Pottery Barn 2011 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2011 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In determining the type and number of equity awards granted to an individual executive, the Compensation

Committee considered such factors as:

• The individual’s performance and contribution to the profitability of the company;

• The type and number of awards previously granted to an individual;

• An individual’s outstanding awards;

• The vesting schedule of the individual’s outstanding awards;

• The relative value of awards offered by comparable companies to executives in comparable positions to

fairly benchmark awards of different sizes and type;

• Internal equity between positions within the company;

• The appropriate mix between long-term incentive awards and other types of compensation, such as base

salary and bonus; and

• Additional factors, including succession planning and retention of the company’s high-level potential

executives.

The Compensation Committee believes that each of these factors influences the type and number of shares

appropriate for each individual and that no one factor is determinative.

In determining the level of restricted stock unit and stock-settled stock appreciation right grants for named

executive officers other than the Chief Executive Officer, the Compensation Committee took into account the

Chief Executive Officer’s assessment of the performance of the company and the adequacy of compensation

levels of named executive officers. In determining the level of restricted stock unit and stock-settled stock

appreciation right grants for the Chief Executive Officer, in 2011 the Compensation Committee took into account

the performance of the company and the assessment of the independent members of the Board of Directors

concerning the performance of the Chief Executive Officer.

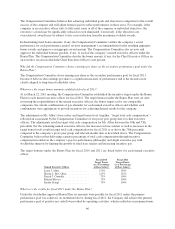

What equity grants were made in fiscal 2011?

At its March 2011 meeting, the Compensation Committee approved equity grants to the named executive officers

consisting of restricted stock units and stock-settled stock appreciation rights. In determining the number and

type of equity grants to be made to the named executive officers, the Compensation Committee considered both

the retention value of granting restricted stock units that provide named executive officers with immediate value

because they have no purchase price (but are subject to vesting) and the benefits to our stockholders of granting

stock-settled stock appreciation rights with value that is tied to sustained long-term stock price performance.

Generally, the Compensation Committee continued to target a range between the 50th and 75th percentile of

target total direct compensation of our peer group.

The equity grants approved at the March 2011 meeting are as follows:

Named Executive Officer

Number of

Restricted

Stock

Units

Number of Stock-

Settled Stock

Appreciation

Rights

Laura J. Alber ...................... 67,010 186,185

Sharon L. McCollam ................ 21,320 59,240

Patrick J. Connolly .................. 15,230 42,315

Richard Harvey .................... 16,450 45,700

Sandra Stangl ...................... 18,275 50,780

50% of the restricted stock units granted to the named executive officers vest on the second anniversary of the

award’s grant date and the remaining 50% of the restricted stock units vest on the fourth anniversary of the

48