Pottery Barn 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Reserves for shrinkage are estimated and recorded throughout the year, at the concept and channel level, as a

percentage of net sales based on historical shrinkage results, expectations of future shrinkage and current

inventory levels. Actual shrinkage is recorded at year-end based on the results of our physical inventory count

and can vary from our estimates due to such factors as changes in operations within our distribution centers, the

mix of our inventory (which ranges from large furniture to small tabletop items) and execution against loss

prevention initiatives in our stores, distribution centers, off-site storage locations, and with our third party

transportation providers. Accordingly, there is no remaining shrinkage reserve balance at year-end.

Due to these factors, our obsolescence and shrinkage reserves contain uncertainties. Both estimates have

calculations that require management to make assumptions and to apply judgment regarding a number of factors,

including market conditions, the selling environment, historical results and current inventory trends. If actual

obsolescence or shrinkage estimates change from our original estimate, we will adjust our reserves accordingly

throughout the year. Management does not believe that changes in the assumptions used in these estimates would

have a significant effect on our inventory balances. We have made no material changes to our assumptions

included in the calculations of the obsolescence and shrinkage reserves throughout the year. In addition, we do

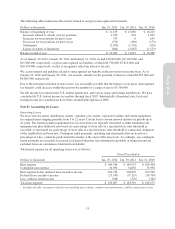

not believe a 10% change in our inventory reserves would have a material effect on net earnings. As of

January 29, 2012 and January 30, 2011, our inventory obsolescence reserves were $12,026,000 and $12,348,000,

respectively.

Advertising and Prepaid Catalog Expenses

Advertising expenses consist of media and production costs related to catalog mailings, e-commerce advertising

and other direct marketing activities. All advertising costs are expensed as incurred, or upon the release of the

initial advertisement, with the exception of prepaid catalog expenses. Prepaid catalog expenses consist primarily

of third party incremental direct costs, including creative design, paper, printing, postage and mailing costs for all

of our direct response catalogs. Such costs are capitalized as prepaid catalog expenses and are amortized over

their expected period of future benefit. Such amortization is based upon the ratio of actual direct-to-customer

revenues to the total of actual and estimated future direct-to-customer revenues on an individual catalog basis.

Estimated future direct-to-customer revenues are based upon various factors such as the total number of catalogs

and pages circulated, the probability and magnitude of consumer response and the assortment of merchandise

offered. Each catalog is generally fully amortized over a six to nine month period, with the majority of the

amortization occurring within the first four to five months. Prepaid catalog expenses are evaluated for

realizability on a monthly basis by comparing the carrying amount associated with each catalog to the estimated

probable remaining future profitability (remaining direct-to-customer net revenues less merchandise cost of

goods sold, selling expenses and catalog-related costs) associated with that catalog. If the catalog is not expected

to be profitable, the carrying amount of the catalog is impaired accordingly.

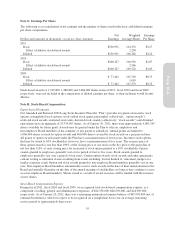

Total advertising expenses (including catalog advertising, e-commerce advertising and all other advertising

costs) were approximately $301,316,000, $293,623,000 and $264,963,000 in fiscal 2011, fiscal 2010 and fiscal

2009, respectively.

Property and Equipment

Property and equipment is stated at cost. Depreciation is computed using the straight-line method over the

estimated useful lives of the assets below.

Leasehold improvements Shorter of estimated useful life or lease term (generally 2 –22 years)

Fixtures and equipment 2 – 20 years

Buildings and building improvements 5 – 40 years

Capitalized software 2 – 10 years

Interest costs related to assets under construction, including software projects, are capitalized during the

construction or development period. We capitalized interest costs of $1,016,000, $1,277,000 and $1,763,000 in

fiscal 2011, fiscal 2010 and fiscal 2009, respectively.

46