Pizza Hut 2007 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2007 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.62 YUM! BRANDS, INC.

FISCAL YEAR Our fiscal year ends on the last Saturday in

December and, as a result, a 53rd week is added every five or

six years. Fiscal year 2005 included 53 weeks. The first three

quarters of each fiscal year consist of 12 weeks and the fourth

quarter consists of 16 weeks in fiscal years with 52 weeks and

17 weeks in fiscal years with 53 weeks. In fiscal year 2005, the

53rd week added $96 million to total revenues and $23 million

to total operating profit in our Consolidated Statement of Income.

Our subsidiaries operate on similar fiscal calendars with period

or month end dates suited to their businesses. The subsidiaries’

period end dates are within one week of YUM’s period end date

with the exception of all of our international businesses except

China. The international businesses except China close one

period or one month earlier to facilitate consolidated reporting.

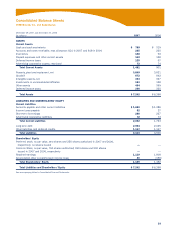

RECLASSIFICATIONS We have reclassified certain items in the

accompanying Consolidated Financial Statements and Notes

thereto for prior periods to be comparable with the classification

for the fiscal year ended December 29, 2007. These reclassifica-

tions had no effect on previously reported net income.

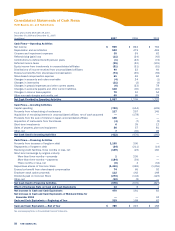

Specifically, we reclassified $15 million for the cumulative

impact of excess tax benefits from prior year exercises of share-

based compensation that were inappropriately recognized as

Deferred income taxes in 2006 to Common Stock. This correc-

tion also resulted in Net Cash Provided by Operating Activities

decreasing by $3 million and $5 million versus previously reported

amounts for the years ended 2006 and 2005, respectively, with

an offsetting impact to Net Cash Used in Financing Activities.

Additionally, we have netted amounts previously presented

as Wrench litigation (income) expense and AmeriServe and other

charges (credits) in our Consolidated Statements of Income for

2006 and 2005 and included those amounts in Other (income)

expense in the current year presentation. These two items

resulted in a $1 million and $4 million increase in Other (income)

expense in 2006 and 2005, respectively.

FRANCHISE AND LICENSE OPERATIONS We execute franchise

or license agreements for each unit which set out the terms of our

arrangement with the franchisee or licensee. Our franchise and

license agreements typically require the franchisee or licensee to

pay an initial, non-refundable fee and continuing fees based upon

a percentage of sales. Subject to our approval and their payment

of a renewal fee, a franchisee may generally renew the franchise

agreement upon its expiration.

We incur expenses that benefit both our franchise and

license communities and their representative organizations and

our Company operated restaurants. These expenses, along with

other costs of servicing of franchise and license agreements

are charged to general and administrative (“G&A”) expenses as

incurred. Certain direct costs of our franchise and license opera-

tions are charged to franchise and license expenses. These costs

include provisions for estimated uncollectible fees, franchise and

license marketing funding, amortization expense for franchise

related intangible assets and certain other direct incremental

franchise and license support costs.

We monitor the financial condition of our franchisees and

licensees and record provisions for estimated losses on receiv-

ables when we believe that our franchisees or licensees are unable

to make their required payments. While we use the best informa-

tion available in making our determination, the ultimate recovery

of recorded receivables is also dependent upon future economic

events and other conditions that may be beyond our control. Net

provisions for uncollectible franchise and license receivables of

$2 million, $2 million and $3 million were included in Franchise

and license expenses in 2007, 2006 and 2005, respectively.

REVENUE RECOGNITION Our revenues consist of sales by Com-

pany operated restaurants and fees from our franchisees and

licensees. Revenues from Company operated restaurants are

recognized when payment is tendered at the time of sale. The

Company presents sales net of sales tax and other sales related

taxes. We recognize initial fees received from a franchisee or

licensee as revenue when we have performed substantially all ini-

tial services required by the franchise or license agreement, which

is generally upon the opening of a store. We recognize continuing

fees based upon a percentage of franchisee and licensee sales

as earned. We recognize renewal fees when a renewal agreement

with a franchisee or licensee becomes effective. We include initial

fees collected upon the sale of a restaurant to a franchisee in

refranchising (gain) loss.

DIRECT MARKETING COSTS We charge direct marketing costs

to expense ratably in relation to revenues over the year in which

incurred and, in the case of advertising production costs, in the

year the advertisement is first shown. Deferred direct marketing

costs, which are classified as prepaid expenses, consist of media

and related advertising production costs which will generally be

used for the first time in the next fiscal year and have historically

not been significant. To the extent we participate in advertis-

ing cooperatives, we expense our contributions as incurred. Our

advertising expenses were $556 million, $521 million and $519

million in 2007, 2006 and 2005, respectively. We report sub-

stantially all of our direct marketing costs in occupancy and other

operating expenses.

RESEARCH AND DEVELOPMENT EXPENSES Research and

development expenses, which we expense as incurred, are

reported in G&A expenses. Research and development expenses

were $39 million, $33 million and $33 million in 2007, 2006 and

2005, respectively.

SHARE-BASED EMPLOYEE COMPENSATION We account for

share-based employee compensation in accordance with SFAS

No. 123 (Revised 2004), “Share-Based Payment” (“SFAS 123R”).

SFAS 123R requires all share-based payments to employees,

including grants of employee stock options and stock apprecia-

tion rights (“SARs”), to be recognized in the financial statements

as compensation cost over the service period based on their

fair value on the date of grant. Compensation cost is recognized

over the service period on a straight-line basis for the fair value

of awards that actually vest.

IMPAIRMENT OR DISPOSAL OF LONG-LIVED ASSETS In accor-

dance with SFAS No. 144, “Accounting for the Impairment or

Disposal of Long-Lived Assets” (“SFAS 144”), we review our

long-lived assets related to each restaurant that we are currently

operating and have not offered to refranchise, including any allo-

cated intangible assets subject to amortization, semi-annually

for impairment, or whenever events or changes in circumstances

indicate that the carrying amount of a restaurant may not be

recoverable. We evaluate restaurants using a “two-year history

of operating losses” as our primary indicator of potential impair-

ment. Based on the best information available, we write down

an impaired restaurant to its estimated fair market value, which

becomes its new cost basis. We generally measure estimated

fair market value by discounting estimated future cash flows.