Pottery Barn 2011 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2011 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

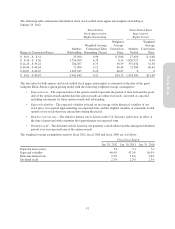

Selling, General and Administrative Expenses

Selling, general and administrative expenses consist of non-occupancy related costs associated with our retail

stores, distribution warehouses, customer care centers, supply chain operations (buying, receiving and inspection)

and corporate administrative functions. These costs include employment, advertising, third party credit card

processing and other general expenses.

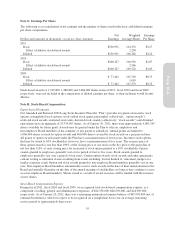

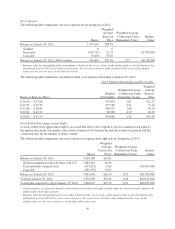

Stock-Based Compensation

We account for stock-based compensation arrangements by measuring and recording compensation expense in

our consolidated financial statements for all stock-based awards using a fair value method. For stock options and

stock-settled stock appreciation rights (“option awards”), fair value is determined using the Black-Scholes

valuation model, while restricted stock units are valued using the closing price of our stock on the date prior to

the date of grant. Significant factors affecting the fair value of option awards include the estimated future

volatility of our stock price and the estimated expected term until the option award is exercised, converted or

cancelled. The fair value of the award is amortized over the requisite service period.

Foreign Currency Translation

As of January 29, 2012, our 16 retail stores in Canada and our limited operations in Asia and Europe, expose us

to market risk associated with foreign currency exchange rate fluctuations.

Additionally, some of our foreign operations have a functional currency different than the U.S. dollar, such as in

Canada (functional currency of the Canadian Dollar) and in Europe (functional currency of the Euro or Great

British Pound). Assets and liabilities are translated into U.S. dollars using the current exchange rates in effect at

the balance sheet date, while revenues and expenses are translated at the average exchange rates during the

period. The resulting translation adjustments are recorded as other comprehensive income within stockholders’

equity. Gains and losses resulting from foreign currency transactions have not been significant and are included

in selling, general and administrative expenses.

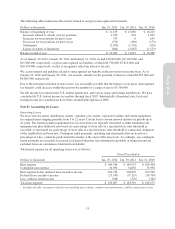

Earnings Per Share

Basic earnings per share is computed as net earnings divided by the weighted average number of common shares

outstanding for the period. Diluted earnings per share is computed as net earnings divided by the weighted

average number of common shares outstanding for the period plus common stock equivalents consisting of

shares subject to stock-based awards with exercise prices less than or equal to the average market price of our

common stock for the period, to the extent their inclusion would be dilutive.

Income Taxes

Income taxes are accounted for using the asset and liability method. Under this method, deferred income taxes

arise from temporary differences between the tax basis of assets and liabilities and their reported amounts in the

consolidated financial statements. We record reserves for estimates of probable settlements of foreign and

domestic tax audits. At any one time, many tax years are subject to audit by various taxing jurisdictions. The

results of these audits and negotiations with taxing authorities may affect the ultimate settlement of these issues.

Additionally, our effective tax rate in a given financial statement period may be materially impacted by changes

in the mix and level of our earnings.

New Accounting Pronouncements

In June 2011, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update

(“ASU”) 2011-05, Comprehensive Income (Topic 220): Presentation of Comprehensive Income. This guidance

revises the manner in which entities present comprehensive income in their financial statements. The new

guidance removes the presentation options in previous guidance and requires entities to report components of

comprehensive income in either (1) a continuous statement of comprehensive income or (2) two separate but

consecutive statements. The new guidance does not change the items that must be reported in other

comprehensive income. This amended guidance is effective for our first quarter of fiscal 2012 and will only

impact the presentation of comprehensive income within our consolidated financial statements.

49

Form 10-K