Pottery Barn 2011 Annual Report Download - page 160

Download and view the complete annual report

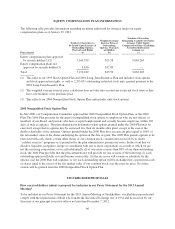

Please find page 160 of the 2011 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fund”); Luxor Wavefront, LP (the “Wavefront Fund”); Luxor Capital Partners Offshore Master Fund, LP

(the “Offshore Master Fund”); Luxor Capital Partners Offshore, Ltd. (the “Offshore Feeder Fund”); Luxor

Spectrum Offshore Master Fund, LP (the “Spectrum Offshore Master Fund”); Luxor Spectrum Offshore,

Ltd. (the “Spectrum Offshore Feeder Fund”); Luxor Capital Group, LP (“Luxor Capital Group”); Luxor

Management, LLC (“Luxor Management”); LCG Holdings, LLC (“LCG Holdings”); and Christian Leone

(“Mr. Leone”), with the Securities and Exchange Commission on March 21, 2012. The Onshore Fund,

Luxor Capital Group, LCG Holdings, Luxor Management and Mr. Leone have shared voting and dispositive

power over 1,536,103 shares of our common stock individually beneficially owned by the Onshore Fund.

The Spectrum Onshore Fund, Luxor Capital Group, LCG Holdings, Luxor Management and Mr. Leone

have shared voting and dispositive power over 24,989 shares of our common stock individually beneficially

owned by the Spectrum Onshore Fund. The Wavefront Fund, Luxor Capital Group, LCG Holdings, Luxor

Management and Mr. Leone have shared voting and dispositive power over 521,670 shares of our common

stock individually beneficially owned by the Wavefront Fund. The Offshore Master Fund, the Offshore

Feeder Fund, Luxor Capital Group, LCG Holdings, Luxor Management and Mr. Leone have shared voting

and dispositive power over 2,468,111 shares of our common stock individually beneficially owned by the

Offshore Master Fund. The Spectrum Offshore Master Fund, the Spectrum Offshore Feeder Fund, Luxor

Capital Group, LCG Holdings, Luxor Management and Mr. Leone have shared voting and dispositive power

over 277,826 shares of our common stock individually beneficially owned by the Spectrum Offshore Master

Fund. Luxor Capital Group, Luxor Management and Mr. Leone have shared voting and dispositive power

over 316,042 shares of our common stock held in separate accounts managed by Luxor Capital Group.

(6) Mr. Connolly owns $1,373,217 in the Williams-Sonoma, Inc. Stock Fund under our 401(k) plan as of

March 26, 2012. The number of shares listed in the table includes 35,174 shares held in the Williams-

Sonoma, Inc. Stock Fund. This number was calculated by dividing the amount owned in the Williams-

Sonoma, Inc. Stock Fund by $39.04, the closing price of Williams-Sonoma, Inc. common stock on

March 26, 2012. The number of shares listed in the table also includes 14,078 restricted stock units that will

vest and become settleable for an equal number of shares of our common stock within 60 days of March 26,

2012 (prior to withholding of any such shares to satisfy applicable statutory withholding requirements).

(7) Ms. Alber owns $490,574 in the Williams-Sonoma, Inc. Stock Fund under our 401(k) plan, as of March 26,

2012. The number of shares listed in the table includes 12,565 shares held in the Williams-Sonoma, Inc.

Stock Fund. This number was calculated by dividing the amount owned in the Williams-Sonoma, Inc. Stock

Fund by $39.04, the closing price of Williams-Sonoma, Inc. common stock on March 26, 2012. The number

of shares listed in the table also includes 17,579 restricted stock units that will vest and become settleable

for an equal number of shares of our common stock within 60 days of March 26, 2012 (prior to withholding

of any such shares to satisfy applicable statutory withholding requirements).

(8) Ms. McCollam owns $345,204 in the Williams-Sonoma, Inc. Stock Fund under our 401(k) plan as of

March 26, 2012. The number of shares listed in the table includes 8,842 shares held in the Williams-

Sonoma, Inc. Stock Fund. This number was calculated by dividing the amount owned in the Williams-

Sonoma, Inc. Stock Fund by $39.04, the closing price of Williams-Sonoma, Inc. common stock on

March 26, 2012. The number of shares listed in the table also includes 17,579 restricted stock units that will

vest and become settleable for an equal number of shares of our common stock within 60 days of March 26,

2012 (prior to withholding of any such shares to satisfy applicable statutory withholding requirements).

(9) Mr. Harvey owns $809,969 in the Williams-Sonoma, Inc. Stock Fund under our 401(k) plan as of March 26,

2012. The number of shares listed in the table includes 20,747 shares held in the Williams-Sonoma, Inc.

Stock Fund. This number was calculated by dividing the amount owned in the Williams-Sonoma, Inc. Stock

Fund by $39.04, the closing price of Williams-Sonoma, Inc. common stock on March 26, 2012. The number

of shares listed in the table also includes 13,246 restricted stock units that will vest and become settleable

for an equal number of shares of our common stock within 60 days of March 26, 2012 (prior to withholding

of any such shares to satisfy applicable statutory withholding requirements).

(10) Ms. Stangl owns $187,297 in the Williams-Sonoma, Inc. Stock Fund under our 401(k) plan as of March 26,

2012. The number of shares listed in the table includes 4,797 shares held in the Williams-Sonoma, Inc.

64