Pottery Barn 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

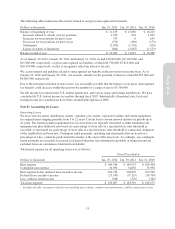

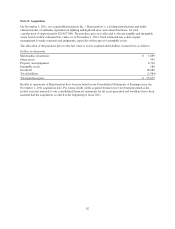

Stock Options

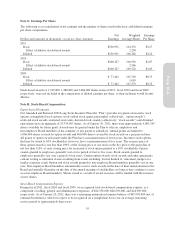

The following table summarizes our stock option activity during fiscal 2011:

Shares

Weighted

Average

Exercise

Price

Weighted Average

Contractual Term

Remaining (Years)

Intrinsic

Value1

Balance at January 30, 2011 1,367,629 $28.81

Granted 0 0

Exercised (429,773) 22.37 $7,343,000

Canceled (3,160) 29.20

Balance at January 29, 2012 (100% vested) 934,696 $31.76 2.25 $4,338,000

1Intrinsic value for outstanding and vested options is based on the excess, if any, of the market value on the last business day

of the fiscal year (or $35.12) over the exercise price. For exercises, intrinsic value is based on the excess of the market

value over the exercise price on the date of exercise.

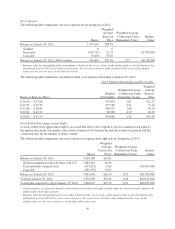

The following table summarizes information about stock options outstanding at January 29, 2012:

Stock Options Outstanding and Exercisable

Range of Exercise Prices

Number

Outstanding

Weighted Average

Contractual Term

Remaining (Years)

Weighted

Average

Exercise

Price

$ 20.90 – $ 27.00 235,859 1.02 $22.23

$ 27.25 – $ 32.39 273,780 2.21 31.10

$ 32.80 – $ 38.84 328,557 2.60 36.70

$ 39.80 – $ 41.99 96,500 4.19 40.15

$ 20.90 – $ 41.99 934,696 2.25 $31.76

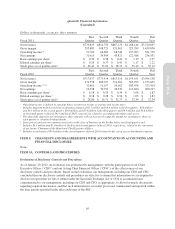

Stock-Settled Stock Appreciation Rights

A stock-settled stock appreciation right is an award that allows the recipient to receive common stock equal to

the appreciation in the fair market value of our common stock between the date the award was granted and the

conversion date for the number of shares vested.

The following table summarizes our stock-settled stock appreciation right activity during fiscal 2011:

Shares

Weighted

Average

Conversion

Price1

Weighted Average

Contractual Term

Remaining (Years)

Intrinsic

Value2

Balance at January 30, 2011 3,429,200 $13.81

Granted (weighted average fair value of $14.27)

1,489,452 40.36

Converted into common stock (675,815) 9.84 $18,969,000

Canceled (301,195) 19.02

Balance at January 29, 2012 3,941,642 $24.13 6.52 $51,284,000

Vested at January 29, 2012 1,474,509 $15.64 6.42 $29,116,000

Vested plus expected to vest at January 29, 2012 3,308,095 $23.76 6.52 $43,855,000

1Conversion price is defined as the price from which stock-settled stock appreciation rights are measured and is equal to the

market value on the date of grant.

2Intrinsic value for outstanding and vested rights is based on the excess, if any, of the market value on the last business day

of the fiscal year (or $35.12) over the conversion price. For conversions, intrinsic value is based on the excess of the

market value over the conversion price on the date of the conversion.

56