Pottery Barn 2011 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2011 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

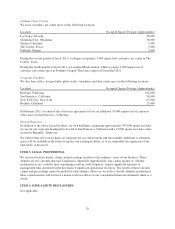

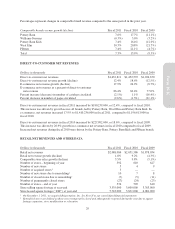

Fiscal 2011 Fiscal 2010 Fiscal 2009

Store

Count

Avg. LSF

Per Store

Store

Count

Avg. LSF

Per Store

Store

Count

Avg. LSF

Per Store

Williams-Sonoma 259 6,500 260 6,400 259 6,300

Pottery Barn 194 13,800 193 13,100 199 13,000

Pottery Barn Kids 83 8,200 85 8,100 87 8,100

West Elm 37 17,100 36 17,100 36 17,600

Williams-Sonoma Home — — — — 11 13,200

Rejuvenation 3 17,200 — — — —

Outlets1— — 18 19,600 18 20,200

Total2576 10,000 592 9,800 610 10,000

1Beginning in fiscal 2011, Outlet stores and their leased square footage have been reclassified into their respective brands.

2Temporary “pop-up” stores, where lease terms are typically short-term in nature and are used to test new markets, are not

included in the totals above as they are not considered permanent stores.

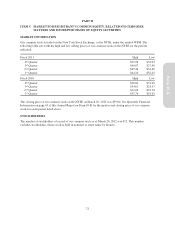

Retail net revenues in fiscal 2011 increased by $36,498,000, or 1.8%, compared to fiscal 2010. This increase was

primarily driven by West Elm, Pottery Barn, international franchise operations and Pottery Barn Kids, despite a

1.5% year-over-year reduction in retail leased square footage, due to 16 net fewer stores (including the closure of

our Williams-Sonoma Home stores at the end of fiscal 2010). Comparable store sales in fiscal 2011 increased

3.5%.

Retail net revenues in fiscal 2010 increased by $173,552,000, or 9.2%, compared to fiscal 2009. This increase

was driven by growth of 9.8% in comparable store sales, partially offset by a 4.1% year-over-year reduction in

retail leased square footage, including 18 net fewer stores. Increased net revenues during fiscal 2010 were driven

by the Pottery Barn, West Elm and Williams-Sonoma brands.

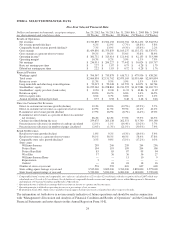

COST OF GOODS SOLD

Dollars in thousands Fiscal 2011

% Net

Revenues Fiscal 2010

% Net

Revenues Fiscal 2009

% Net

Revenues

Cost of goods sold1$2,261,039 60.8% $2,130,299 60.8% $1,999,467 64.4%

1Includes total occupancy expenses of $500,660,000, $506,712,000 and $519,224,000 in fiscal 2011, fiscal 2010 and fiscal 2009,

respectively.

Cost of goods sold includes cost of goods, occupancy expenses and shipping costs. Cost of goods consists of cost

of merchandise, inbound freight expenses, freight-to-store expenses and other inventory related costs such as

shrinkage, damages and replacements. Occupancy expenses consist of rent, depreciation and other occupancy

costs, including common area maintenance and utilities. Shipping costs consist of third party delivery services

and shipping materials.

Our classification of expenses in cost of goods sold may not be comparable to other public companies, as we do

not include non-occupancy related costs associated with our distribution network in cost of goods sold. These

costs, which include distribution network employment, third party warehouse management and other

distribution-related administrative expenses, are recorded in selling, general and administrative expenses.

Within our reportable segments, the direct-to-customer channel does not incur freight-to-store or store occupancy

expenses, and typically operates with lower markdowns and inventory shrinkage than the retail channel.

However, the direct-to-customer channel incurs higher customer shipping, damage and replacement costs than

the retail channel.

Fiscal 2011 vs. Fiscal 2010

Cost of goods sold increased by $130,740,000, or 6.1%, in fiscal 2011 compared to fiscal 2010. Cost of goods

sold as a percentage of net revenues remained flat at 60.8% in fiscal 2011 (which includes expense of

approximately $375,000 from lease termination related costs associated with underperforming retail stores)

30