Pottery Barn 2011 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2011 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

If we fail to attract and retain key personnel, our business and operating results may be harmed.

Our future success depends to a significant degree on the skills, experience and efforts of key personnel in our

senior management, whose vision for our company, knowledge of our business and expertise would be difficult

to replace. If any of our key employees leaves, are seriously injured or are unable to work, and we are unable to

find a qualified replacement, we may be unable to execute our business strategy.

In addition, our main offices are located in the San Francisco Bay Area, where competition for personnel with

retail and technology skills can be intense. If we fail to identify, attract, retain and motivate these skilled

personnel, especially in this challenging economic environment, our business may be harmed. Further, in the

event we need to hire additional personnel, we may experience difficulties in attracting and successfully hiring

such individuals due to competition for highly skilled personnel, as well as the significantly higher cost of living

expenses in our market.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

We lease store locations, distribution centers, customer care centers and corporate facilities for original terms

ranging generally from 3 to 22 years. Certain leases contain renewal options for periods of up to 20 years.

For our store locations, our gross leased store space, as of January 29, 2012, totaled approximately 5,743,000

square feet for 576 stores compared to approximately 5,831,000 square feet for 592 stores as of January 30, 2011.

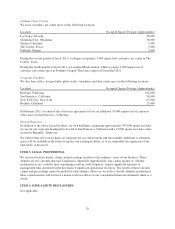

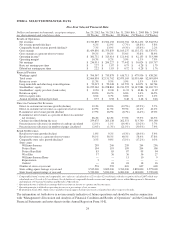

Distribution Centers

We lease distribution facility space in the following locations:

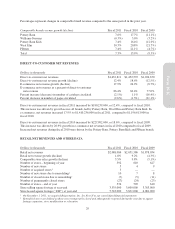

Location Occupied Square Footage (Approximate)

Olive Branch, Mississippi 2,105,000

South Brunswick, New Jersey 1,351,000

City of Industry, California 1,180,000

Memphis, Tennessee11,023,000

Claremont, North Carolina 412,000

Portland, Oregon 91,000

Urbancrest, Ohio 73,000

Lakeland and Pompano Beach, Florida 72,000

1See Note F to our Consolidated Financial Statements for more information.

In March 2011, we entered into a seven year agreement to lease a 412,000 square foot building in Claremont,

North Carolina to support our upholstered furniture manufacturing and furniture delivery operations. This new

facility replaced our Hickory, North Carolina facility upon its lease expiration in April 2011.

During the third quarter of fiscal 2011, we eliminated 781,000 square feet of excess distribution capacity by

exiting one of our distribution centers located in Cranbury, New Jersey upon its lease expiration.

During the fourth quarter of fiscal 2011, we acquired Rejuvenation Inc., which occupies 91,000 square feet of

distribution space in Portland, Oregon. This lease expires in December 2021.

In addition to the above long-term contracts, we enter into other agreements for offsite storage needs for both our

distribution centers and our retail store locations, as well as other distribution center operations. As of

January 29, 2012, we had approximately 136,000 square feet of leased space relating to these agreements that is

not included in the occupied square footage reported above. This compares to approximately 236,000 square feet

of leased space as of January 30, 2011.

19

Form 10-K