Pottery Barn 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

based on a percentage of sales, cannot be predicted with certainty at the onset of the lease term. Accordingly, any

contingent rental payments are recorded as incurred each period when the sales threshold is probable of being

met and are excluded from our calculation of deferred rent liability. See Notes A and E to our Consolidated

Financial Statements.

We are party to a variety of contractual agreements under which we may be obligated to indemnify the other

party for certain matters. These contracts primarily relate to our commercial contracts, operating leases,

trademarks, intellectual property, financial agreements and various other agreements. Under these contracts, we

may provide certain routine indemnification relating to representations and warranties or personal injury matters.

The terms of these indemnifications range in duration and may not be explicitly defined. Historically, we have

not made significant payments for these indemnifications. We believe that if we were to incur a loss in any of

these matters, the loss would not have a material effect on our financial condition or results of operations.

Other Contractual Obligations

We have other liabilities reflected in our Consolidated Balance Sheets. The payment obligations associated with

these liabilities are not reflected in the table above due to the absence of scheduled maturities. The timing of

these payments cannot be determined, except for amounts estimated to be payable in fiscal 2012 which are

included in our current liabilities as of January 29, 2012.

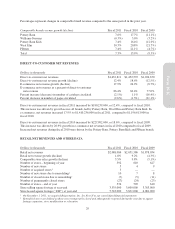

Commercial Commitments

The following table provides summary information concerning our outstanding commercial commitments as of

January 29, 2012:

Amount of Outstanding Commitment Expiration By Period

Dollars in thousands Fiscal 2012

Fiscal 2013

to Fiscal 2015

Fiscal 2016

to Fiscal 2017 Thereafter Total

Credit facility $ — — — — $ —

Letter of credit facilities 23,544 — — — 23,544

Standby letters of credit 9,420 — — — 9,420

Total $32,964 — — — $32,964

Credit Facility

We have a credit facility that provides for a $300,000,000 unsecured revolving line of credit that may be used for

loans or letters of credit. Prior to March 23, 2015, we may, upon notice to the lenders, request an increase in the

credit facility of up to $200,000,000, to provide for a total of $500,000,000 of unsecured revolving credit. The

credit facility contains certain financial covenants, including a maximum leverage ratio (funded debt adjusted for

lease and rent expense to earnings before interest, income tax, depreciation, amortization and rent expense

“EBITDAR”), and covenants limiting our ability to dispose of assets, make acquisitions, be acquired (if a default

would result from the acquisition), incur indebtedness, grant liens and make investments. The credit facility

contains events of default that include, among others, non-payment of principal, interest or fees, violation of

covenants, inaccuracy of representations and warranties, bankruptcy and insolvency events, material judgments,

cross-defaults to material indebtedness and events constituting a change of control. The occurrence of an event of

default will increase the applicable rate of interest by 2.0% and could result in the acceleration of our obligations

under the credit facility and an obligation of any or all of our U.S. subsidiaries that have guaranteed the credit

facility to pay the full amount of our obligations under the credit facility. As of January 29, 2012, we were in

compliance with our financial covenants under the credit facility and, based on current projections, we expect to

be in compliance throughout fiscal 2012. The credit facility matures on September 23, 2015, at which time all

outstanding borrowings must be repaid and all outstanding letters of credit must be cash collateralized.

We may elect interest rates calculated at (i) Bank of America’s prime rate (or, if greater, the average rate on

overnight federal funds plus one-half of one percent, or a rate based on LIBOR plus one percent) plus a margin

based on our leverage ratio or (ii) LIBOR plus a margin based on our leverage ratio. During fiscal 2011 and fiscal

35

Form 10-K