $ 35.12 $ 35.12

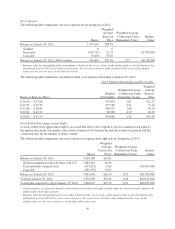

Fiscal 2010

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

Full

Year

Net revenues $717,637 $775,554 $815,516 $1,195,451 $3,504,158

Gross margin 270,558 286,727 311,281 505,293 1,373,859

Operating income1,2,5,6 32,461 51,197 56,162 183,594 323,414

Net earnings 19,538 30,759 36,530 113,400 200,227

Basic earnings per share3$ 0.18 $ 0.29 $ 0.34 $ 1.08 $ 1.87

Diluted earnings per share3$ 0.18 $ 0.28 $ 0.34 $ 1.05 $ 1.83

Stock price (as of quarter-end) 4$ 28.80 $ 26.71 $ 32.37 $ 32.34 $ 32.34

1Operating income is defined as earnings before net interest income or expense and income taxes.

2Includes impairment and early lease termination charges of $1.5 million and $6.0 million in the first quarter, $0.8 million

and $4.3 million in the second quarter, $0.0 million and $3.4 million in the third quarter and $0.9 million and $3.8 million

in the fourth quarter of fiscal 2011 and fiscal 2010, respectively, related to our underperforming retail stores.

3The sum of the quarterly net earnings per share amounts will not necessarily equal the annual net earnings per share as

each quarter is calculated independently.

4Stock prices represent our common stock price at the close of business on the Friday before our fiscal quarter-end.

5Includes $3.3 million and $1.0 million in the first and second quarter of fiscal 2010, respectively, related to the retirement

of our former Chairman of the Board and Chief Executive Officer.

6Includes a net benefit of $0.4 million in the second quarter of fiscal 2010 related to the exit of excess distribution capacity.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND

FINANCIAL DISCLOSURE

None.

ITEM 9A. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

As of January 29, 2012, an evaluation was performed by management, with the participation of our Chief

Executive Officer (“CEO”) and our Acting Chief Financial Officer (“CFO”), of the effectiveness of our

disclosure controls and procedures. Based on that evaluation, our management, including our CEO and CFO,

concluded that our disclosure controls and procedures are effective to ensure that information we are required to

disclose in reports that we file or submit under the Securities Exchange Act of 1934 is accumulated and

communicated to our management, including our CEO and CFO, as appropriate, to allow for timely discussions

regarding required disclosures, and that such information is recorded, processed, summarized and reported within

the time periods specified in the rules and forms of the SEC.

65

Form 10-K