Pottery Barn 2011 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2011 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

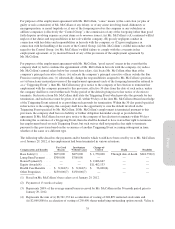

For purposes of the employment agreement with Ms. Alber, “good reason” is defined as, without Ms. Alber’s

consent, (i) a reduction in her base salary (except pursuant to a reduction generally applicable to senior

executives of the company), (ii) a material diminution of her authority or responsibilities, (iii) a reduction of

Ms. Alber’s title, (iv) Ms. Alber ceasing to report directly to the Board of Directors, or (v) the Board of Directors

failing to re-nominate Ms. Alber for Board membership when her Board term expires while she is employed by

the company. In addition, upon any such voluntary termination for good reason, Ms. Alber must provide written

notice to the company of the existence of one or more of the above conditions within 90 days of its initial

existence and the company must be provided with at least 30 days to remedy the condition.

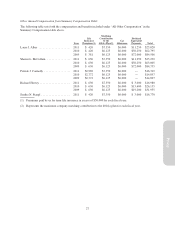

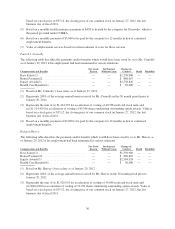

The following table describes the payments and/or benefits which would have been owed by us to Ms. Alber as

of January 29, 2012 if her employment had been terminated in various situations.

Compensation and Benefits

For Good

Reason

Involuntary

Without Cause

Change-of-

Control Death Disability

Base Salary(1) ............ $ 2,400,000 $ 2,400,000 $ 2,400,000 $ 2,400,000(2) $ 2,400,000(2)

Bonus Payment(3) ......... $ 2,833,333 $ 2,833,333 $ 2,833,333 $ 2,833,333(2) $ 2,833,333(2)

Equity Awards ............ $12,405,448(4) $12,405,448(4) $15,443,866(5) $12,405,448(4) $12,405,448(4)

Health Care Benefits(6) ..... $ 54,000 $ 54,000 $ 36,000 $ 54,000 $ 54,000

(1) Based on Ms. Alber’s base salary as of January 29, 2012.

(2) Will be reduced by the amount of any payments Ms. Alber receives through company-paid insurance

policies.

(3) Represents 200% of the average annual bonus received by Ms. Alber in the 36 month period prior to

January 29, 2012.

(4) Represents the sum of (i) $10,135,948 for acceleration of vesting of 288,609 restricted stock units and

(ii) $2,269,500 for acceleration of vesting of 260,593 shares underlying outstanding option awards. Value is

based on a stock price of $35.12, the closing price of our common stock on January 27, 2012, the last

business day of fiscal 2011.

(5) Represents the sum of (i) $12,804,366 for acceleration of vesting of 364,589 restricted stock units and

(ii) $2,639,500 for acceleration of vesting of 403,685 shares underlying outstanding option awards. Value is

based on a stock price of $35.12, the closing price of our common stock on January 27, 2012, the last

business day of fiscal 2011.

(6) Based on a monthly payment of $3,000 to be paid by the company for 18 months or 12 months, as

applicable, in lieu of continued employment benefits.

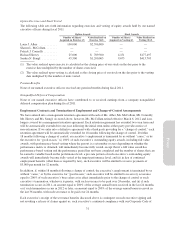

Sharon L. McCollam

We entered into an employment agreement with Sharon L. McCollam, effective as of December 28, 2002 and

amended as of November 11, 2008. Effective March 6, 2012, she retired from her position as our Executive Vice

President, Chief Operating and Chief Financial Officer and is no longer covered by her employment agreement.

Prior to Ms. McCollam’s retirement, her agreement provided for (i) continuation of her base salary at the time of

termination for a period of one year plus an additional lump sum amount equal to 80% of Ms. McCollam’s base

salary, (ii) outplacement services at a level commensurate with her position at no cost to her, and (iii) payment of

the premiums for health care coverage under COBRA for Ms. McCollam and her dependents for up to 18 months

(or, if earlier, until she either commences new employment or she and her dependents are no longer eligible for

COBRA coverage) in the event her employment was terminated by us without “cause” or if Ms. McCollam

terminated her employment with us for “good reason.” As described in the section titled “Compensation

Discussion and Analysis” beginning on page 38, we entered into a Separation Agreement and General Release

with Ms. McCollam under which she is entitled to receive these severance benefits, as well as certain other

benefits in connection with her retirement.

34