Pottery Barn 2011 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2011 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

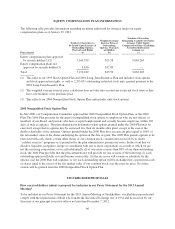

Name and Address of Beneficial Owner Position with Company

Amount and Nature of

Beneficial Ownership Percent of

Class(1)Shares Options

Adrian D.P. Bellamy ......................... Director 73,432 78,750 *

Rose Marie Bravo ........................... Director 2,618(11) — *

Mary Ann Casati ............................ Director 2,630(12) — *

Adrian T. Dillon ............................. Director 46,107(13) 36,750 *

Anthony A. Greener .......................... Director 30,462(14) 6,750 *

Ted W. Hall ................................ Director 12,377(15) 6,750 *

Michael R. Lynch ........................... Director 35,264 82,750 *

Lorraine Twohill ............................ Director 2,630(16) — *

All current executive officers and directors as a

group (14 persons) ......................... — 1,257,133(17) 1,019,329 2.3%

* Less than 1%.

(1) Assumes exercise of stock options currently exercisable or exercisable within 60 days of March 26, 2012 by

the named individual into shares of our common stock. Based on 99,584,007 shares outstanding as of

March 26, 2012.

(2) The information above and in this footnote is based on information taken from the Schedule 13G of

McMahan Family Trust dtd 12/7/06 filed with the Securities and Exchange Commission on March 2, 2012.

McMahan Family Trust dtd 12/7/06 has sole voting and dispositive power over 11,124,366 shares of our

common stock.

(3) The information above and in this footnote is based on information taken from the Schedule 13G of

BlackRock, Inc. filed with the Securities and Exchange Commission on February 10, 2012. BlackRock, Inc.

has sole voting and dispositive power over 7,437,551 shares of our common stock.

(4) The information above and in this footnote is based on information taken from the Schedule 13G filed

jointly by Stephen F. Mandel, Jr., individually and as Managing Member of Lone Pine Managing Member

LLC, for itself and as Managing Member of (a) Lone Pine Associates LLC, for itself and as the general

partner of (i) Lone Spruce, L.P., (ii) Lone Balsam, L.P. and (iii) Lone Sequoia, L.P.; (b) Lone Pine Members

LLC, for itself and as the general partner of (i) Lone Cascade, L.P. and (ii) Lone Sierra, L.P.; and (c) Lone

Pine Capital LLC, with the Securities and Exchange Commission on February 14, 2012. Each of Stephen F.

Mandel, Jr. and Lone Pine Managing Member LLC has shared voting power over 6,235,380 shares of our

common stock and shared power to dispose or direct the disposition of 6,235,380 shares of our common

stock. Lone Pine Associates, the general partner of Lone Spruce, L.P., Lone Sequoia, L.P. and Lone Balsam,

L.P., has the power to direct the affairs of Lone Spruce, L.P., Lone Sequoia, L.P. and Lone Balsam, L.P.,

including decisions respecting the disposition of the proceeds from the sale of shares. Lone Pine Members

LLC, the general partner of Lone Cascade, L.P. and Lone Sierra, L.P., has the power to direct the affairs of

Lone Cascade, L.P. and Lone Sierra, L.P., including decisions respecting the disposition of the proceeds

from the sale of shares. Lone Pine Capital LLC, the investment manager of Lone Cypress, Lone Kauri and

Lone Monterey Master Fund, has the power to direct the receipt of dividends from or the proceeds of the

sale of shares held by Lone Cypress, Lone Kauri and Lone Monterey Master Fund. Lone Pine Managing

Member LLC, the Managing Member of Lone Pine Associates LLC, Lone Pine Members LLC and Lone

Pine Capital LLC, has the power to direct the affairs of Lone Pine Associates LLC, Lone Pine Members

LLC and Lone Pine Capital LLC. Mr. Mandel is the Managing Member of Lone Pine Managing Member

LLC and in that capacity directs its operations.

(5) The information above and in this footnote is based on information taken from the Schedule 13G filed

jointly by Luxor Capital Partners, LP (the “Onshore Fund”); Luxor Spectrum, LLC (the “Spectrum Onshore

63

Proxy