Pottery Barn 2011 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2011 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PROPOSAL 3

ADVISORY VOTE ON EXECUTIVE COMPENSATION

What is this proposal?

This is a proposal asking stockholders to approve, on an advisory basis, the compensation of our named

executive officers as disclosed in this Proxy Statement in accordance with the Dodd-Frank Wall Street Reform

and Consumer Protection Act of 2010, or the “Dodd-Frank Act,” and the applicable SEC rules. This proposal is

commonly known as a “Say on Pay” proposal, and gives our stockholders the opportunity to express their views

on the compensation of our named executive officers.

Compensation Program and Philosophy

As described in detail under the headings “Information Concerning Executive Officers” and “Compensation

Discussion and Analysis,” our executive officer compensation program is designed to attract, retain and motivate

highly qualified personnel who are critical to our success while maintaining direct links between executive pay,

individual performance, the company’s financial performance and stockholder returns. The Compensation

Committee believes that the company’s executive compensation programs should support the company’s

objective of creating value for its stockholders.

Accordingly, the Compensation Committee believes that executive officers should have a significant interest in

the company’s stock performance, and compensation programs should link executive compensation to

stockholder value. One of the ways that the company has sought to accomplish these goals is by making a

significant portion of individual compensation directly dependent on the company’s achievement of financial

goals, which in turn enhances long-term stockholder return while encouraging executives to build an equity

interest in the company. In 2011, the Compensation Committee also retained Frederic W. Cook & Co., Inc. to

evaluate the risk in the company’s compensation programs.

Fiscal 2011 Compensation

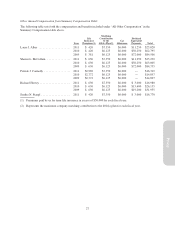

To align our executive compensation packages with our executive compensation philosophy, the following

compensation actions were approved by the Compensation Committee for fiscal 2011:

Adjustments to Base Salary and Bonus Target Amounts: The base salaries and bonus targets as a percentage of

base salary of our named executive officers were increased for fiscal 2011 to bring target total cash compensation

for our named executive officers from generally between the 50th percentile and the 75th percentile to generally

above the 75th percentile compared to the company’s proxy peer group and relevant market data as described

under “Compensation Discussion and Analysis” in this Proxy Statement.

Performance-Based Cash Bonus: Performance-based cash bonuses were paid for performance in fiscal 2011 as a

result of the achievement of positive net cash flow by operating activities, exceeding earnings per share goals set

by the Compensation Committee for fiscal 2011 and outstanding leadership and individual performance by our

named executive officers in fiscal 2011.

Performance- and Time-Based Equity: The company granted our named executive officers a mixture of

performance-based and time-based equity awards in fiscal 2011. Restricted stock units that vest on the second

anniversary and the fourth anniversary of the grant date, in each case, only if positive net cash flow by operating

activities is achieved, provide both retention value and incentives to achieve the company’s financial goals, while

stock appreciation rights that vest in equal installments over four years also encourage our named executive

officers to stay with the company and to increase stockholder value by increasing our stock price.

In addition to the above summary, stockholders are urged to read the “Compensation Discussion and Analysis”

section of this Proxy Statement for detail about our executive compensation programs, including information

about the fiscal 2011 compensation of our named executive officers.

22