Pottery Barn 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

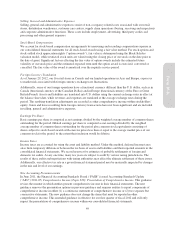

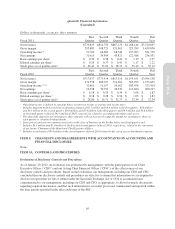

deferral period. As of January 29, 2012 and January 30, 2011, $12,150,000 and $13,996,000, respectively, was

included in other long-term obligations. Additionally, we have purchased life insurance policies on certain

participants to potentially offset these unsecured obligations. The cash surrender value of these policies was

$12,684,000 and $12,939,000 as of January 29, 2012 and January 30, 2011, respectively, and was included in

other assets, net.

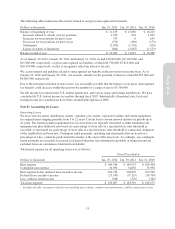

Note J: Commitments and Contingencies

We are involved in lawsuits, claims and proceedings incident to the ordinary course of our business. These

disputes, which are not currently material, are increasing in number as our business expands and our company

grows larger. Litigation is inherently unpredictable. Any claims against us, whether meritorious or not, could be

time consuming, result in costly litigation, require significant amounts of management time and result in the

diversion of significant operational resources. The results of these lawsuits, claims and proceedings cannot be

predicted with certainty. However, we believe that the ultimate resolution of these current matters will not have a

material adverse effect on our consolidated financial statements taken as a whole.

We are party to a variety of contractual agreements under which we may be obligated to indemnify the other

party for certain matters. These contracts primarily relate to our commercial contracts, operating leases,

trademarks, intellectual property, financial agreements and various other agreements. Under these contracts, we

may provide certain routine indemnifications relating to representations and warranties or personal injury

matters. The terms of these indemnifications range in duration and may not be explicitly defined. Historically, we

have not made significant payments for these indemnifications. We believe that if we were to incur a loss in any

of these matters, the loss would not have a material effect on our financial condition or results of operations.

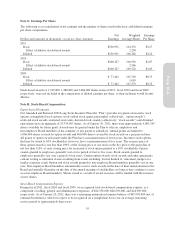

Note K: Related Party Transactions

Retirement and Consulting Agreement

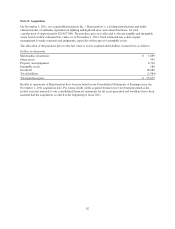

On January 25, 2010, the independent members of our Board of Directors (the “Board”) approved our entry into

a Retirement and Consulting Agreement (the “Agreement”) with W. Howard Lester (“Mr. Lester”), our former

Chairman of the Board and Chief Executive Officer. Pursuant to the terms of the Agreement, Mr. Lester retired

as Chairman of the Board and Chief Executive Officer on May 26, 2010. Upon his retirement and in recognition

of his contributions to the Company, Mr. Lester received, among other things, accelerated vesting of his

outstanding stock options, stock-settled stock appreciation rights and restricted stock units. The total expense

recorded in fiscal 2010 associated with Mr. Lester’s retirement, consisting primarily of stock-based

compensation expense, was approximately $4,319,000. The total expense recorded in fiscal 2010 associated with

Mr. Lester’s consulting services, consisting primarily of stock-based compensation expense and cash

compensation, among other things, was approximately $1,616,000. As a result of Mr. Lester’s death in

November 2010, the Agreement terminated and all unvested stock units and cash payments granted under the

Agreement were forfeited.

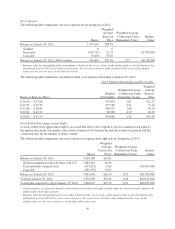

Airplane Lease Agreement

On May 16, 2008, we entered into an aircraft lease agreement with a limited liability company (the “LLC”)

owned by Mr. Lester for use of a Bombardier Global 5000 aircraft owned by the LLC, through May 2011.

During fiscal 2011, fiscal 2010 and fiscal 2009, we paid a total of $1,319,000, $4,500,000 and $4,500,000 to the

LLC, respectively.

In conjunction with the Agreement entered into between us and Mr. Lester on January 25, 2010, Mr. Lester

agreed to give us an option to purchase this aircraft at the end of the lease term for its then estimated fair value of

$32,000,000. Immediately prior to the end of the lease term, we assigned our rights to purchase the aircraft to

Wells Fargo Equipment Finance, Inc. (“Wells Fargo”). We then entered into a Master Lease Agreement (the

“Master Lease”) with Wells Fargo to lease the aircraft. The Master Lease commenced on May 16, 2011, has a

term of 10 years and is classified as an operating lease. During fiscal 2011, we made total rental payments of

$1,380,000 under this lease.

59

Form 10-K