Pottery Barn 2011 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2011 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

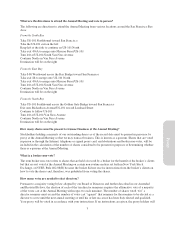

Non-Employee Director Compensation During Fiscal 2011

The following table shows the compensation provided to our non-employee directors during fiscal 2011:

Fees Earned

or Paid in

Cash ($)

Stock

Awards ($)(1)

Option Awards

($)

Non-Stock

Incentive Plan

Compensation

($)

Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings

All Other

Compensation

($) Total ($)

Adrian D.P. Bellamy . . $275,000 $254,995(2) — — — $36,301(3)(4) $566,296

Rose Marie Bravo ..... $ 69,000 $ 91,970(5) — — — $ 1,618(6)(7) $162,588

Mary Ann Casati ..... $ 69,000 $ 91,971(8) — — — $ 579(9) $161,550

Adrian T. Dillon ...... $137,000 $112,993(10) — — — $ 7,371(11)(12) $257,364

Anthony A. Greener . . . $112,500 $ 92,484(13) — — — $ 2,500(14)(15) $207,484

Ted W. Hall ......... $126,500 $ 92,484(16) — — — $ 4,482(17)(18) $223,466

Michael R. Lynch ..... $134,750 $100,711(19) — — — $19,812(20)(21) $255,273

Richard T. Robertson . . $ 33,125 — — — — $ 7,307(22)(23) $ 40,432

Lorraine Twohill ..... $ 69,000 $ 91,971(24) — — — $ 579(25) $161,550

David B. Zenoff ...... $ 27,125 — — — — $24,571(26)(27) $ 51,696

(1) Based on the fair market value of the award granted in fiscal 2011, which is calculated by multiplying the closing price

of our stock on the trading day prior to the grant date by the number of units granted. The number of restricted stock

units granted is determined by dividing the total monetary value of each award, equal to the annual equity grant as

identified in the preceding table, by the closing price of our common stock on the trading day prior to the grant date,

rounding down to the nearest whole share.

(2) Represents the fair market value associated with a restricted stock unit award of 6,540 shares of common stock made

on May 25, 2011, with a fair value as of the grant date of $38.99 per share for an aggregate grant date fair value of

$254,995.

(3) Includes taxable value of discount on merchandise of $9,591.

(4) Includes dividend equivalent payments made with respect to outstanding stock unit awards of $26,710.

(5) Represents the fair market value associated with a restricted stock unit award of 2,618 shares of common stock made

on June 17, 2011, with a fair value as of the grant date of $35.13 per share for an aggregate grant date fair value of

$91,970.

(6) Includes taxable value of discount on merchandise of $152.

(7) Includes dividend equivalent payments made with respect to an outstanding restricted stock unit award of $1,466.

(8) Represents the fair market value associated with a restricted stock unit award of 2,630 shares of common stock made

on January 23, 2012, with a fair value as of the grant date of $34.97 per share for an aggregate grant date fair value of

$91,971.

(9) Represents a dividend equivalent payment made with respect to an outstanding restricted stock unit award of $579.

(10) Represents the fair market value associated with a restricted stock unit award of 2,898 shares of common stock made

on May 25, 2011, with a fair value as of the grant date of $38.99 per share for an aggregate grant date fair value of

$112,993.

(11) Includes taxable value of discount on merchandise of $4,508.

(12) Includes dividend equivalent payments made with respect to an outstanding restricted stock unit award of $2,863.

(13) Represents the fair market value associated with a restricted stock unit award of 2,372 shares of common stock made

on May 25, 2011, with a fair value as of the grant date of $38.99 per share for an aggregate grant date fair value of

$92,484.

(14) Includes taxable value of discount on merchandise of $156.

(15) Includes dividend equivalent payments made with respect to an outstanding restricted stock unit award of $2,344.

8