Pizza Hut 2007 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2007 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

In February 2007, the FASB issued SFAS No. 159, “The Fair

Value Option for Financial Assets and Financial Liabilities” (“SFAS

159”). SFAS 159 provides companies with an option to report

selected financial assets and financial liabilities at fair value.

Unrealized gains and losses on items for which the fair value

option has been elected are reported in earnings at each sub-

sequent reporting date. SFAS 159 is effective for fiscal years

beginning after November 15, 2007, the year beginning Decem-

ber 30, 2007 for the Company. We did not elect to begin reporting

any financial assets or liabilities at fair value upon adoption of

SFAS 159 nor do we currently anticipate that the adoption of SFAS

159 will materially impact the Company going forward.

In December 2007, the FASB issued SFAS No. 141 (revised

2007), “Business Combinations” (“SFAS 141R”). SFAS 141R,

which is broader in scope than SFAS 141, applies to all transac-

tions or other events in which an entity obtains control of one

or more businesses, and requires that the acquisition method

be used for such transactions or events. SFAS 141R, with lim-

ited exceptions, will require an acquirer to recognize the assets

acquired, the liabilities assumed, and any noncontrolling inter-

est in the acquiree at the acquisition date, measured at their

fair values as of that date. This will result in acquisition related

costs and anticipated restructuring costs related to the acquisi-

tion being recognized separately from the business combination.

This statement is effective as the beginning of an entity’s first

fiscal year beginning after December 15, 2008, the year beginning

December 28, 2008 for the Company. The impact of SFAS 141R

on the Company will be dependent upon the extent to which we

have transactions or events occur that are within its scope.

In December 2007, the FASB issued SFAS No. 160, “Non-

controlling Interests in Consolidated Financial Statements”

(“SFAS 160”). SFAS 160 amends Accounting Research Bulletin

No. 51, “Consolidated Financial Statements,” and will change

the accounting and reporting for noncontrolling interests, which

are the portion of equity in a subsidiary not attributable, directly

or indirectly to a parent. SFAS 160 is effective for fiscal years

beginning on or after December 15, 2008, the year beginning

December 28, 2008 for the Company and requires retroactive

adoption of its presentation and disclosure requirements. We

do not anticipate that the adoption of SFAS 160 will materially

impact the Company.

3.

Two-for-One Common Stock Split

On May 17, 2007, the Company announced that its Board of

Directors approved a two-for-one split of the Company’s outstand-

ing shares of Common Stock. The stock split was effected in

the form of a stock dividend and entitled each shareholder of

record at the close of business on June 1, 2007 to receive one

additional share for every outstanding share of Common Stock

held. The stock dividend was distributed on June 26, 2007, with

approximately 261 million shares of Common Stock distributed.

All per share and share amounts in the accompanying Financial

Statements and Notes to the Financial Statements have been

adjusted to reflect the stock split.

4.

Earnings Per Common Share (“EPS”)

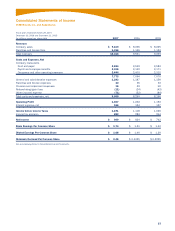

2007 2006 2005

Net income $ 909 $ 824 $ 762

Weighted-average common shares

outstanding (for basic calculation) 522 546 572

Effect of dilutive share-based

employee compensation 19 18 25

Weighted-average common and

dilutive potential common

shares outstanding (for diluted

calculation) 541 564 597

Basic EPS $ 1.74 $ 1.51 $ 1.33

Diluted EPS $ 1.68 $ 1.46 $ 1.28

Unexercised employee stock options

and stock appreciation rights

(in millions) excluded from the

diluted EPS compensation(a) 5.7 13.3 7.5

(a) These unexercised employee stock options and stock appreciation rights were

not included in the computation of diluted EPS because to do so would have been

antidilutive for the periods presented.

5.

Items Affecting Comparability of Net Income

and Cash Flows

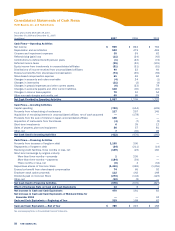

SALE OF AN INVESTMENT IN UNCONSOLIDATED AFFILIATE —

JAPAN In December 2007, we sold our interest in our uncon-

solidated affiliate in Japan for $128 million in cash (includes the

impact of related foreign currency contracts that were settled in

December 2007). Our international subsidiary that owned this

interest operates on a fiscal calendar with a period end that is

approximately one month earlier than our consolidated period

close. Thus, consistent with our historical treatment of events

occurring during the lag period, the pre-tax gain on the sale of

this investment of approximately $87 million will be recorded in

the first quarter of 2008. However, the cash proceeds from this

transaction were transferred from our international subsidiary to

the U.S. in December 2007 and are thus reported on our Con-

solidated Statement of Cash Flows for the year ended December

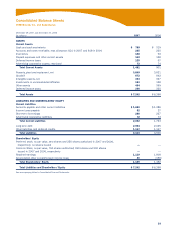

29, 2007. The offset to this cash on our Consolidated Balance

Sheet at December 29, 2007 is in accounts payable and other

current liabilities.

While we will no longer have an ownership interest in this

entity that operates both KFCs and Pizza Huts in Japan, it will

continue to be a franchisee as it was when it operated as an

unconsolidated affiliate. This sale of our interest will result in

lower Other income as we will no longer record our share of the

entity’s earnings under the equity method of accounting. Had this

sale occurred at the beginning of 2007, our International Divi-

sion’s Other income would have decreased $4 million.