Pottery Barn 2011 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2011 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

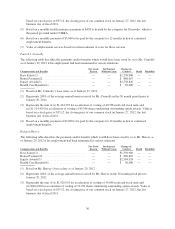

based on a stock price of $35.12, the closing price of our common stock on January 27, 2012, the last

business day of fiscal 2011.

(5) Based on a monthly health insurance premium of $458 to be paid by the company for 18 months, which is

the period provided under COBRA.

(6) Based on a monthly payment of $3,000 to be paid by the company for 12 months in lieu of continued

employment benefits.

(7) Value of outplacement services based on current estimate of costs for these services.

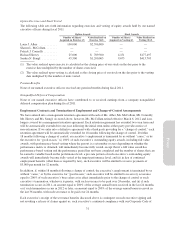

Patrick J. Connolly

The following table describes the payments and/or benefits which would have been owed by us to Mr. Connolly

as of January 29, 2012 if his employment had been terminated in various situations.

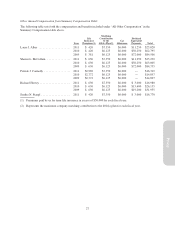

Compensation and Benefits

For Good

Reason

Involuntary

Without Cause

Change-of-

Control Death Disability

Base Salary(1) ................................ — — $1,250,000 — —

Bonus Payment(2) ............................. — — $ 866,667 — —

Equity Awards(3) ............................. — — $2,538,826 — —

Health Care Benefits(4) ......................... — — $ 36,000 — —

(1) Based on Mr. Connolly’s base salary as of January 29, 2012.

(2) Represents 200% of the average annual bonus received by Mr. Connolly in the 36 month period prior to

January 29, 2012.

(3) Represents the sum of (i) $1,424,397 for acceleration of vesting of 40,558 restricted stock units and

(ii) $1,114,429 for acceleration of vesting of 89,346 shares underlying outstanding option awards. Value is

based on a stock price of $35.12, the closing price of our common stock on January 27, 2012, the last

business day of fiscal 2011.

(4) Based on a monthly payment of $3,000 to be paid by the company for 12 months in lieu of continued

employment benefits.

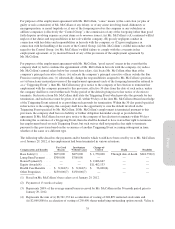

Richard Harvey

The following table describes the payments and/or benefits which would have been owed by us to Mr. Harvey as

of January 29, 2012 if his employment had been terminated in various situations.

Compensation and Benefits

For Good

Reason

Involuntary

Without Cause

Change-of-

Control Death Disability

Base Salary(1) ................................ — — $1,350,000 — —

Bonus Payment(2) ............................. — — $ 866,667 — —

Equity Awards(3) ............................. — — $2,584,924 — —

Health Care Benefits(4) ......................... — — $ 36,000 — —

(1) Based on Mr. Harvey’s base salary as of January 29, 2012.

(2) Represents 200% of the average annual bonus received by Mr. Harvey in the 36 month period prior to

January 29, 2012.

(3) Represents the sum of (i) $1,920,924 for acceleration of vesting of 54,696 restricted stock units and

(ii) $664,000 for acceleration of vesting of 70,700 shares underlying outstanding option awards. Value is

based on a stock price of $35.12, the closing price of our common stock on January 27, 2012, the last

business day of fiscal 2011.

36