Pottery Barn 2011 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2011 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

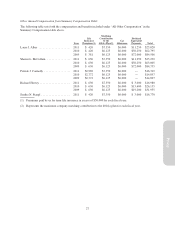

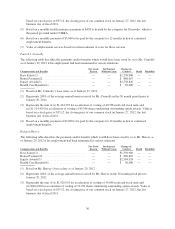

Option Exercises and Stock Vested

The following table sets forth information regarding exercises and vesting of equity awards held by our named

executive officers during fiscal 2011:

Option Awards Stock Awards

Number of Shares

Acquired on Exercise (#)

Value Realized on

Exercise ($)(1)

Number of Shares

Acquired on Vesting (#)

Value Realized on

Vesting ($)(2)

Laura J. Alber ............ 100,000 $2,596,800 — —

Sharon L. McCollam ....... — — — —

Patrick J. Connolly ......... — — — —

Richard Harvey ........... 25,000 $ 709,500 4,151 $177,497

Sandra N. Stangl .......... 45,500 $1,200,065 9,675 $413,703

(1) The value realized upon exercise is calculated as the closing price of our stock on the day prior to the

exercise date multiplied by the number of shares exercised.

(2) The value realized upon vesting is calculated as the closing price of our stock on the day prior to the vesting

date multiplied by the number of units vested.

Pension Benefits

None of our named executive officers received any pension benefits during fiscal 2011.

Nonqualified Deferred Compensation

None of our named executive officers have contributed to or received earnings from a company nonqualified

deferred compensation plan during fiscal 2011.

Employment Contracts and Termination of Employment and Change-of-Control Arrangements

We have entered into a management retention agreement with each of Ms. Alber, Ms. McCollam, Mr. Connolly,

Mr. Harvey and Ms. Stangl. As noted above, however, Ms. McCollam retired effective March 6, 2012 and is no

longer covered by a management retention agreement. Each retention agreement has an initial two-year term and

will be automatically extended for one-year following the initial term unless either party provides notice of

non-extension. If we enter into a definitive agreement with a third party providing for a “change of control,” each

retention agreement will be automatically extended for 18 months following the change of control. If within

18 months following a change of control, an executive’s employment is terminated by us without “cause,” or by

the executive for “good reason,” (i) 100% of such executive’s outstanding equity awards, including full value

awards, with performance-based vesting where the payout is a set number or zero depending on whether the

performance metric is obtained, will immediately become fully vested, except that if a full value award has

performance-based vesting and the performance period has not been completed and the number of shares that can

be earned is variable based on the performance level, a pro-rata portion of such executive’s outstanding equity

awards will immediately become fully vested at the target performance level, and (ii) in lieu of continued

employment benefits (other than as required by law), such executive will be entitled to receive payments of

$3,000 per month for 12 months.

In addition, if, within 18 months following a change of control, the executive’s employment is terminated by us

without “cause,” or by the executive for “good reason,” such executive will be entitled to receive (i) severance

equal to 200% of such executive’s base salary as in effect immediately prior to the change of control or such

executive’s termination, whichever is greater, with such severance to be paid over 24 months, and (ii) if such

termination occurs in 2011, an amount equal to 200% of the average annual bonus received in the last 24 months,

or if such termination occurs in 2012 or later, an amount equal to 200% of the average annual bonus received in

the last 36 months, with such severance to be paid over 24 months.

Each executive’s receipt of the severance benefits discussed above is contingent on such executive signing and

not revoking a release of claims against us, such executive’s continued compliance with our Corporate Code of

31

Proxy