Pottery Barn 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note L: Stock Repurchase Program

In January 2011, our Board of Directors authorized a stock repurchase program to purchase up to $125,000,000

of our common stock, and in January 2012, our Board of Directors authorized a new stock repurchase program to

purchase up to $225,000,000 of our common stock. During fiscal 2011, we repurchased 5,384,036 shares of our

common stock at an average cost of $36.11 per share and a total cost of approximately $194,429,000. As of

January 29, 2012, we had completed our $125,000,000 stock repurchase program authorized by our Board of

Directors in January 2011, and had $155,571,000 remaining under the $225,000,000 stock repurchase program

authorized by our Board of Directors in January 2012.

Stock repurchases under this program may be made through open market and privately negotiated transactions at

times and in such amounts as management deems appropriate. The timing and actual number of shares

repurchased will depend on a variety of factors including price, corporate and regulatory requirements, capital

availability and other market conditions. The stock repurchase program does not have an expiration date and may

be limited or terminated at any time without prior notice.

During fiscal 2010, we repurchased $125,000,000, or 4,263,463 shares of our common stock, at an average cost

of $29.32 per share under programs previously authorized by our Board of Directors. We did not repurchase any

shares of our common stock during fiscal 2009.

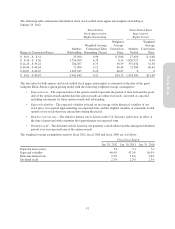

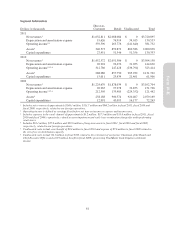

Note M: Segment Reporting

We have two reportable segments, direct-to-customer and retail. The direct-to-customer segment has seven

merchandising concepts (Williams-Sonoma, Pottery Barn, Pottery Barn Kids, PBteen, West Elm, Williams-

Sonoma Home and Rejuvenation) and sells our products through our six e-commerce websites (williams-

sonoma.com, potterybarn.com, potterybarnkids.com, pbteen.com, westelm.com and rejuvenation.com) and seven

direct mail catalogs (Williams-Sonoma, Pottery Barn, Pottery Barn Kids, Pottery Barn Bed and Bath, PBteen,

West Elm and Rejuvenation). The retail segment has five merchandising concepts which sell products for the

home (Williams-Sonoma, Pottery Barn, Pottery Barn Kids, West Elm and Rejuvenation). The five retail

merchandising concepts are operating segments, which have been aggregated into one reportable segment, retail.

Management’s expectation is that the overall economic characteristics of each of our major concepts within each

reportable segment will be similar over time based on management’s judgment that the operating segments have

had similar historical economic characteristics and are expected to have similar long-term financial performance

in the future.

These reportable segments are strategic business units that offer similar home-centered products. They are

managed separately because the business units utilize two distinct distribution and marketing strategies. Based on

management’s best estimate, our operating segments include allocations of certain expenses, including

advertising and employment costs, to the extent they have been determined to benefit both channels. These

operating segments are aggregated at the channel level for reporting purposes due to the fact that our brands are

interdependent for economies of scale and we do not maintain fully allocated income statements at the brand

level. As a result, material financial decisions related to the brands are made at the channel level. Furthermore, it

is not practicable for us to report revenue by product group.

We use earnings before unallocated corporate overhead, interest and taxes to evaluate segment profitability.

Unallocated costs before income taxes include corporate employee-related costs, occupancy expenses (including

depreciation expense), administrative costs and third party service costs, primarily in our corporate systems,

corporate facilities and other administrative departments. Unallocated assets include corporate cash and cash

equivalents, deferred income taxes, the net book value of corporate facilities and related information systems,

and other corporate long-lived assets.

Income tax information by segment has not been included as taxes are calculated at a company-wide level and

are not allocated to each segment.

60