Pizza Hut 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68 YUM! BRANDS, INC.

FACILITY ACTIONS Refranchising (gain) loss, store closure

(income) costs and store impairment charges by reportable seg-

ment are as follows:

2007 2006 2005

U.S.

Refranchising net (gain) loss(a) $ (12) $ (20) $ (40)

Store closure (income) costs(b) (9) (1) 2

Store impairment charges 23 38 44

Closure and impairment expenses $ 14 $ 37 $ 46

International Division

Refranchising net (gain) loss(a) $ 3 $ (4) $ (3)

Store closure (income) costs(b) 11 (1)

Store impairment charges 13 15 10

Closure and impairment expenses $ 14 $ 16 $ 9

China Division

Refranchising net (gain) loss(a) $ (2) $ — $ —

Store closure (income) costs(b) —(1) (1)

Store impairment charges 77 8

Closure and impairment expenses $ 7 $ 6 $ 7

Worldwide

Refranchising net (gain) loss(a) $ (11) $ (24) $ (43)

Store closure (income) costs(b) (8) (1) —

Store impairment charges 43 60 62

Closure and impairment expenses $ 35 $ 59 $ 62

(a) Refranchising (gain) loss is not allocated to segments for performance reporting

purposes.

(b) Store closure (income) costs include the net gain or loss on sales of real estate

on which we formerly operated a Company restaurant that was closed, lease

reserves established when we cease using a property under an operating lease

and subsequent adjustments to those reserves, and other facility-related expenses

from previously closed stores.

The following table summarizes the 2007 and 2006 activity

related to reserves for remaining lease obligations for closed

stores.

Estimate/

Beginning Amounts New Decision CTA/ Ending

Balance Used Decisions Changes Other Balance

2007 Activity $ 36 (12) 8 1 1 $ 34

2006 Activity $ 44 (17) 8 1 — $ 36

Assets held for sale at December 29, 2007 and December 30,

2006 total $9 million and $13 million, respectively, of U.S. prop-

erty, plant and equipment, primarily land, on which we previously

operated restaurants and are included in prepaid expenses and

other current assets on our Consolidated Balance Sheets.

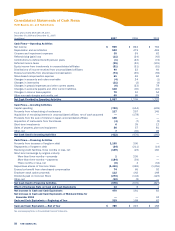

6.

Supplemental Cash Flow Data

2007 2006 2005

Cash Paid For:

Interest $ 177 $ 185 $ 132

Income taxes 264 304 232

Significant Non-Cash Investing and

Financing Activities:

Capital lease obligations

incurred to acquire assets $ 59(a) $ 9 $ 7

Net investment in direct

financing leases 33 — —

(a) Includes the capital lease of an airplane (see Note 14).

During 2006 we assumed the full liability associated with capital

leases of $97 million and short-term borrowings of $23 million

when we acquired the remaining fifty percent ownership interest

of our Pizza Hut U.K. unconsolidated affiliate (See Note 7). Previ-

ously, our fifty percent share of these liabilities were reflected

in our Investment in unconsolidated affiliate balance under the

equity method of accounting and were not presented as liabilities

on our Consolidated Balance Sheet.

7.

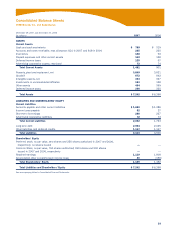

Pizza Hut United Kingdom Acquisition

On September 12, 2006, we completed the acquisition of the

remaining fifty percent ownership interest of our Pizza Hut U.K.

unconsolidated affiliate for $187 million in cash, including

transaction costs and prior to $9 million of cash assumed. This

unconsolidated affiliate owned more than 500 restaurants in the

U.K. The acquisition was driven by growth opportunities we see in

the market and the desire of our former partner in the unconsoli-

dated affiliate to refocus its business to other industry sectors.

Prior to this acquisition, we accounted for our ownership interest

under the equity method of accounting. Our Investment in uncon-

solidated affiliate balance for the Pizza Hut U.K. unconsolidated

affiliate was $51 million at the date of this acquisition.

Subsequent to the acquisition we consolidated all of the

assets and liabilities of Pizza Hut U.K. These assets and liabili-

ties were valued at fifty percent of their historical carrying value

and fifty percent of their fair value upon acquisition. During 2007

we finalized our purchase price allocation such that assets and

liabilities recorded for Pizza Hut U.K. due to the acquisition were

as follows:

Current assets, including cash of $9 $ 27

Property, plant and equipment 338

Intangible assets 18

Goodwill 125

Total assets acquired 508

Current liabilities, other than capital lease obligations

and short-term borrowings 107

Capital lease obligation, including current portion 97

Short-term borrowings 23

Other long-term liabilities 43

Total liabilities assumed 270

Net assets acquired (cash paid and investment allocated) $ 238